The Best BigCommerce Apps for Financing

Today, the most popular tools for ecommerce firms are extensions and applications from third parties. Their primary goal is to make your everyday life easier and to assist you in boosting the value of your business. If you didn’t have it, you would be missing out on a lot of worthwhile and practical possibilities. As a result, industry giants like Magento and Shopify have their own App Stores. In this piece, we’ll examine the top 10 financing options available for BigCommerce. Additionally, you’ll learn about eCommerce financing, including what it is, why you need tools for it, and other information. Extensions that can assist you with finance, checkout optimization, and other issues are available here. Let’s start.

Table of contents

What is eCommerce Financing?

eCommerce financing is a type of funding that gives business loans to online retailers. Digital loans also aid online retailers in expanding, paying for marketing costs, and boosting sales. E-commerce funding is used by online vendors to control cash flow and meet payment obligations. These payment obligations cover marketing costs like advertising and affiliate programs. Over the past few years, eCommerce sales have soared. Due to this, there is now a desire for online shopping, which is assisting both traditional and deejatl business growth.

What forms of funding does online commerce have?

In essence, it’s very similar to doing business as usual. However, we will still mention each technique and provide a brief summary.

Revenue-based financing

Revenue-based finance (RBF), as a financing solution that is suitable for e-commerce businesses, has grown in popularity in recent years. In essence, revenue-based financing is a different type of financing where businesses are given money based on expected future sales. Once you submit an application for revenue-based financing, your company will be the subject of risk analyses. If you qualify for funding, money will be sent to you in as little as 48 hours. When compared to bank loans, which need fixed monthly payments, revenue-based financing allows you a lot more repayment freedom.

Bank loans

A business loan application normally starts with the submission of application papers along with supporting paperwork like your company’s incorporation certificate and financial statements. The bank conducts a credit analysis on your company after receiving all necessary documentation, taking into consideration a number of factors to decide if a loan should be issued. These comprise, among others, the financial statements of your business, cash flow, business plan, and asset coverage ratio. If your loan application is approved, the bank will give you money that must be paid back at a specific interest rate.

Inventory financing

A short-term, asset-based loan (or line of credit) made available to your company to buy goods is known as inventory finance. Contrary to bank lending, inventory financing does not call for the pledge of assets or other property as collateral. Instead, the bought inventory acts as collateral, giving the creditor the right to take your inventory and sell it if you stop making loan payments.

Invoice financing

Companies can get capital based on receivables through invoice financing, a type of asset-based financing.

What is the best financing option for e-commerce?

We are unable to respond. No two businesses are the same and require the same types of finance. Each business has unique characteristics and earnings. Choosing the best financing option requires careful consideration of your assets, income, and outgoings.

Best Financing Apps for BigCommerce

Affirm Marketing

According to studies, most buyers who finance large-ticket products make their decision early in the buying process. In comparison to a straightforward integration at checkout, adding promotional messaging up the funnel could raise conversion rates by two to three times. With the help of customized programs from Affirm, you can convert surfers into buyers, raise the average order value, and grow your clientele. To enable promotional messaging for both new and existing Affirm merchants, use this specific app.

The main feature of this app is

- You may show a customer’s anticipated monthly payment amount on product pages and at checkout thanks to the Affirm Marketing app. Prices can be reframed as manageable monthly payments, which will increase conversion and average order value.

You can use this app for free. .

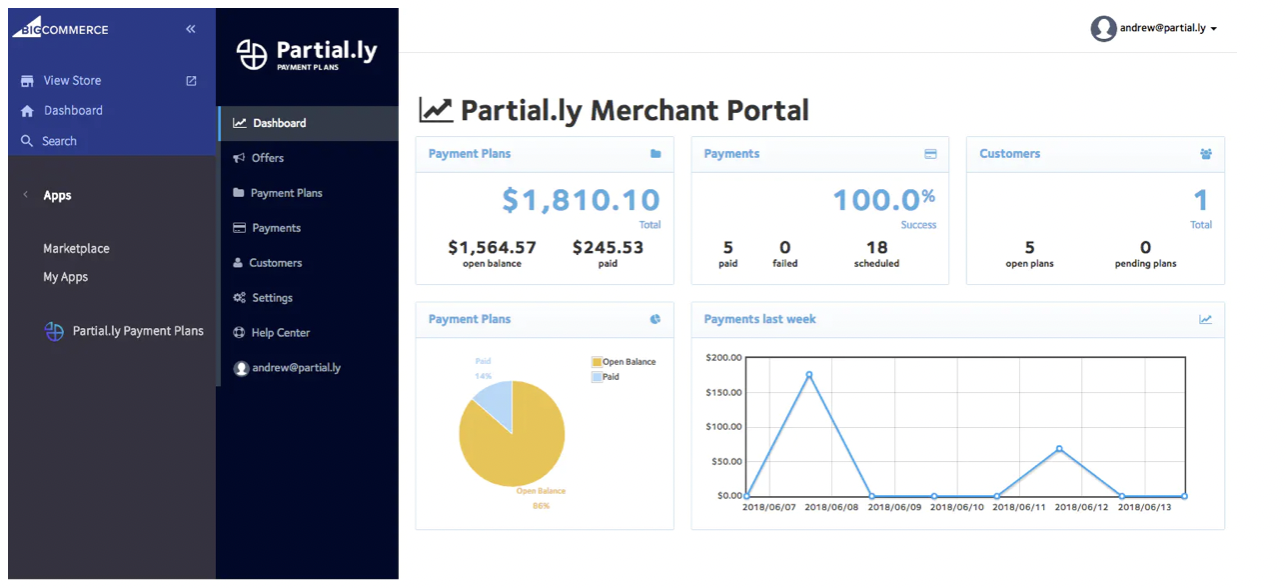

Partial.ly Payment Plans

With its wealth of capabilities, the Partial.ly app for BigCommerce stores may increase sales and facilitate payments. Establish down payment, frequency, and repayment schedules to let customers buy expensive items at a pace that works for their budgets. You will also be able to seamlessly incorporate a flexible payment plan offer into your checkout process and enable clients to customize plans up to the predetermined limits. You get such features as

- Paying with automated simplicity. Utilize pre-scheduled, automated payments for payment plans to streamline your collections and bill consumers precisely in accordance with your specifications.

- Customers alter plans. Offer payment terms that benefit both you and your consumers to increase sales. Allow consumers to tailor programs up to the boundaries you specify.

- Versatile manual payments. Process payments that have previously been scheduled early or make a custom payment of any amount and the remaining payments will be automatically adjusted.

- Ready for global e-commerce. From Australia to the US, there are 25 countries where businesses can use Partial.ly, and more are constantly being added.

- Total command over the payment plan. Decide on the down payment, repayment schedule, term, and any supplementary line item fees. Plan ahead so that it precisely complies with your operational procedures.

This app is available for free usage. .

Optty BNPL Banners

With just one integration, Optty enables direct access to all BNPL service providers worldwide. A business arrangement with the provider and two simple clicks will get you up and running with today’s Optty integration’s direct access to 50+ BNPL providers in 59 countries and 36 currencies. With a focus on giving customers more options, increasing conversion rates, and optimizing the overall shopping and checkout experience, Optty’s aim is to boost the performance of merchants. The world’s first global Buy Now Pay Later (BNPL) integration technology is called Optty. The Optty software, which is available for free, has a ton of features that give merchants the control they need to efficiently manage their BNPL and alternative payment options. You also get such benefits as

- One-to-many integration. All of Optty’s international BNPL partners are accessible through a single integration.

- Controls for customization. Utilizing the Optty Retail Control Centre and the Optty BNPL Banner App, you can completely customize your product pages. In your product pages, you may prioritize BNPL providers by dragging them up or down. You can also place on-site BNPL logos with an obvious call-to-action element and quickly activate or deactivate BNPL providers as necessary.

- Integrate BNPL interactions, whether new or existing, quickly. Install the Optty BNPL Banner App and configure your product pages, footer, and listing pages using our intuitive Optty Retail Control Centre to meet BNPL criteria.

You can utilize this plugin for free. .

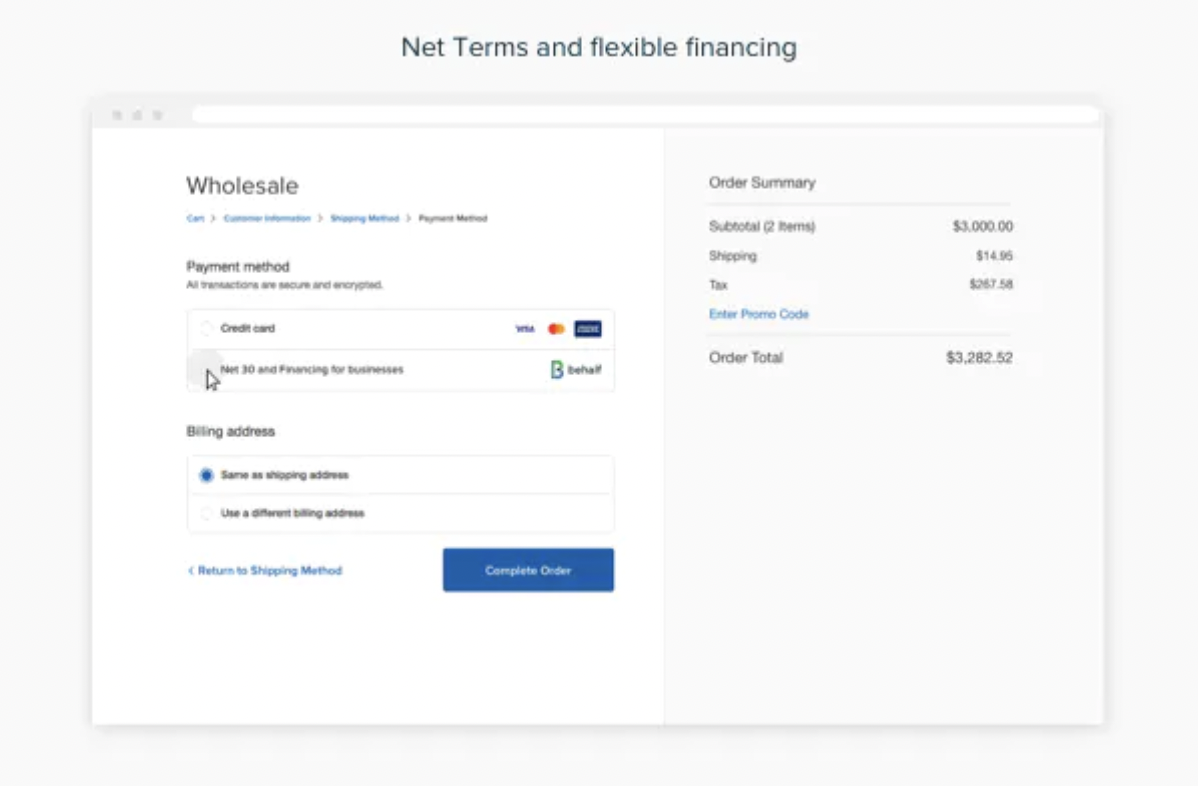

Behalf

Behalf assists B2B retailers in the US in providing financing and no-fee net terms to their business customers at the moment of sale. Behalf is simple to integrate into the BigCommerce checkout flows that already exist, allowing customers to join up and complete their purchases all on the same website. Customers can rapidly prequalify for net terms/financing using Behalf, and if authorized, they can use Behalf to pay for their eCommerce orders. You get functionality like

- Rapid setup. Open a merchant account at Behalf.com and request your API keys during the installation of the app if you want to add Behalf as a payment option. You can map your store order status by using the new payment configuration page that Behalf will offer.

- Quick payment. Make an automated eCommerce finance experience to hasten the collection of debt. After the transaction is approved, you will be paid by the following business day.

- Boost sales and order values on average. Give your business clients more purchasing power and watch your company expand. The AOV and revenue of our merchant partners have grown by 53-83% and 44%, respectively.

- Offering NET and extended financing. Get paid up front and give your clients the credit they require. Increase sales, lower risk, and, regardless of the size of the transaction, receive payment within one business day of approval.

This app is available without cost. .

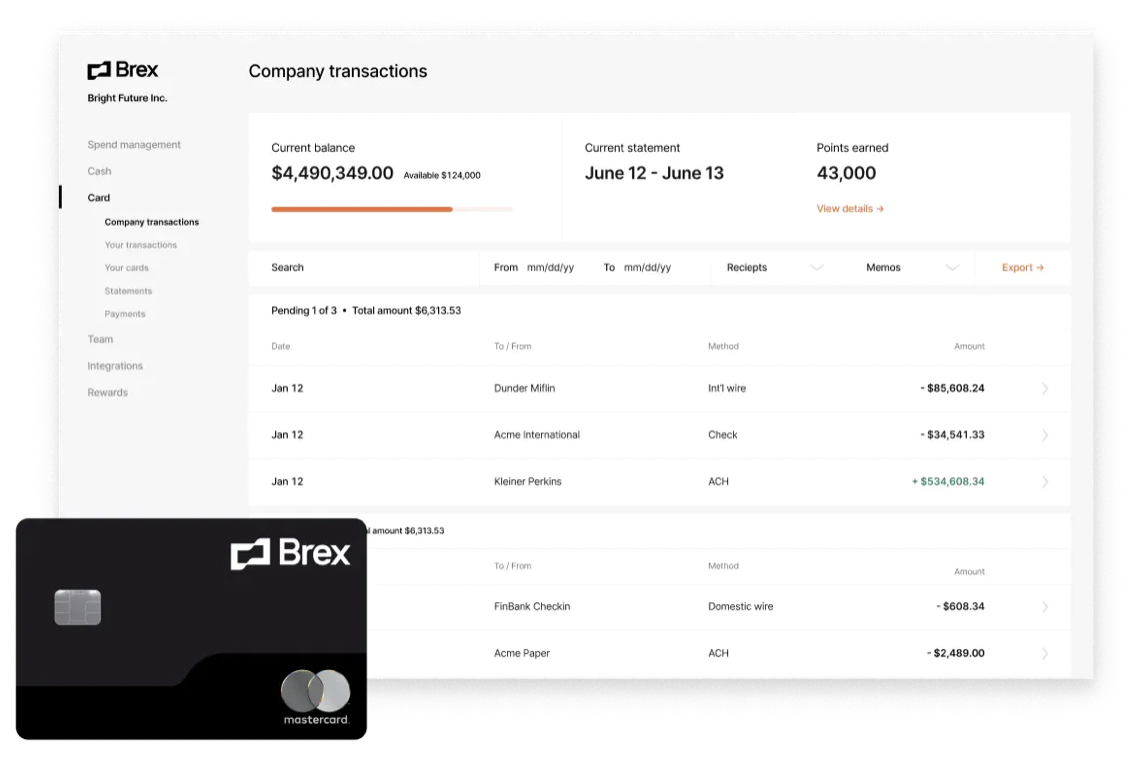

Brex

With credit cards, cash management, spending, and accounting all in one spot, Brex makes it simple to set up your entire company account the right way. With no personal guarantee, you can open an account online in 10 minutes and receive your account number, routing number, and credit cards immediately after acceptance. Even overseas, Brex doesn’t charge fees for sending checks, ACH transfers, or wire transfers, and you get cash back on every dollar you spend using your Brex card. It’s your financial OS since all of your credit, cash, and controls are in one location. You also receive such features as

- Simple to control spending. Recurring and scheduled payments, user responsibilities, and approval channels all help to speed up teamwork and keep spending within policy and on schedule while tracking trends.

- Boost your company’s credit. Brex informs major business bureaus about your timely payments so you can establish a business credit history.

- Internal integrations. Integrating Concur, Expensify, Gusto, QuickBooks, Xero, and NetSuite will save you hours of work.

- Unrestricted rewards on all card purchases. There are no fees, only points for everything, such as 8x on rideshare or 1.5x on advertisements.

- In minutes, live assistance. Use the phone, chat, or email to contact our staff. Our client satisfaction rating is 95%.

This plug-in may be used without cost. .

Reliant Funding

With fixed cost capital from Reliant Funding, you may quickly, easily, and flexibly overcome any working capital constraints your company is now experiencing. Get the cash you need to power your business. Funding solutions, which are now accessible for small firms with gross annual sales of above $100,000, start at $5,000 and can go up to $250,000 depending on the company’s financials. Fixed cost capital gives you the ability to take action, whether it’s buying merchandise, engaging in marketing, or filling a short-term funding shortfall.

The main benefit of this plugin is that it was designed with an optional daily payment system that lets you foresee your spending in advance. You can get the money you need without transferring any of your personal or corporate assets.

This app have custom pricing. .

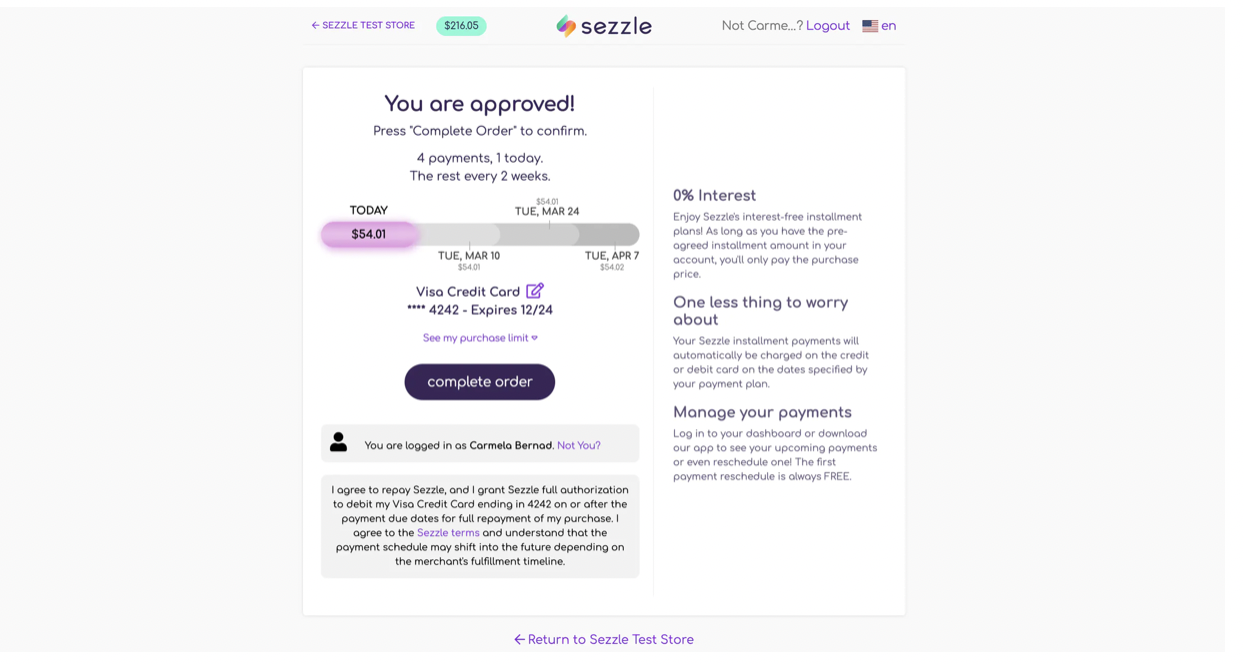

Sezzle

You can purchase more with Sezzle and pay later. So that you may obtain what you need when you need it, divide your order into 4 payments of 0% interest over a period of 6 weeks. Sezzle boosts the performance of your store by converting more browsers into customers, increasing cart sizes, and gaining access to millions of next-generation consumers who demand fairness, transparency, and payment flexibility. Sezzle’s straightforward merchant solutions enable customers to flexibly finance any order—in-person or online—from $5 to $25,000 without having to deal with cumbersome payment methods. You receive features like

- Powerful Performance. Sezzle users benefit from greater basket sizes, improved conversion rates, and a decrease in abandoned shopping carts and returned items.

- Next-Gen Traffic Driver. To direct our +9mm customers to retailers they’ll enjoy, Sezzle develops individualized marketing campaigns.

- Lightning-fast and Simple Button Clicks. Start selling more right away, integrate in a matter of minutes, and get paid in full the following day.

This application is free to use. .

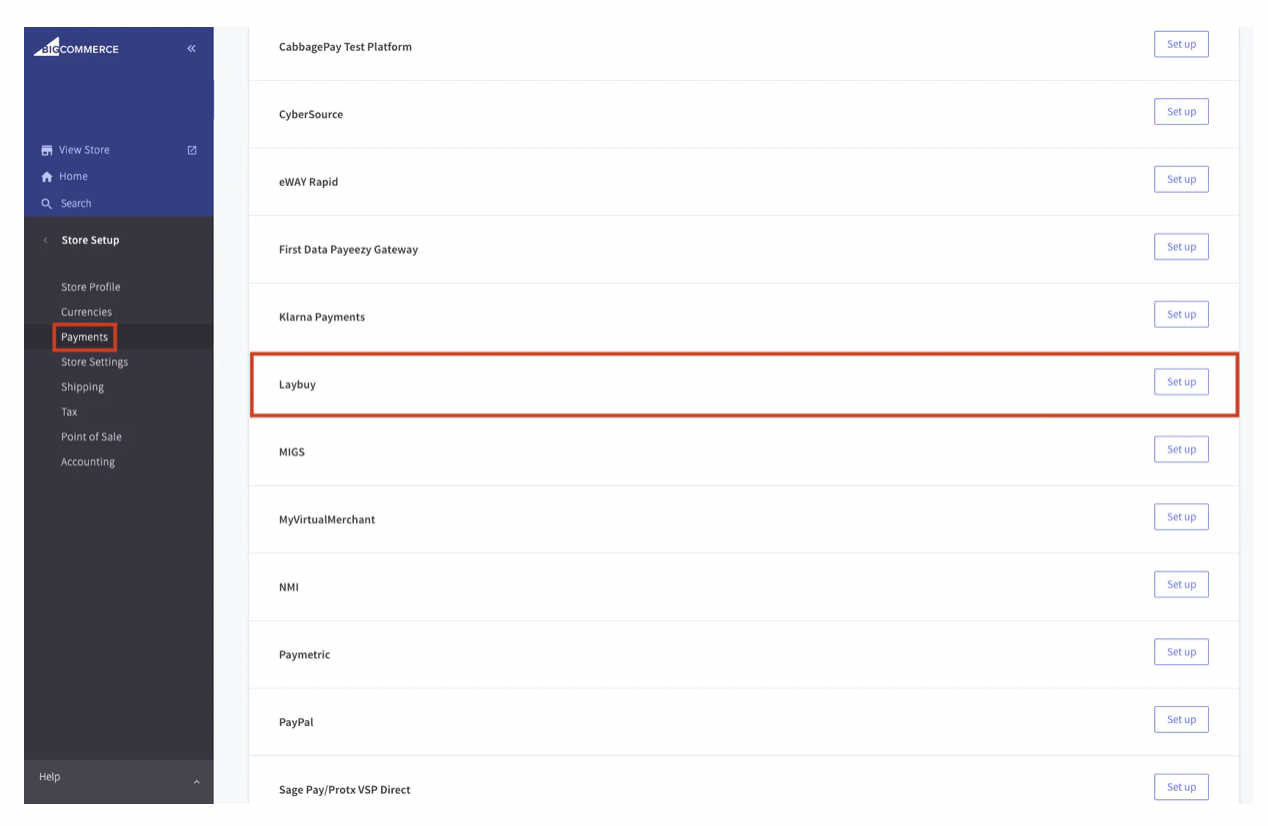

Laybuy

Laybuy gives BigCommerce retailers more options and flexibility when it comes to how customers can pay. Customers have the option of making six weekly payments at no interest to “buy now, pay later.” The actual winners from Laybuy are entrepreneurs like you. Customers can use Laybuy to pay for more expensive things since it increases the average order value and basket size, improves conversion rates, and expands client acquisition. Additionally, a totally independent, third-party credit bureau checks the credit and affordability of Laybuy customers to lower the risk of defaults and fraud. You also get features like

- Increasing your revenue and clientele. Laybuy raises your conversion rate, average order value, and customer acquisition.

- Payment, immediate. Laybuy smoothly, automatically, and promptly pays all merchants upfront.

- Fraud risk eliminated. For all payments, Laybuy takes all non-payment and fraud risks.

- Integrated seamlessly. Our integration with BigCommerce is complete.

- Promotional Banner. Show a price breakdown banner on your product pages to show clients how much their payments will cost over the course of six weeks. increasing the basket size and sales.

You can exploit this app for free. .

Credit Key

Order volumes and order values increase considerably when using real-time B2B credit. With the help of our exclusive B2B underwriting procedure, Credit Key is able to quickly and accurately analyze businesses and provide them with a deeper line of credit at the time of purchase. This plugin offers such benefits as

- Getting paid. Now. Instead of waiting for customers to pay using trade credit, receive payment right away.

- You are not required to be a bank. Credit Key factors all invoices and takes on all risk, allowing you to concentrate on your company.

This app is available for free usage. .

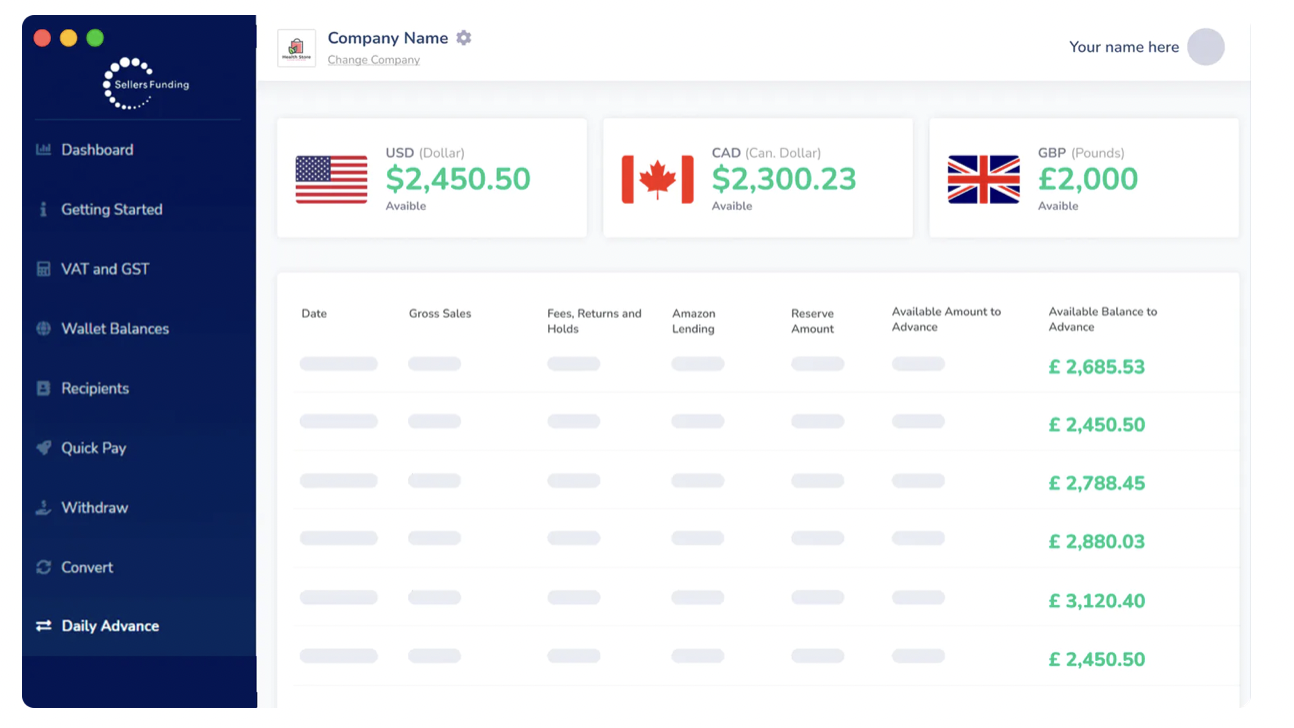

SellersFunding

For thousands of online merchants just like you, this plugin is the most reliable source of financial solutions. Its goal is to support online sellers’ growth. App provides a range of goods that are tailored to the distinct business requirements of each client because of this. Plugin can assist you in improving your cash flow to spur growth with a variety of services, including working capital funding, invoice factoring, the daily advance, and more. Here are some ways that improved cash flow might benefit your company:

- Purchase merchandise to attract more clients

- Introduce new items

- Enlarge your market reach

- Pay for business expenses without sacrificing anything

- $50,000,000 in less than 48 hours

- No effect on your credit rating

- Additionally, access your daily marketplace revenue without paying high costs

This app has customized pricing. .

FAQ

What is eCommerce financing?

E-commerce financing is a type of funding that gives business loans to online retailers (shops). eCommerce loan enables online retailers to develop, pay for marketing costs, and boost sales.

What are the sources of funding for business?

Retained earnings, equity, term loans, debt, letter of credit, debentures, euro issuance, working capital loans, venture investment, etc. are some of the sources of corporate financing.

Why is funding crucial in e-commerce?

It’s easy. Every business’s primary source of funding is financing. eCommerce isn’t an exception. You will be able to extend your internet store to a high level with the aid of money.