Shopify Capital Guide: How to Secure Funding for Your Business

Are you a Shopify merchant willing to secure funding for your e-commerce business? This Shopify Capital guide will help you!

Below, you will learn everything about the program. We start with what Shopify Capital is, moving to the first loan application.

The platform’s funding program has many advantages. It offers flexible conditions for merchants, reducing paperwork. It is also worth mentioning that Capital relies on your daily sales for repayments.

Whether you’re starting your e-commerce business or looking to scale, this guide is for you! It will show you how Shopify Capital can elevate your business to the next level.

Learn valuable tips on how to maximize your funding opportunities. Discover a balanced evaluation of the program’s pros and cons. By the end, you’ll know how Shopify Capital can support your business’s financial needs.

Keep reading to uncover whether this funding program is the right fit for you.

Table of contents

What is Shopify Capital?

Shopify Capital is a financing program designed to provide eligible businesses with quick access to funding through merchant cash advances and loans. This program evaluates your store’s location, sales history, and overall engagement with the Shopify platform to determine eligibility. By leveraging these factors, it offers tailored financial solutions that help merchants invest in growth, manage cash flow, or seize new opportunities without the lengthy approval processes typical of traditional loans.

Whether you’re looking to expand your inventory, invest in marketing, or cover operational costs, the program offers a streamlined way to secure the funding you need directly through your Shopify admin. But what funding options does this program offer?

- Shopify Capital lets merchants apply for business loans provided as lump sums, known as the loan amount, with a fixed borrowing cost, which represents the cost of the funds.

- As a merchant, you’ll need to repay the total payment amount, which includes both the loan amount and the borrowing cost.

- The loan amount is deposited directly into your business bank account, and repayments are made through a percentage of your daily sales, referred to as the daily payment percentage. Thus, you return less on a slow day and more on a busy day.

- The exact total payment amount and daily payment percentage are determined based on your risk profile. The cost of borrowing is a simple, fixed fee, meaning the total amount you’ll return to Shopify won’t increase.

However, several factors influence the amount you can receive from Shopify Capital, ranging from a few thousand dollars to potentially millions. The size of your business, sales volume, and loan purpose are key determinants. Businesses with consistent sales and good credit history typically qualify for larger loans.

When applying, you’ll need to justify the amount by outlining how you plan to use the funds. A strong understanding of your business’s financial health will help convince Shopify of your repayment ability. Unlike traditional loans, this program does not support lending against equity in your business.

How Does It Work?

So, the entire workflow around Shopify Capital includes the following four steps:

- Eligibility Check. As a merchant, you must first pass an eligibility check to qualify for the program. You can check your eligibility by logging into your Shopify account or contacting Shopify support.

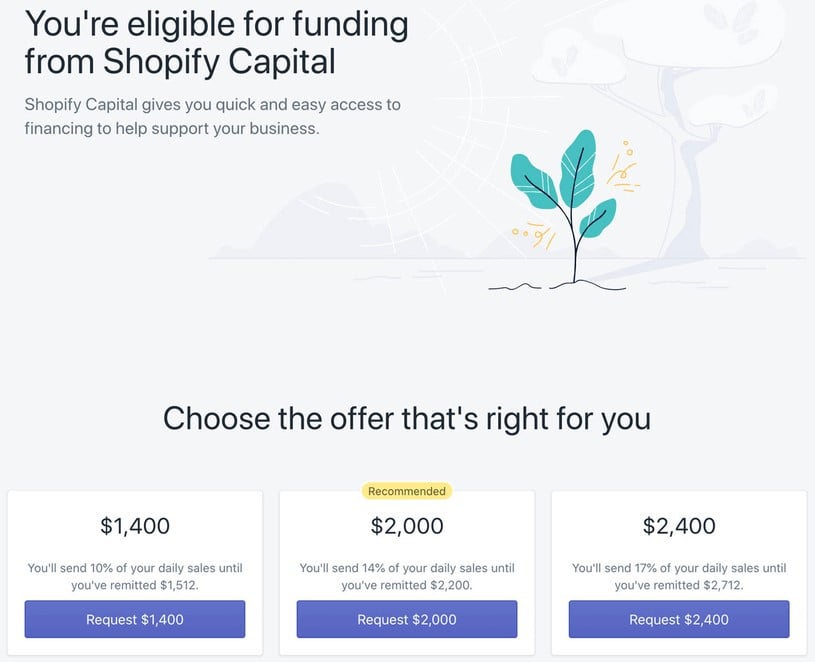

- Offer Received. Once eligible, you’ll receive a quote from Shopify. Pre-qualified sellers are presented with three non-negotiable financing offers. You can choose the one that best fits your needs. It’s essential to carefully review the terms, including the funding amount, repayment terms, and fees. Once you accept an offer, the funds will be deposited directly into your Shopify account within two to five business days.

- Repayment. Repayment is automatically managed by Shopify, with a percentage of your daily sales going toward the loan. If sales increase, you’ll pay off the loan faster; if sales decrease, payments will be slower. You can monitor your repayment status, daily sales revenue, remaining balance, and payment history directly in your Shopify account.

- Future Discounts. The program rewards merchants with good credit by offering discounts on future repayments. If you repay your loan on time and maintain a healthy store, you may qualify for larger funding amounts and better terms in the future.

Let’s explore some of these steps in more detail.

Eligibility Criteria for Merchants

Shopify Capital eligibility is the first essential step that every merchant takes on the way to the platform’s loans. As we’ve already mentioned, the system assesses eligibility for funding based on different criteria, such as your store’s sales history and interactions with Shopify. Although a personal credit check is not usually required, Shopify may review your business credit history. The platform’s main Public Eligibility Criteria include:

- Your store must use Shopify Payments or a third-party payment gateway.

- It should be active for at least three months.

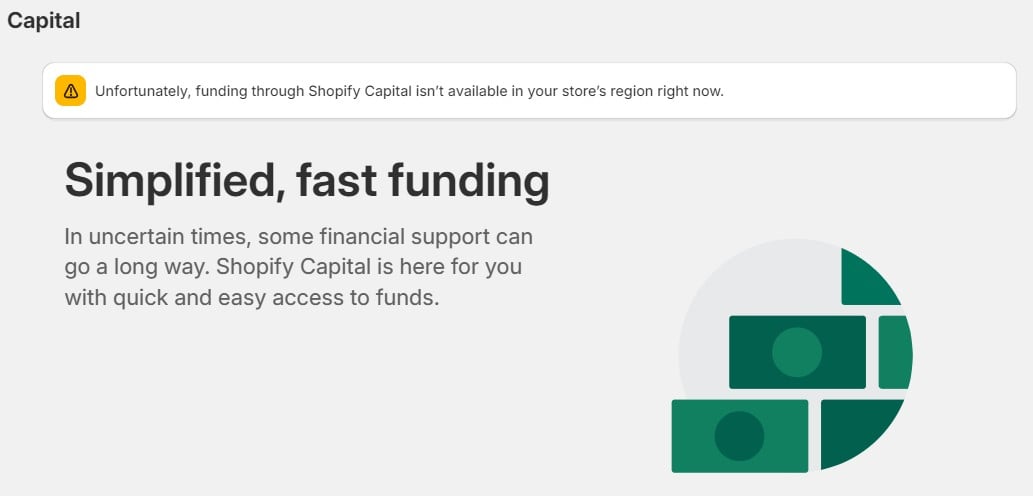

- And, of course, your business must be located in the United States, Canada, Australia, or the United Kingdom. No exceptions are possible here.

In addition to the public eligibility criteria, Shopify usually considers such additional factors as sales volume, payment disputes, chargebacks, platform interactions, buyer behavior, and store performance using AI to determine risk level and assess whether your business can repay the funding.

The program employs a detailed underwriting process to evaluate funding requests. It’s obvious that the platform’s goal is not only supporting merchants but also generating more income. To achieve the second goal, Shopify works only with reliable e-commerce websites, so the underwriting process associated with Shopify Capital is designed to systematically assess each store’s eligibility. If your business is not eligible due to its location, you will see the following message:

If your store doesn’t receive a funding offer, it’s not yet the end. It means that your business currently does not meet the requirements established by the program. When your store qualifies for funding, you will receive notifications through both the Shopify admin dashboard and via email, confirming your eligibility. Below, we share tips on how to increase your Shopify Capital eligibility.

Offers & Repayment: The Difference Between Cash Advances & Merchant Loans

Shopify monitors merchant accounts and invites eligible sellers to apply for Capital funding via two different types of offers – cash advances and merchant loans. Receiving an invitation, however, does not guarantee approval, as it is based on preliminary qualifications. After you choose from typically three offered options, the underwriting team may request additional information to verify your business.

Should issues arise that affect eligibility, Shopify might adjust the offer or deem you currently ineligible. If approved and the offer is accepted, funds are typically disbursed to your business account within 2-5 business days, and you start to repay.

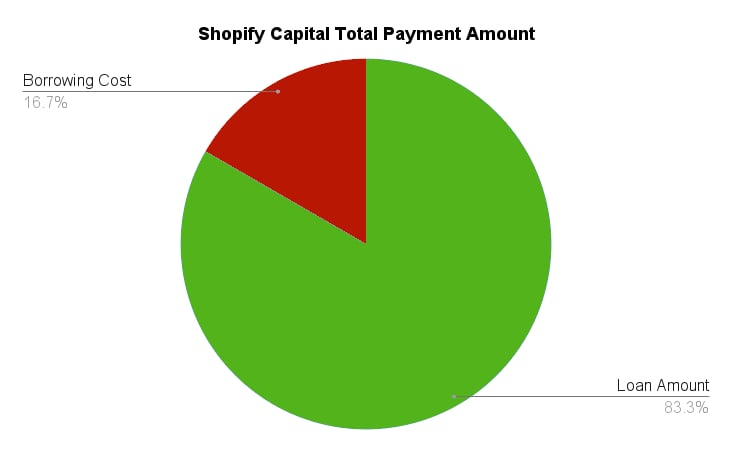

Since Shopify does not use standard interest rates, we’d like to explain how the costs are structured in Shopify Capital. Instead of the traditional approach, the platform uses factor rates that depend on the borrowed amount and your business’s financial health. For example, if you borrow $10,000 and your factor rate is 1.2, your repayment will be calculated as follows: $10,000 x 1.2 = $12,000. Where the loan amount is $10,000, the borrowing cost is $2,000, and the total payment amount is $12,000. The structure of Shopify Capital’s total payment amount in this case looks as follows:

Do cash advances and merchant loans operate the same way? Yes, they do, but there’s one key difference.

Capital Loans

Shopify Capital provides loans from $200 to more than $1 million with a 12-month term. Eligibility depends on your average sales and cash flow. Once approved, funds are deposited into your business bank account within a few business days and can be used for business expansion or online sales.

Repayment is tied to a percentage of your daily sales, referred to as the discount rate, with an average rate of 10%. To ensure you’re on track to repay the loan within 12 months, you need to pay back one-sixth of the total loan amount every 60 days.

Merchant Cash Advances

Like business loans, Shopify Capital cash advances have the same range and are repaid via daily sales. The primary distinction is that cash advances lack a fixed repayment term. You repay more on days with higher sales, less on slower sales days, and nothing on days without sales, allowing your repayment schedule to flexibly match your business’s cash flow.

Shopify Capital Review: Is It Right for Your Business?

Before deciding if Shopify Capital is the right choice for you, let’s look at its pros and cons and then compare it to traditional business loans.

Pros & Cons

Shopify Capital offers several advantages that make it an appealing option for merchants. The most notable benefits include:

- Quick Funding: The platform lets you access funds within a few business days.

- Minimal Paperwork: You can apply for the program straight in your admin with minimum documentation.

- Repayment Flexibility: Repayments are made as a percentage of daily sales, which aligns with your business’s cash flow.

- No Fixed Term on Advances: Cash advances don’t have a fixed repayment term, offering more flexibility during slower business periods.

On the other hand, Shopify Capital also comes with certain disadvantages that may deter some merchants from applying for the program. These include:

- Cost of Capital: This parameter may be higher compared to traditional loans due to the convenience and risk associated with non-fixed repayment schedules.

- Sales Dependency: Your ability to repay depends heavily on daily sales; lower sales mean slower repayment, which could extend the debt burden.

- Limited Availability: The program is only available to Shopify merchants in 4 countries, and eligibility is based on sales history and other performance metrics.

vs. Traditional Business Loans

| Feature | Shopify Capital | Traditional Business Loans |

| Accessibility | Accessible to Shopify merchants based on store data | Requires extensive credit checks and financial history |

| Eligibility Criteria | Sales performance and history on Shopify platform | Credit history, business performance, collateral, etc. |

| Geography | US, UK, Australia, and Canada | Available everywhere |

| Application Process | Minimal paperwork, fast approval based on Shopify analytics | Often lengthy with extensive documentation required |

| Repayment Terms | Flexible | Fixed monthly payments |

| Repayment Flexibility | Payments adjust based on daily sales volume | Fixed payments that do not consider current sales |

| Speed of Funding | Funds can be available within a few business days | Can take weeks or even months to process |

| Cost of Capital | Potentially higher due to flexible repayment terms | Generally lower interest rates with structured terms |

| Funding Amounts | Ranges from $200 to $1 million depending on eligibility | Can potentially be higher, based on creditworthiness |

| Target Users | Shopify merchants only | Broad range of businesses across various sectors |

While Shopify Capital provides speed and flexibility, it often comes with higher costs and less predictable repayment terms compared to traditional loans. However, if your business has consistent online sales, Shopify Capital could be an excellent fit. It allows you to access funds quickly without the need for the extensive documentation that traditional banks typically require, making it a convenient option for businesses with steady cash flow.

How to Apply for Shopify Capital: A Step-by-Step Guide

Applying for Shopify Capital is a straightforward process, especially since it’s fully integrated into your Shopify admin panel. Follow this step-by-step guide to apply:

- Check Your Eligibility. Shopify proactively monitors your store’s sales performance and will notify you directly in your Shopify admin if you are eligible to apply for funding. If your business follows the requirements, you’ll see an invitation under Shopify Admin > Finances.

- Review & Select an Offer. Once notified, you can view the funding offers available to you. Shopify typically provides three different options, each with specific terms and amounts. Evaluate each one carefully to select the offer that aligns with your business’s financial status and growth objectives.

- Provide Necessary Documentation. Although you may need to provide additional documentation at this stage, Shopify aims to make this process as seamless as possible, utilizing the data already available through your website.

- Accept the Offer. After selecting your preferred offer, confirm your agreement to the program’s terms and conditions. Once you accept the offer, funds will be deposited into your bank account within a few business days.

- Start Using the Funds & Let Shopify Control The Repayment. Use the capital to grow your business, whether it’s for buying inventory, expanding marketing efforts, or covering daily operational costs. We explore some success stories below to illustrate possible use cases.

Since repayments are automatically deducted from your daily sales, it’s crucial to maintain a steady volume of transactions. Note that it is possible to monitor your repayment progress directly from your Shopify admin under the “Finances” section.

7 Tips to Increase Your Eligibility

- Boost Your Sales Volume. It’s up to you to decide how to increase sales, but there are two main tips to follow: Ensure your Shopify store is fully optimized for conversions and invest in marketing strategies to drive traffic and increase sales.

- Maintain a Consistent Sales Record. Focus on customer retention strategies such as loyalty programs, exceptional customer service, and regular engagement through content and offers. If your business is seasonal, plan strategies to manage off-peak times better.

- Reduce Chargebacks and Disputes. Offer clear and visible return and shipping policies to reduce customer misunderstandings and disputes. Provide excellent customer service.

- Improve Financial Health. Keep your operating costs under control and regularly review your expenses to improve the financial health of your business. Maintaining clear and organized financial records will help you do that.

- Use Shopify Payments. Use Shopify Payments if possible. The tool integrates seamlessly with the program, allowing Shopify to track your financial health more efficiently.

- Stay Informed About Updates. Regularly check Shopify’s updates: Implementing new tools and features, such as Shopify Collabs, can help you boost your store’s performance.

- Prepare a Business Plan. Shopify may require a business plan that outlines your business model, market, growth strategy, and how you intend to use and repay the funding. Therefore, create one before applying.

By following these tips, you can improve your store’s performance, demonstrate your business’s viability, and increase your chances of getting approved. Always remember that the key to approval often lies in demonstrating a track record of success and a clear plan for future growth.

Success Stories

Let’s see how Shopify Capital helps existing businesses to expand. Below, we share success stories about four different companies that applied for the program and experienced a significant boost.

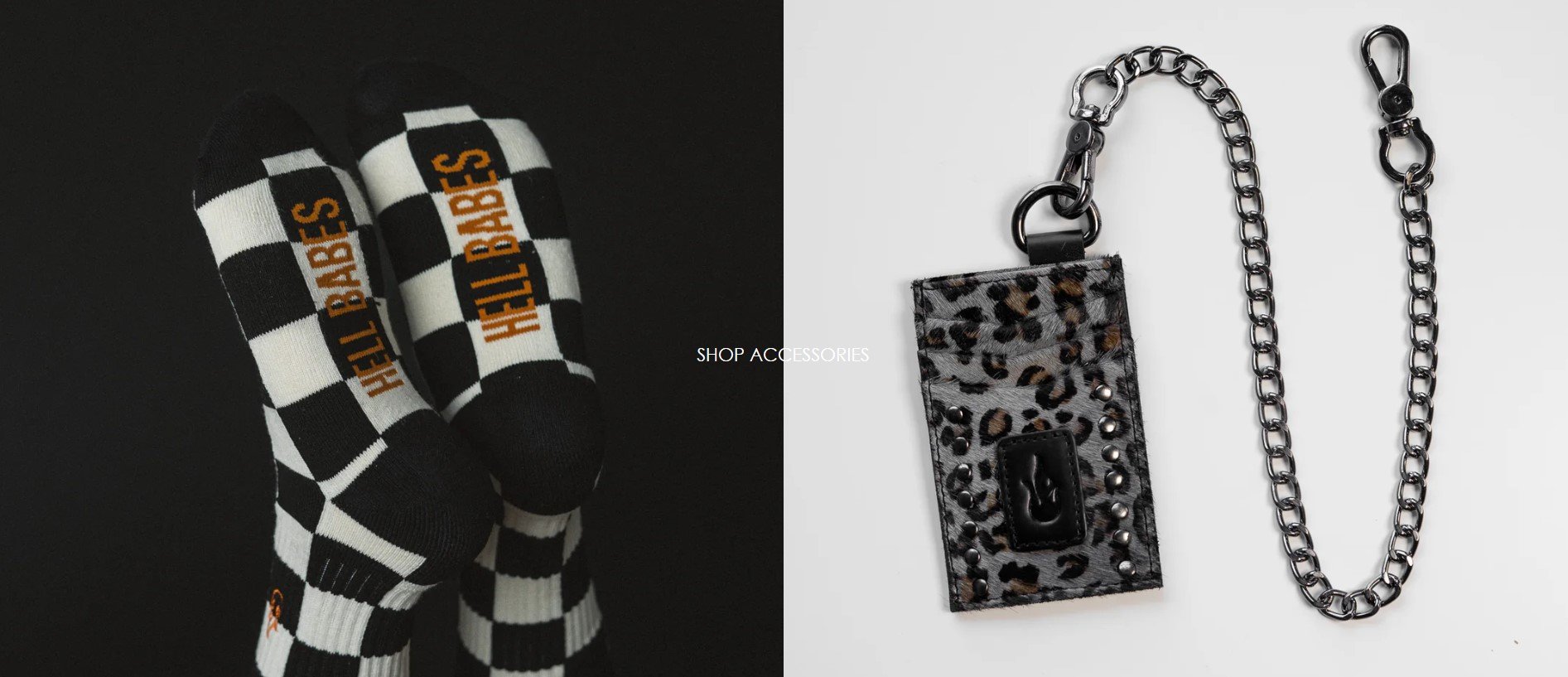

Hell Babes: Thriving with Shopify Capital’s Simplicity & Merchant-Friendly Conditions

Jessica Wise founded , a lifestyle brand that celebrates freedom and empowerment within motorcycle culture. As a small business owner, she faced numerous challenges such as managing cash flow, acquiring customers, and ensuring timely product delivery. Initially relying on credit cards for funding, Jessica soon realized its limitations and turned to Shopify Capital, attracted by its simple and direct funding options presented through her store dashboard.

With the program, Jessica appreciated the lower interest rates compared to traditional credit options, and the automated repayment process that deducted a percentage from daily sales, allowing her to focus on business growth. This shift was especially beneficial when Hell Babes began investing in ads, which nearly doubled their sales. Jessica found that Shopify offered a more straightforward and trustworthy funding solution compared to other external financing options. Since embracing the program, Hell Babes has secured multiple funding rounds, enabling rapid growth and investment in inventory.

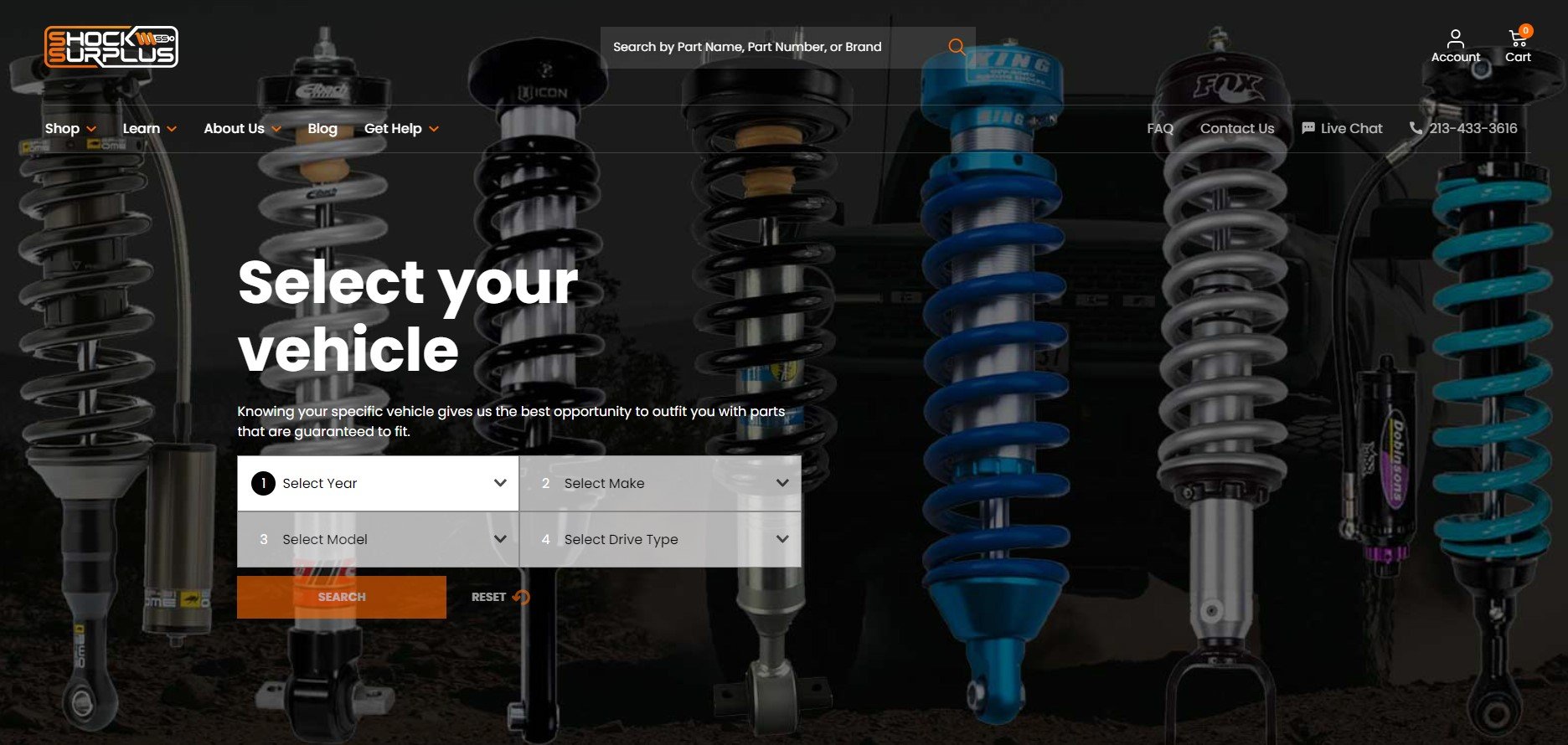

Shock Surplus: Fueling Growth with Accessible Shopify Capital Loans

, founded in 2012, revolutionized the auto parts industry by transforming the traditional catalog shopping experience for shock absorbers into a streamlined, one-click online purchase process. Starting on platforms like eBay and Amazon, the company soon realized the limitations of these marketplaces, particularly in controlling the customer experience and high acquisition costs. In 2017, Shock Surplus shifted to a direct-to-consumer model via Shopify, resulting in sales doubling and a significant reduction in cost per sale from 15% to 6%.

Facing the need for more substantial funding to support inventory, marketing, and website enhancements, Shock Surplus turned to Shopify Capital after traditional banking routes proved unhelpful. Traditional lenders failed to recognize the full potential of the business, focusing narrowly on metrics like cash balance and EBITDA, which didn’t reflect the company’s operational success or growth trajectory.

Shopify offered a seamless solution with minimal paperwork and no personal credit checks, allowing funding to be approved and disbursed rapidly – sometimes within two days. This hassle-free approach enabled Shock Surplus to invest aggressively in web development and content creation, significantly enhancing the user experience and educational resources for customers.

Since partnering with Shopify, Shock Surplus has secured about $2 million through three rounds of funding. The company has seen substantial revenue growth, increased its average order value, and reduced product return rates.

The Public Pet: Expanding Inventory to Get Impressive Revenue Growth

, founded by Jordan Lee, is a thriving pet supply company that offers a wide range of products designed to meet the diverse needs of pet owners. Jordan Lee credits a significant part of the company’s success to Shopify Capital, which has been a pivotal factor in their revenue growth of 40% to 50%. This increase was primarily fueled by the ability to expand the company’s inventory and introduce new products into the market. With the financial backing from Shopify, The Public Pet could invest in a broader range of inventory, tapping into new product lines and catering to a wider customer base. The flexible repayment terms ensured that The Public Pet could manage its cash flow more efficiently, investing in growth opportunities without the pressure of fixed repayment schedules.

Porter Road: Remarkable Achievement with Shopify Capital

, led by CEO Chris Carter, is a company that has masterfully capitalized on strategic marketing to drive exceptional sales growth. Under Chris’s leadership, Porter Road has implemented a marketing strategy that not only attracts new customers but also retains them, leading to significant business expansion. Chris Carter highlighted a remarkable achievement where a $1 million marketing investment resulted in over $11 million in sales in a single day. This impressive return on investment underscores the effectiveness of Porter Road’s marketing approach, which is finely tuned to resonate with its target audience and maximize conversion rates. The company’s ability to craft compelling marketing campaigns backed by Shopify Capital that communicate the value of their products has been a key driver of these sales.

Wrapping Up: Evaluating The Program for Your Business

Shopify Capital offers a unique and accessible funding solution tailored specifically for Shopify merchants. It stands out from traditional business loans by providing a more streamlined and flexible approach, with eligibility largely based on your store’s performance rather than extensive credit checks. Whether you’re eligible for a cash advance or a merchant loan, Shopify Capital provides quick access to funds, which can be crucial for scaling your business, managing inventory, or seizing growth opportunities.

Understanding how Shopify Capital works is key to determining if it’s the right fit for your business. By exploring the eligibility criteria and the differences between cash advances and merchant loans, you can make an informed decision on which option aligns best with your financial needs. The program’s future discounts and potential incentives further enhance its appeal, offering more value to committed Shopify merchants.

Applying for Shopify Capital is straightforward, thanks to its integration within the Shopify platform. By following the step-by-step guide provided, and implementing the seven tips to increase your eligibility, you can enhance your chances of securing the funding you need. The success stories highlight how other merchants have leveraged Shopify Capital to fuel their business growth, providing inspiration and real-world examples of the program’s potential impact.

Shopify Capital is a valuable resource for Shopify merchants looking to access quick, flexible funding tailored to their unique business needs. Whether you’re expanding your operations, managing cash flow, or investing in new opportunities, Shopify Capital can be a powerful tool to help you achieve your business goals.

FAQ

What is Shopify Capital?

Shopify Capital is a funding program designed for Shopify merchants, offering timely financial assistance through merchant cash advances and loans. It provides an alternative to traditional bank loans, focusing on helping merchants grow their businesses with less stringent qualification criteria.

How much can you get from Shopify Capital?

The amount you can receive from the program varies, generally ranging from $200 to $1 million. The specific amount offered is based on your store’s sales performance, historical revenue, and other operational metrics that Shopify reviews.

How is Shopify Capital paid back?

Repayments for Shopify Capital are made through a fixed percentage of your daily sales. This means the amount you repay daily varies with your store’s sales volume, which helps to align repayment with your business cash flow.

Is Shopify Capital personally guaranteed?

No, the program does not require personal guarantees. The funding is unsecured, meaning you don’t need to pledge personal assets as collateral.

Can you negotiate Shopify Capital?

The terms of Shopify Capital, including the funding amount and repayment percentage, are typically not negotiable. You’ll usually receive three offers with a low, medium, and high amount to choose from. Terms are calculated based on Shopify’s assessment of your business’s performance and risk.

Do you pay interest on Shopify Capital?

Instead of traditional interest, the program uses a factor rate to determine a fixed borrowing cost that you agree to repay. This amount is added to the capital provided, and the total is repaid as part of your daily sales deductions.

Can I pay off my Shopify Capital early?

Yes, you can repay early without any penalties. Early repayment can be a good strategy to reduce the amount of daily sales allocated to repayments, freeing up cash flow for other uses.