Exploring Magento 2 Backend: Import/Export Tax Rates

Tax rate management in Magento 2 is quite a straightforward process if you conduct business locally. However, when you expand and start operating in several states with different legislation, not to mention international operations, manual tax rates entering becomes hugely time-consuming. What alternative opportunity does Magento 2 offer? By default, the platform has a separate screen where you can import all the necessary tax rates, preliminarily downloading them by ZIP code. In the following material, we explore how to transfer a set of tax rates back and forth and talk about an alternative solution.

Table of contents

Where to Get Tax Rates for Magento 2

You can view and download tax rates at Trading Economics; for instance, there is a page with . Alternatively, you can rely on such services as Avalara. The platform provides free for every ZIP code in the US.

How to Export Tax Rates from Magento 2

If you already have a list of tax rates in Magento 2 and need to apply changes to them, you can export the corresponding data as a CSV file, modify it, and re-import the rates back. It is one of the most straightforward ways to implement the update. So, let’s see how to run the first part of the task.

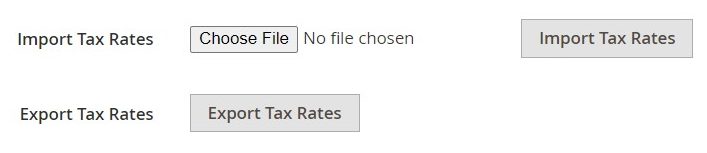

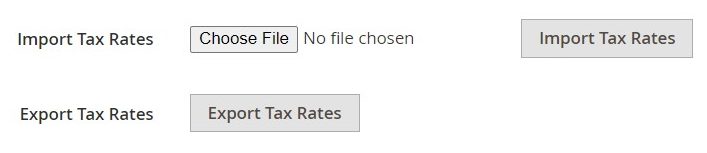

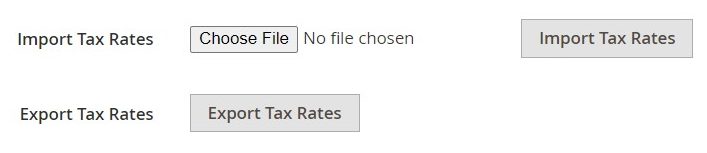

When in the Magento 2 backend, go to the Import/Export Tax Rates screen under System -> Data Transfer. Find the Export Tax Rates button and click it. The download process starts.

Your Magento 2 tax rates are available in the download location of your web browser. You must admit that exporting them is an extremely user-friendly process. What about editing?

How to Edit Tax Rates in Magento 2

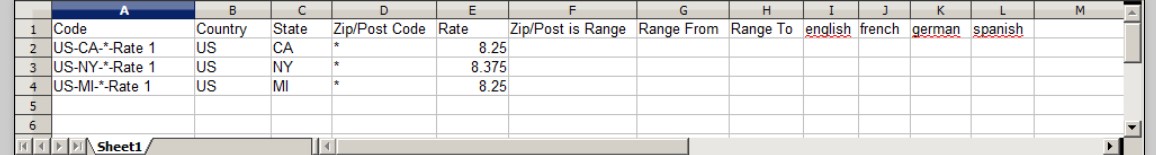

Open the file with your Magento 2 tax rates in a spreadsheet editor, such as OpenOffice Calc. You will face such columns as Code, Country, State, Zip/Post Code, Rate, Range From, Range To, as well as a column for each store view, just like shown below:

It is recommended to open the new tax rate data that you want to import side by side with the exported one in a second spreadsheet. Rename column headers to follow the Magento export data requirements. Don’t forget to delete any columns that have no data. Alternatively, you can recreate the structure of the original Magento export data file. Pay heed to the fact that tax rate columns can contain only numeric data. Also, if any new tax zones and rates are required, you have to define them in the Magento 2 backend. Last but not least, you have to save the prepared data as a CSV file. If any of these requirements are violated, you won’t be able to import tax rates to Magento 2.

Note that you can also apply changes to tax rates right in the Magento 2 backend. This procedure is described along with several other aspects of tax management here: Magento 2 Backend Exploration: Taxes.

How to Import Tax Rates to Magento 2

Now, when your CSV file with new tax rates is prepared, you can import it to Magento 2. The Magento 2 backend contains a screen for this procedure under System -> Data Transfer -> Import/Export Tax Rates.

Hit the Browse button to look for the CSV file with the prepared tax rate update. Choose it and hit Import Tax Rates. That’s it!

Note that the tax rate import to Magento 2 might take several minutes to transfer the data. You will be notified about the successful completion.

If an error message displays, your import file doesn’t follow the Magento 2 requirements. Address the existing issues and try again.

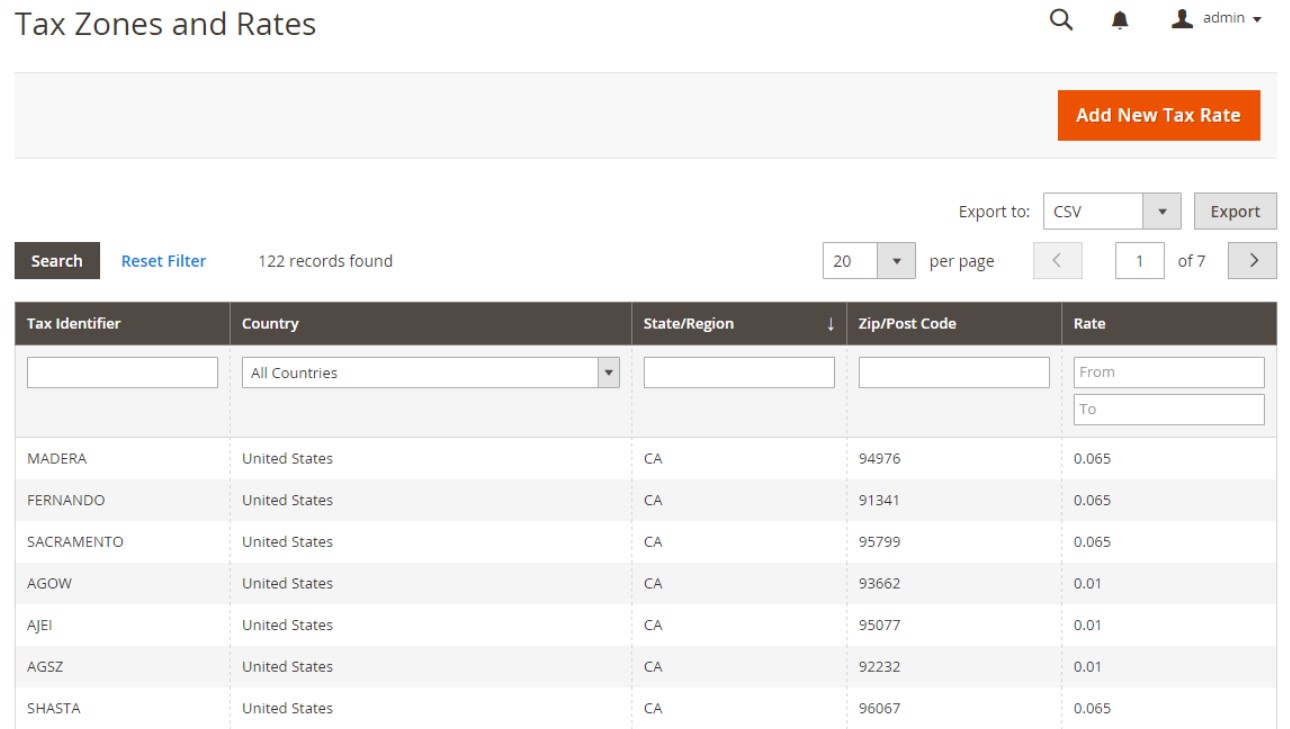

If everything is fine, you will find your new tax rates under Stores –> Taxes –> Tax Zones and Rates.

Now, it is recommended to run some test transactions. Use customers with different ZIP codes to check whether the updated tax rates are applied correctly.

Faster Way to Import & Export Taxes in Magento 2

Starting from 2.2.4, Magento enables more advanced sales automation with tax compliance and reporting based on the Vertex Cloud integration. Alternatively, you can find various reliable options that simplify and automate your daily chores. Improved Import & Export is among such solutions.

If the default import and export mechanisms of Magento 2 no longer satisfy your demands, you get a perfect opportunity to use a more fully-featured tool. It not only implements automated data updates but also integrates your e-commerce website with external systems aimed at more efficient tax management.

The problem of the native data import/export solutions is that they cannot automate data transfer processes or solve issues related to different attribute standards. Below, we’ve just explored the default tax rate update sequence that includes manual data export, CSV editing, and data import. Besides, the selection of supported file formats is limited to CSV. Luckily, you can address these issues.

Automated Data Transfers

The Improved Import & Export module offers two different kinds of automated transfers, while the default solution doesn’t have any. The extension enables creating schedules. You select a predefined interval or specify a custom one to let the plugin do all the work for you. The image below illustrates the process:

The system of triggers represents another approach. It enables you to define rules and conditions. When the defined provision is met, the extension initiates the import/export processes.

When transferring Magento 2 tax rates, choose one that better satisfies your needs.

Mapping

Different data storing standards not only make every system unique but also beget lots of headaches. The guide above contains a chapter that describes how to edit a CSV file with tax rates to make it suitable for the Magento 2 requirements. Unfortunately, the platform doesn’t let you apply changes in the Magento 2 backend. Therefore, you have to spend a plethora of time modifying a data file in a third-party environment.

As for the Improved Import & Export Magento 2 extension, it helps you address various issues of this kind with the help of the following features:

- Presets – choose a predefined scheme, and the extension will map attributes automatically, applying changes to data files for you;

- Manual Matching – at the same time, you can still edit attributes right in the Magento 2 admin;

- Attribute Values Mapping – mapping attribute values is possible too;

- Attribute Values Editing – as well as editing them in bulk;

- Filters – with this feature, you can export data that you need instead of the entire scope;

- Category Mapping – when it comes to product import, it is possible to move products right to the categories that already exist in your catalog or create new ones;

- Attributes On The Fly – if some attributes are missed, it is no longer a problem since the module can recreate them.

Apply a preset as follows:

Extended Connectivity Options

As we’ve just illustrated above, Magento 2 is bound to CSV files, when it comes to tax rates updates. However, you have an opportunity to use more file formats while applying changes. The Improved Import & Export module supports not only CSV but also XML, ODS, JSON, and Excel. Such files can be compressed and provided as archives.

Besides, you can freely move data between your Magento 2 store and a wide range of file sources, including local and remote servers, as well as cloud storage.

Besides, Improved Import & Export provides the ability to create API connections for various complex integrations, including ones related to tax management platforms. As a result, you can avoid file transfers in the usual sense.

The extension also enables direct file URL downloads. If a file with updated tax rates is provided via URL, you don’t have to download it before importing it. Just paste its link in the import profile.

Moreover, you can streamline Google Sheets import. The process looks as follows:

Another tool that lets you freely move tax data to Magento 2 is the Magento 2 Migration add-on of the Improved Import and Export extension. Focussed on moving Magento 1 data to Magento 2, it integrates databases of the two websites to implement seamless integration.

As a store owner, you can control data transfers from a command line. However, the Magento 2 backend also gets all the necessary leverages.

The add-on rests upon the foundation of the following features:

- The Freedom of Selective Migration. Nobody dictates to you what entities to move. Only you can choose what data to transfer.

- The Efficiency of Direct SQL Connection. All information is transferred from one database to another. No intermediaries participate in this process, resulting in fast and user-friendly migration.

- The Power of Zero Downtime. Since you connect databases and move entity by entity, no downtime associated with the migration occurs.

- The Flexibility of M2-M2 Migration. Two Magento 2 websites can be synchronized to move current tax data between them.

Follow the links below to peruse more information about the extension and its add-on and see how they cope with tax rated and other entities:

Get Improved Import & Export Magento 2 Extension

Get Magento 2 Migration Add-on