PSG eCommerce Grant Explained: Your Ultimate Guide to Government Funding for SMEs in Singapore

Navigating the digital landscape is a critical step for small and medium-sized enterprises in today’s economy, and the PSG eCommerce Grant is a powerful tool designed to accelerate this transition. With the rapid shift towards online commerce, businesses that fail to embrace digital solutions risk being left behind. That’s where the Productivity Solutions Grant comes in — a key component of Singapore’s broader strategy to fuel digital transformation and help SMEs compete globally.

Below, we explore how the PSG eCommerce Grant works, diving into what it offers, who qualifies, and how it can impact your business. From understanding the grant’s scope to navigating the application process, this guide will help you determine if the PSG Grant fits your business needs. We’ll cover everything from the benefits of partnering with pre-approved vendors to real-world success stories of SMEs that have transformed their online operations through this initiative.

We’ll also walk you through a step-by-step application process and share practical tips on selecting the most suitable eCommerce solutions. Whether you’re just starting out in eCommerce or looking to enhance your existing setup, this guide will provide the insights you need to effectively tap into the potential of the PSG eCommerce Grant.

Table of contents

- 1 What is the PSG eCommerce Grant?

- 2 Eligibility Criteria for the PSG eCommerce Grant

- 3 Benefits of the PSG eCommerce Grant for SMEs

- 4 How to Choose the Right eCommerce Solution for Your Business

- 5 Step-by-Step Guide to Applying for the PSG Grant

- 6 Success Stories: How Businesses Have Benefited from PSG

- 7 Final Words: Is the PSG Grant Right for Your Business?

- 8 FAQ

What is the PSG eCommerce Grant?

At its core, the PSG eCommerce Grant is a strategic initiative by the Singaporean government aimed at supercharging the digital growth of SMEs. But what exactly does that mean?

In a nutshell, the grant offers financial support to businesses looking to adopt pre-approved digital solutions that streamline their online operations, enhance customer engagement, and drive sales.

The PSG eCommerce Grant’s meaning goes beyond mere funding — it’s part of a broader push by Enterprise Singapore, a government agency tasked with empowering local businesses to thrive in an increasingly digital economy. Enterprise Singapore plays a pivotal role, acting as both facilitator and gatekeeper. It carefully curates a list of pre-approved eCommerce solutions, ensuring that businesses have access to reliable tools that meet industry standards. This not only simplifies the selection process for SMEs but also reduces the risk associated with implementing new technologies.

So, what types of solutions does the Enterprise Singapore grant cover? PSG provides a comprehensive array of options tailored to different aspects of digital commerce:

- Website Development: The grant can be used to build or enhance your online store, focusing on mobile optimization, user experience, and robust backend systems that support seamless product management and checkout processes.

- Digital Marketing: Leverage advanced SEO services, social media management tools, and targeted advertising platforms to boost your online visibility. The goal is simple: attract more customers and convert clicks into sales.

- Online Payment Systems: Secure, integrated payment gateways are crucial for any eCommerce business. The PSG Grant helps implement reliable, user-friendly payment solutions that support various payment methods, increasing trust and customer satisfaction.

By addressing these key areas, PSG helps SMEs tackle the challenges of digital transformation head-on. For businesses looking to expand their reach and stay competitive, this grant isn’t just a financial boost — it’s an opportunity to leap forward in the digital age.

Eligibility Criteria for the PSG eCommerce Grant

Before diving into the digital transformation journey, businesses must first determine if they meet the PSG eCommerce Grant eligibility requirements. This isn’t a one-size-fits-all funding opportunity; it’s tailored to support Singapore’s small and medium-sized enterprises that are prepared to embrace digital solutions but need financial assistance to take that leap. Let’s break down the key criteria you need to meet to qualify for this grant.

- Registered and Operating in Singapore. The PSG grant requirements stipulate that your business must be legally registered and actively operating within Singapore. This ensures that the grant supports local enterprises, bolstering the domestic economy. If your business is incorporated outside of Singapore or primarily operates overseas, you will not qualify.

- Local Shareholding of at Least 30%. Another critical eligibility factor is ownership. The PSG grant criteria require that at least 30% of your business’s shares are held by Singapore Citizens or Permanent Residents. This condition aims to ensure that the grant benefits enterprises with a strong local presence and investment. If your ownership structure doesn’t meet this threshold, consider adjusting it before applying or exploring other funding options.

- Financial Thresholds. The financial health of your business also plays a role in eligibility. To qualify for the grant, your company should have:

- Annual Sales Turnover of Up to 100 Million SGD;

- Up to 200 Employees.

These limits are set to target SMEs specifically, excluding larger enterprises that have more substantial resources for digital investments. If your business exceeds these thresholds, it may not be eligible for the PSG grant, but alternative funding programs could be a better fit.

Common Reasons for Ineligibility — And How to Avoid Them

Despite the clear guidelines, businesses often make avoidable errors in the application process. Here are some typical pitfalls and how you can navigate around them:

- Incomplete Documentation: Many applications are denied due to missing or incorrect paperwork. Before you apply, double-check that all required documents, including proof of registration and financial statements, are in order.

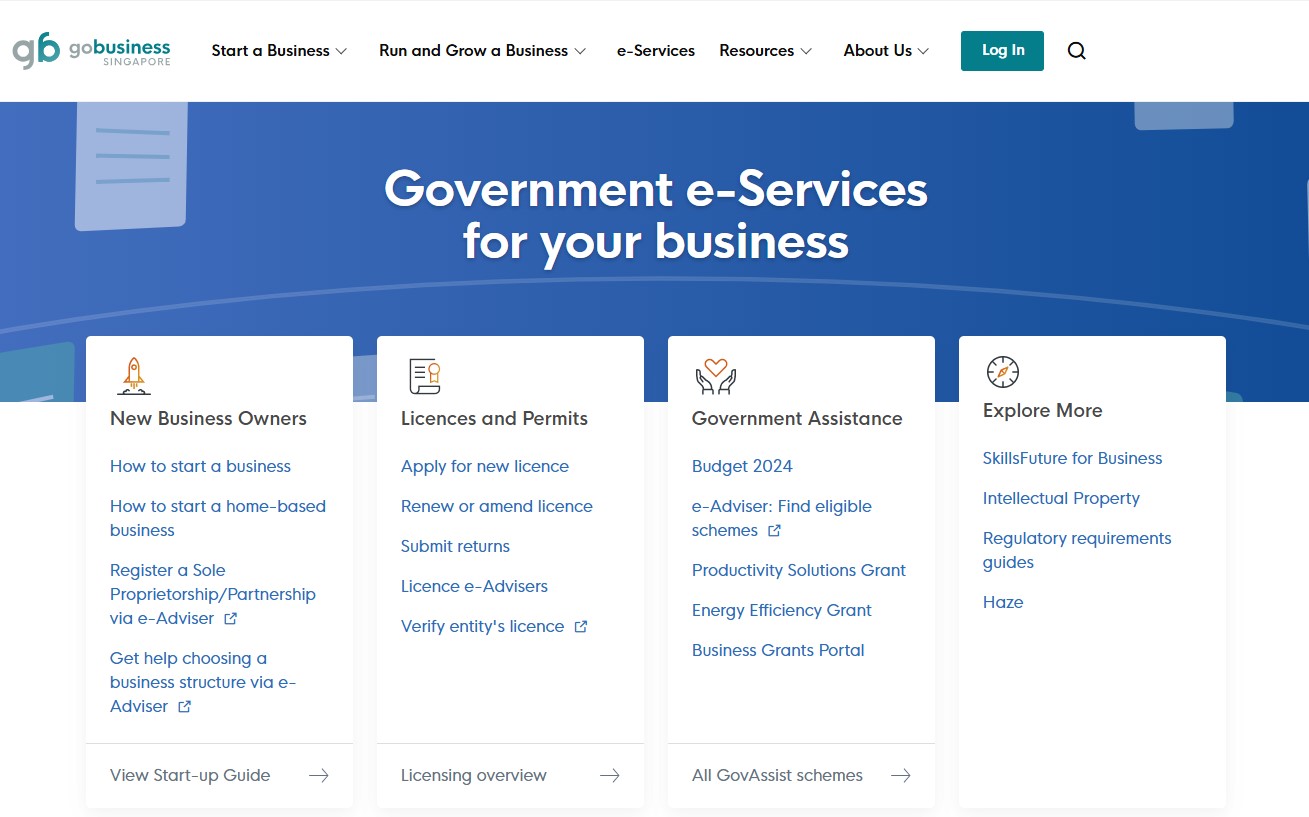

- Choosing Non-Approved Vendors: The grant only covers solutions from pre-approved vendors. Selecting a vendor outside this list will lead to automatic disqualification. Always refer to the official list on the GoBusiness portal to verify eligibility.

- Failure to Meet Implementation Deadlines: The grant has strict timelines for implementing the approved solutions. Delays can result in the forfeiture of funding. Plan your project carefully and coordinate closely with your vendor to ensure you meet all deadlines.

By understanding and meeting these PSG grant requirements, SMEs can position themselves for a smooth application process and tap into vital resources for digital growth. For those ready to take the leap, PSG can be a game-changer, opening doors to new digital possibilities.

Benefits of the PSG eCommerce Grant for SMEs

In an era where online presence is more critical than ever, the benefits of the PSG eCommerce Grant extend far beyond mere financial relief. This initiative is crafted to empower SMEs in Singapore, providing a robust framework to accelerate digital adoption and unlock new growth opportunities. Let’s explore how this grant helps level the playing field for local businesses.

1. Financial Support That Translates into Real Cost Savings

For many SMEs, the cost of implementing digital projects can be a daunting hurdle. The grant offers substantial funding — covering up to 50% of the project costs — making it a valuable lifeline for businesses that might otherwise struggle to afford digital upgrades. This SME funding in Singapore isn’t just about offsetting expenses; it’s a strategic investment that allows businesses to channel their resources into areas that foster innovation and scalability.

By lowering the financial barriers to entry, the grant enables companies to take bolder steps toward digital transformation, whether it’s developing a high-performance website, integrating advanced eCommerce tools, or enhancing customer engagement through digital marketing.

2. Access to a Curated Network of Pre-Approved Vendors

One of the standout benefits of PSG is the access it provides to a comprehensive list of pre-approved digital solutions and vendors. This feature is more than a convenience; it’s a safeguard. Enterprise Singapore carefully selects these vendors, ensuring they meet rigorous industry standards and have a proven track record of delivering effective solutions. This takes the guesswork out of vendor selection, allowing SMEs to focus on implementation rather than vetting suppliers.

Whether you’re looking to build a sophisticated eCommerce platform, boost your digital marketing efforts, or streamline payment systems, the grant’s pre-approved solutions offer a trusted path to achieving these goals.

3. Long-Term Growth Through a Stronger Online Presence

Another value of the digital solutions for SMEs offered by the PSG eCommerce Grant lies in their potential for long-term growth. Building or enhancing your digital infrastructure isn’t just a short-term fix; it’s a strategic move that positions your business for sustained success. With a solid online presence, SMEs can tap into new customer segments, increase brand visibility, and compete effectively in both local and international markets.

Moreover, investing in digital tools often leads to improved customer experiences, streamlined operations, and better data-driven decision-making. These enhancements can help businesses adapt quickly to changing market dynamics, making them more resilient and agile in the face of disruption.

How to Choose the Right eCommerce Solution for Your Business

Selecting the right digital tools for your business is a strategic decision that can significantly influence your online success. The PSG eCommerce Grant simplifies this process by offering a curated list of pre-approved PSG eCommerce solutions, tailored to the needs of small and medium-sized enterprises in Singapore. However, knowing where to start and which solutions to choose can still feel overwhelming. Here’s how to navigate this process effectively and make the most out of your PSG funding.

1. Understanding the Range of Pre-Approved PSG eCommerce Solutions

The grant’s roster of pre-approved solutions is designed to cover all critical aspects of an eCommerce business. Here’s an overview of the main categories:

- Website Development and Online Store Setup: The grant supports solutions that help build a responsive, user-friendly website or enhance an existing one. Look for vendors that offer customizable designs, mobile optimization, and robust backend systems for managing products and inventory.

- SEO and Digital Marketing Services: Digital marketing solutions covered by the grant include content creation, social media management, and paid advertising strategies tailored to boost online engagement.

- Payment Integration and eCommerce Tools: The grant includes support for integrated payment systems that facilitate secure and efficient transactions. Additionally, solutions for cart management, analytics, and automation can help streamline your operations and enhance customer experiences.

By choosing from these pre-approved PSG eCommerce solutions, businesses can be confident in the quality and reliability of the tools they implement, minimizing risk and maximizing impact.

2. Tips for Choosing the Right Vendor

Selecting the right vendor is as crucial as choosing the right solution. Here are some key considerations to guide your decision:

- Align Solutions with Business Goals: Start by assessing your business needs and objectives. Are you looking to increase sales, improve customer engagement, or enhance operational efficiency? Match these goals with the capabilities of the eCommerce solutions on offer. For instance, if your priority is customer acquisition, focus on vendors specializing in SEO and digital marketing.

- Evaluate Vendor Expertise: Look beyond the sales pitch and evaluate the vendor’s track record. Check for case studies, client testimonials, and ratings. The PSG grant vendors are pre-approved for a reason, but it’s still wise to dig deeper and ensure they have experience in your specific industry.

- Consider Scalability and Support: Choose solutions that can grow with your business. Scalability is key to avoiding future headaches as your eCommerce operations expand. Additionally, verify the level of support the vendor offers. Reliable, ongoing support can make all the difference in troubleshooting issues and ensuring smooth implementation.

Step-by-Step Guide to Applying for the PSG Grant

Navigating the PSG eCommerce Grant application process can seem daunting, but with a clear plan in place, securing this valuable funding becomes a straightforward task. Here’s a concise, step-by-step guide to help you move from idea to implementation, maximizing your chances of success.

Step 1: Identify Your Business Needs

Before diving into the application, take a moment to reflect on what your business truly requires. The grant covers a range of digital solutions — from website development and SEO services to payment integration and digital marketing tools. Start by assessing your current pain points and growth objectives. Do you need a complete website overhaul, a boost in online visibility, or an enhanced checkout experience? This clarity will help you select the most appropriate solutions and ensure that your funding request aligns with your strategic goals.

Pro Tip: Involve key stakeholders in this evaluation to gain a comprehensive understanding of your business needs and priorities. This will streamline the decision-making process later.

Step 2: Browse Pre-Approved Solutions on the GoBusiness Portal

Once you have a clear idea of what you need, it’s time to explore the pre-approved PSG eCommerce solutions. Head over to the , where you’ll find a curated list of vendors and services that meet the grant’s quality standards. This step is crucial as the PSG only covers solutions from pre-approved providers, ensuring reliability and a higher likelihood of project success.

How to Apply for PSG eCommerce Grant Solutions: Use the portal’s search and filter features to identify the vendors that offer the specific services you’re looking for. Take your time to review the available options, read client feedback, and compare the different solutions on offer.

Step 3: Get a Quotation from a Pre-Approved Vendor

After selecting your preferred solution, contact the vendor directly to obtain a detailed quotation. This document will outline the costs, project scope, and deliverables — all of which are necessary for your application. Ensure that the quotation is clear and itemized, as this will not only help with your application but also provide a transparent breakdown of what you’re paying for.

Pro Tip: Engage in a preliminary discussion with the vendor to confirm that their solution aligns with your expectations. Clarify any doubts about the project timeline and support services to avoid surprises later.

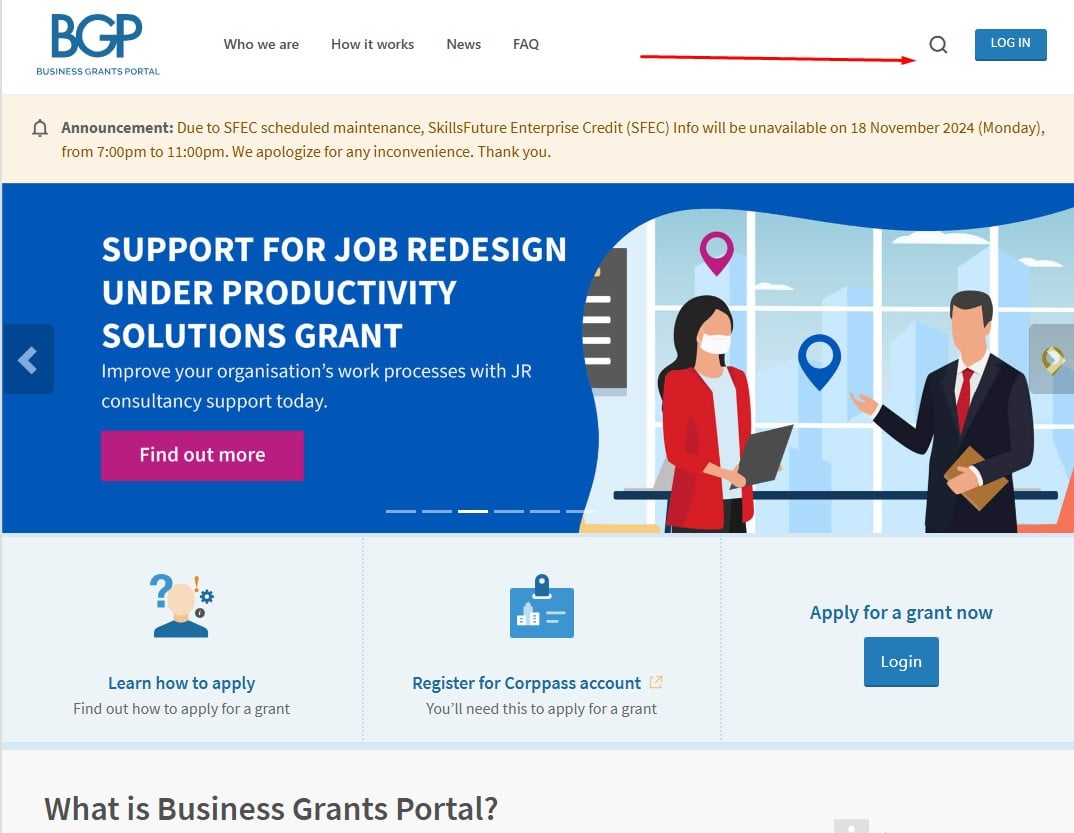

Step 4: Submit Your Application on the Business Grants Portal

Now that you have your quotation, it’s time to apply. The entire application process is conducted through the , a centralized platform for all government grant applications. You’ll need to log in with your CorpPass account, a secure login method for businesses in Singapore.

This is how to apply for PSG eCommerce Grant:

- Log in to the Business Grants Portal with your CorpPass credentials.

- Select “Productivity Solutions Grant” from the list of available grants.

- Upload the necessary documents, including the vendor quotation, proof of business registration, and financial statements.

- Review your application carefully before submission to avoid errors that could delay processing.

The review process typically takes four to six weeks, during which you may be contacted for additional information or clarifications.

Step 5: Implementation and Claim Submission Process

Once your application is approved, you can proceed with implementing the chosen eCommerce solution. Coordinate closely with the vendor to ensure timely execution of the project, as the PSG grant has specific deadlines for completion.

The final steps include:

- Upon project completion, collect all necessary invoices and receipts from the vendor.

- Submit your claim via the Business Grants Portal, including the proof of payment and a project completion report.

- The claim process generally takes a few weeks. Once approved, the reimbursement will be credited directly to your business account.

Pro Tip: Keep thorough records throughout the project implementation. This will not only make the claim submission smoother but also provide a valuable reference for future projects.

Success Stories: How Businesses Have Benefited from PSG

Here are some examples of businesses that have successfully leveraged the PSG eCommerce Grant:

1. Bake Mission

, a local bakery, transitioned from a traditional storefront to an online platform with the assistance of the PSG Grant. By developing an eCommerce website, they expanded their product offerings beyond baked goods, incorporating items from all their existing brands. This digital shift allowed them to implement bundled promotional items, increasing sales and providing consumers with a wider range of products at competitive prices.

2. PAMA

, a company specializing in premium products, adopted an Online to Offline (O2O) strategy under the guidance of MIBC, facilitated by PSG. This approach enabled customers to experience PAMA’s products in partner stores and place orders online, with the option to collect purchases in-store. Aligning online and offline prices enhanced customer convenience and trust, leading to increased sales and brand loyalty.

3. PrintWork

, a printing service provider, faced challenges with manual order processing and customer retention. Utilizing the PSG eCommerce Grant, they developed a customized Matrix Table that allowed customers to obtain instant quotations based on delivery dates and quantities. This automation streamlined operations, reduced delays, and improved customer satisfaction, positioning PrintWork competitively in a crowded market.

4. Ritzhouzz

, a retailer of specialty products, partnered with MIBC to establish an eCommerce presence through the grant. The collaboration included product photoshoots and guidance on listing products online. Ritzhouzz plans to launch Facebook livestreams and digital marketing campaigns to boost brand awareness and reach a broader audience, demonstrating the grant’s role in facilitating comprehensive digital strategies.

5. Wine Connection

, a wine retailer, capitalized on the PSG Grant to create an online store that offered self-collection at their warehouse and contactless payment options. This digital transformation reduced manpower and logistical costs, providing customers with a seamless and safe shopping experience, especially during times when physical interactions were limited.

Final Words: Is the PSG Grant Right for Your Business?

The PSG eCommerce Grant offers a unique opportunity for Singaporean SMEs to accelerate their digital growth with up to 50% funding for pre-approved solutions. If your business struggles with outdated systems or needs a boost in online visibility, the grant can be a strategic game-changer. It helps reduce financial risks and allows companies to implement cutting-edge digital tools quickly.

Before applying, assess your readiness: identify pain points, set clear goals, and ensure you have the resources for implementation. Choosing the right pre-approved solutions and vendors will maximize the grant’s impact, setting your business up for sustainable success.

Although Firebear is not part of this grant program, we can be your partner in digital transformation. We offer robust eCommerce tools for seamless data transfers, connecting your website – Magento, Shopify, Shopware, or BigCommerce – with ERPs, CRMs, accounting systems, and more. Our apps also streamline regular data management tasks like inventory synchronization and order management, ensuring a smooth, integrated digital experience. If you’re ready to take the next step, contact Firebear right now to discuss the digital transformation opportunities we offer.

FAQ

What is a PSG Grant?

The Productivity Solutions Grant (PSG) is a government initiative in Singapore designed to support SMEs in adopting digital solutions and technology. The PSG eCommerce Grant specifically focuses on helping businesses enhance their online presence through pre-approved digital tools like website development, SEO, and payment integration.

How much is the PSG Grant?

The PSG Grant covers up to 50% of the total cost of pre-approved eCommerce solutions. This co-funding aims to reduce the financial burden for SMEs implementing digital projects.

What is the PSG Grant cap?

The typical funding cap for the PSG Grant is S$30,000 per SME. Businesses can apply for multiple projects, but the total funding across all applications cannot exceed the annual limit set by Enterprise Singapore.

What are the conditions for PSG?

To be eligible, your business must be registered and operating in Singapore, have at least 30% local shareholding, have an annual sales turnover of less than S$100 million or fewer than 200 employees, and use the grant to purchase only pre-approved digital solutions.

Can I apply for multiple grants under the PSG scheme?

Yes, SMEs can apply for multiple projects under the PSG scheme, provided they meet the eligibility criteria for each application and do not exceed the overall funding cap.

How long does the approval process take?

The approval process typically takes four to six weeks. During this time, the application is reviewed, and additional documentation may be requested for clarification.

What are the limitations of using the grant?

The PSG Grant only covers pre-approved solutions and must be implemented through pre-approved vendors. It cannot be used for custom software development, business restructuring costs, or projects not directly related to digital transformation.