Everything You Need To Know About E-Commerce Total Cost of Ownership

The Total Cost of Ownership (TCO) of e-commerce has become increasingly important in recent years, especially during a crisis. As businesses seek to stay afloat, TCO is a crucial factor in decision-making when investing in new technology and infrastructure for online sales. In the following article, we define what TCO is and describe its place in an average e-commerce model. You will learn the difference between the in-house and outsourced e-commerce TCO and their relation to open source and SaaS models. After that, we explain how to calculate the e-commerce Total Cost of Ownership. The last chapter explains why TCO is especially important in critical times for companies to understand the full financial impact of their investments and to assess the long-term benefits that e-commerce can bring. So, by carefully considering the e-commerce Total Cost of Ownership, businesses can take vital new steps in optimizing their investment and ensuring success in the competitive e-commerce landscape, but what exactly is TCO?

Table of contents

What Is TCO?

Total Cost of Ownership (TCO) is a financial metric used to evaluate the overall cost of acquiring, operating, and disposing of a product, service, or system. It encompasses all costs associated with a particular asset, including the initial purchase price, maintenance, support, upgrades, and disposal.

The TCO provides a more comprehensive picture of the financial impact of an investment, beyond just the upfront cost, and helps decision-makers evaluate the long-term financial viability of the investment.

Total Cost of Ownership is commonly used in industries such as information technology, manufacturing, and transportation to assess the Total Cost of Ownership of equipment, facilities, and vehicles. When it comes to the e-commerce Total Cost of Ownership, it focuses on other aspects divided between initial and ongoing expenditures associated with the e-commerce model.

How to Calculate TCO?

Calculating the Total Cost of Ownership involves identifying and quantifying all direct and indirect costs associated with acquiring, using, and disposing of an asset. The following formula is used to calculate TCO:

TCO = I + O – R

Where I stands for initial cost, O stands for ongoing costs over 5 years, and R stands for the remaining value after 5 years of depreciation.

Here is a general outline of the steps involved in calculating TCO:

- Identify all initial costs: These are the upfront costs of acquiring the asset, including the purchase price, delivery, and installation.

- Identify all ongoing costs: These are the maintenance costs of using the asset, including maintenance, support, upgrades, training, and other costs.

- Determine the lifespan of the asset: Establish the expected lifespan of the asset and the period over which costs will be incurred. In the example above, we use 5 years.

- Project future costs: Using the expected lifespan and the initial and ongoing costs identified, estimate the future costs of owning the asset.

- Remaining value: Calculate the remaining value for the defined lifespan.

- Total costs: Add up all initial and ongoing costs and deduct the remaining value from them to determine the Total Cost of Ownership.

- Compare to alternatives: Compare the TCO of the asset to alternatives to determine the best investment choice.

Note that a more simple model skips the fifth step so that the initial formula looks as follows: TCO = I + O. Even in this case, TCO calculations are complex and may require expert financial analysis, especially for large or complex assets. However, taking a comprehensive view of the costs associated with an investment, TCO provides valuable information for decision-makers and helps ensure that investments are financially viable over the long term.

E-Commerce Total Cost of Ownership

E-commerce Total Cost of Ownership (TCO) refers to the complete cost of acquiring, using, and upgrading an e-commerce platform and its infrastructure. It encompasses all the initial costs associated with establishing and maintaining an online sales platform (an online storefront, Facebook shop, eBay store, etc.), including hardware and software expenses, employee training, marketing, and advertising costs, and ongoing maintenance and support expenses.

The e-commerce TCO differs from the general TCO in that it tackles the special costs associated with running an online business. For example, a brick-and-mortar store may incur costs such as rent, utilities, and property insurance, but an e-commerce business, on the contrary, includes such expenditures as website hosting, cybersecurity precautions, and the cost of shipping products to clients.

Below, you can see the unique nuances of e-commerce Total Cost of Ownership:

- Website development and hosting costs: The cost of building and maintaining an e-commerce website, including website design and development, hosting, and ongoing support are unique aspects of calculating TCO for e-commerce.

- Payment processing fees: The cost of processing customer payments, including transaction fees, gateway fees, and chargeback fees is also a unique nuance of e-commerce Total Cost of Ownership calculations.

- Shipping and handling costs: Calculating TCO for e-commerce may also include the cost of shipping products to customers, including shipping materials, carrier fees, and handling costs.

- Marketing and advertising expenses: E-commerce TCO calculations usually involve the cost of attracting and retaining customers, including search engine optimization, social media advertising, and email marketing.

- Data security costs: The cost of protecting customer data and transactions, including firewalls, SSL certificates, and cybersecurity insurance, is another integral part of e-commerce TCO.

By considering the unique nuances of e-commerce TCO, businesses can make informed decisions about their online sales platform and ensure that their investments are financially viable over the long term.

However, e-commerce TCO calculations may differ a lot depending on what e-commerce model is utilized: in-house or outsourced.

What is the in-house e-commerce Total Cost of Ownership?

In-house e-commerce Total Cost of Ownership refers to the complete cost of managing and operating an e-commerce platform and infrastructure internally, rather than outsourcing it to a third-party provider. This includes the cost of acquiring and maintaining the necessary hardware and software, hiring and training employees, marketing and advertising expenses, and ongoing support and maintenance expenses.

An in-house e-commerce TCO calculation takes into account the costs associated with building and maintaining an e-commerce platform from within the company, including:

- Hardware and software expenses: The cost of acquiring and maintaining the necessary technology, including servers, software, and tools.

- Employee salaries and benefits: The cost of hiring and training employees to manage and operate the platform, including salaries, benefits, and training expenses.

- Marketing and advertising expenses: The cost of attracting and retaining customers, including search engine optimization, social media advertising, and email marketing.

- Data security expenses: The cost of protecting customer data and transactions, including firewalls, SSL certificates, and cybersecurity insurance.

By calculating the in-house TCO, companies can determine the financial viability of managing their e-commerce platform internally and compare it to the cost of outsourcing to a third-party provider. This helps them make informed decisions about the best way to manage their e-commerce operations and ensure the long-term financial viability of their investments.

What is the outsourced e-commerce Total Cost of Ownership?

Outsourced e-commerce TCO, on the other hand, refers to the complete cost of outsourcing the management and operation of an e-commerce platform and infrastructure to a third-party provider, rather than managing it internally. This includes the cost of the third-party service, as well as any necessary hardware and software expenses, marketing and advertising expenses, and ongoing support and maintenance expenses.

An outsourced e-commerce TCO calculation takes into account the unique costs associated with outsourcing the management and operation of an e-commerce platform, including:

- Third-party service fees: The cost of the outsourcing service, including fees for hosting, platform management, and ongoing support.

- Hardware and software expenses: The cost of acquiring and maintaining any necessary technology, including servers, software, and tools.

- Marketing and advertising expenses: The cost of attracting and retaining customers, including search engine optimization, social media advertising, and email marketing done by third parties or on the side of the company.

- Data security expenses: The cost of protecting customer data and transactions, including firewalls, SSL certificates, and cybersecurity insurance done by third parties or internally.

As you can see, if we compare in-house and outsourced e-commerce TCO, third-party service fees are the only unique category of expenses. Although other categories are associated with the same activities, they are usually done by third parties when we talk about outsourced e-commerce Total Cost of Ownership.

By calculating the outsourced TCO, companies can determine the financial viability of outsourcing their e-commerce platform and compare it to the cost of managing it internally. Furthermore, businesses usually compare the same cost items to see in which model they are associated with reduced expenditures. As a result, a combined approach to e-commerce TCO calculations is applied when a project involves both in-house and outsourced cost items. This helps entrepreneurs make informed decisions about the best way to manage their e-commerce operations and ensure the long-term financial viability of their investments.

SaaS and Open Source models in TCO

The correlation between in-house and outsourced e-commerce Total Cost of Ownership (TCO) and Software as a Service (SaaS) and Open Source models lies in the cost and control over the technology and platform.

In-house e-commerce TCO typically requires higher initial investment and ongoing maintenance costs but provides greater control and customization options over the platform and technology. On the other hand, outsourced e-commerce TCO generally has lower initial costs and relies on the service provider for management and support, but may have limitations in terms of customization and control over the platform.

SaaS e-commerce models are typically associated with the outsourced e-commerce TCO, with lower upfront costs and the service provider managing the technology and platform. Open Source e-commerce models, on the other hand, follow the in-house TCO, with the cost of acquiring and maintaining the technology being the responsibility of the company.

When comparing SaaS and Open Source models from the perspective of Total Cost of Ownership, there are several key differences to consider:

- Initial costs: SaaS models generally have lower initial costs as they are typically subscription-based and don’t require significant investments in hardware or software. Open Source models, on the other hand, require a higher upfront investment as the company must purchase the technology and cover the cost of implementation and customization.

- Ongoing costs: SaaS models often have higher ongoing costs as they require a recurring subscription fee, whereas Open Source models may have lower maintenance costs as the business itself is responsible for ongoing maintenance and upgrades.

- Control and customization: Open Source models provide more control and customization opportunities as the company has access to the source code and can make changes as needed. SaaS models, on the other hand, may have limitations in terms of customization and control because the platform is managed by the service provider.

- Support and maintenance: SaaS models typically provide 24/7 support and maintenance as part of the subscription fee, whereas Open Source models offer limited support options or additional paid plans.

- Scalability: Although both SaaS and Open Source models offer scalability options, SaaS models generally provide higher potential flexibility and scalability.

In terms of TCO, the choice between SaaS and Open Source models will depend on the company’s specific needs, goals, and budget. SaaS models may be a better fit for companies with limited resources or a need for a more streamlined and hands-off approach, while Open Source models may be a better fit for companies with more technical expertise and a desire for greater control and customization.

In general, SaaS is better than Open Source in terms of e-commerce Total Cost of Ownership because it is associated with lower initial costs, better scalability, more user-friendly implementation, regular automated updates, and 24/7 support and maintenance. At the same time, you have to deal with recurring subscription fees, limited customization options, and some security concerns since SaaS solutions may store sensitive business data insecurely.

Open Source looks more attractive than SaaS because it usually offers lower ongoing costs, more control and customization options, access to a large community, a high level of transparency, and outstanding flexibility. As for its drawbacks, they include higher initial costs associated with the necessity to purchase the technology and cover the cost of its implementation and customization, limited support, a certain level of technical expertise required to implement and maintain the project, and security concerns. Open Source models may also raise security concerns as the company is responsible for ensuring the security of the platform.

How to Calculate E-Commerce TCO

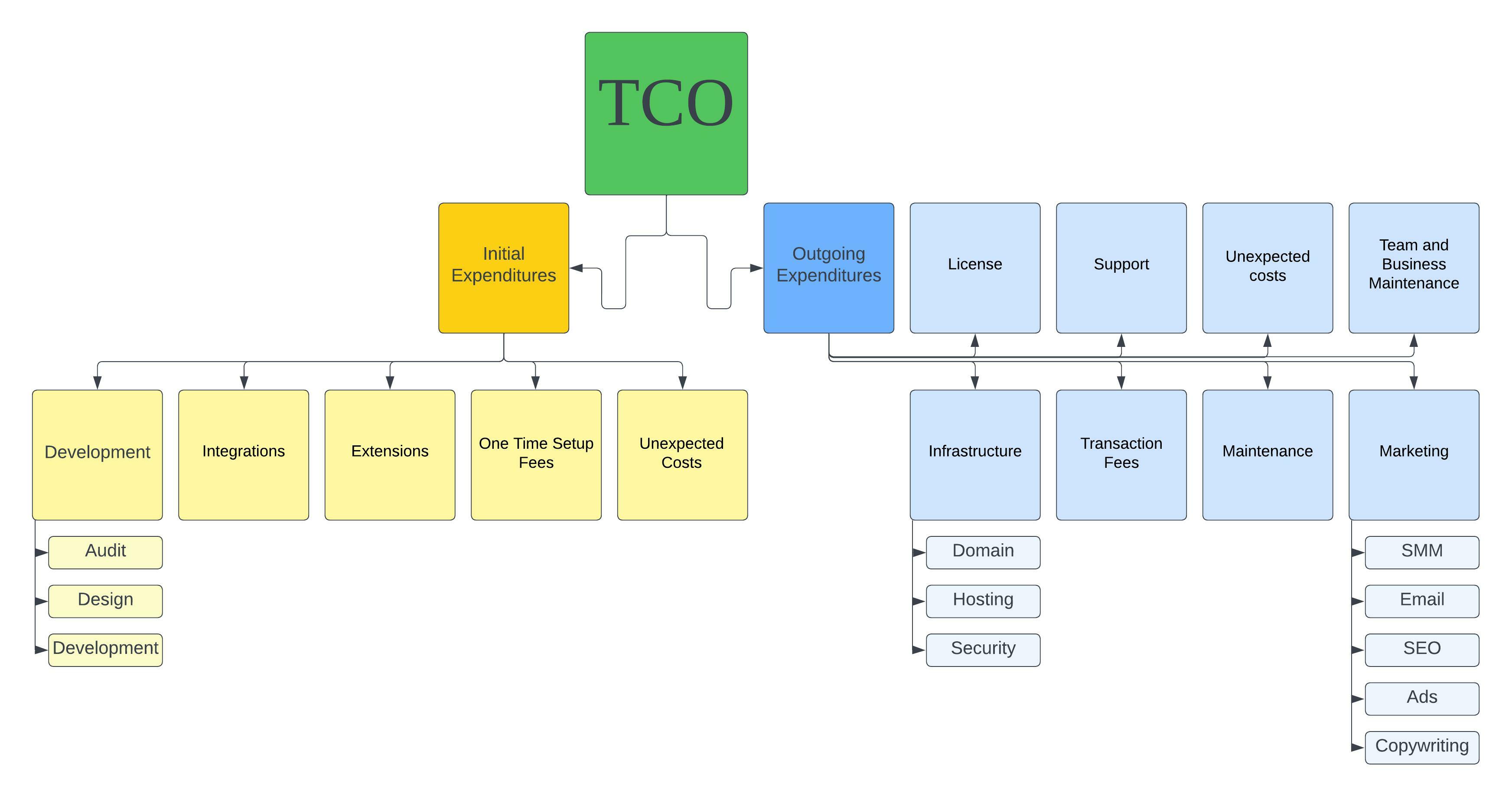

Use the simplified following formula mentioned above to calculate the e-commerce Total Cost of Ownership: TCO = I + O. You can find the structure of the initial and ongoing expenditures in the table below.

| Category of Expenditures | Subcategory | Subdivision | Definition |

| Initial Expenditures | These are all the expenditures associated with the pre-launch period of your e-commerce project. | ||

| Development | Development costs are usually associated with these three activities: audit, design, and actual development. | ||

| Audit | It’s the initial step that helps you calculate the available resources and evaluate the requirements of your new project. | ||

| Design | At this stage, you need to create the architecture of your future e-commerce project and its design. | ||

| Development | It is the actual implementation of what’s been planned during the previous stages. | ||

| Integrations | Now, when your e-commerce website is ready, you may need to connect it to external systems, including ERP, CRM, accounting platforms, and so on. | ||

| Extensions | If the default functionality of the selected e-commerce platform is not enough, you may need to install additional extensions, apps, or modules. | ||

| One-Time Setup Fees | Depending on the selected platform and instruments, you may need to pay one-time setup fees, including domain name registration, template purchase, server configuration, email setup, etc. | ||

| Unexpected costs | Note that unexpected costs may occur at any of these stages. The more detailed and well-planned your initial concept is, the fewer unexpected costs you get. | ||

| Ongoing Expenditures | These are all expenditures associated with the post-launch period of your e-commerce project. | ||

| License | You need to pay for using your platform. Some e-commerce platforms are free to use or offer free plans. The others can cost thousands. | ||

| Infrastructure | Infrastructure costs are often divided into three categories: domain, hosting, and security. | ||

| Domain | You need to pay for your domain name usually on a yearly basis. | ||

| Hosting | The more complex your e-commerce project is, the more complex its hosting costs are since its infrastructure becomes resource-hungry. | ||

| Security | For, instance, an SSL certificate is a must-have component of your security. You can purchase it monthly. | ||

| Transaction Fees & Payment Processing | Transaction fees are another less evident cost that should be factored into the e-commerce Total Cost of Ownership calculation. Both e-commerce platforms and payment gateways may charge for each transaction. | ||

| Maintenance | You need to keep the infrastructure of your website up-to-date, addressing bug fixes and minor functionality losses. And if you want your store to expand and evolve to satisfy the needs of your customers, new features must be added regularly. | ||

| Marketing | Depending on your strategy and goals, you may need to implement different marketing strategies. | ||

| SMM | Using social media platforms as a way to interact with your clients is a good idea. Most businesses do that. It may require hiring specialists and paying for specific SMM tools monthly. | ||

| Email Marketing | Email marketing is an inevitable part of e-commerce. You may either integrate your e-commerce website with third-party systems or install apps that enable the desired functionality. | ||

| SEO | SEO is a complex thing that may require third-party help, an entire department, a bunch of additional instruments, or can be reduced to some basic optimizations. Everything depends on your project and its strategy and goals. | ||

| Ads | E-commerce businesses often rely on ads so don’t miss your chance to increase sales with the help of advertising. | ||

| Copywriting | A copywriter can create articles about your products to attract additional organic traffic to your website. If you don’t have a blog, you may not need this specialist. | ||

| Support | Depending on the size of your e-commerce website, you may need a different support team. If you can handle all support inquiries by yourself in the case of a tiny project, multiple support teams are necessary for a huge website. | ||

| Unexpected costs | If you can easily predict the cost of your initial expenditures, ongoing expenditures are usually associated with various unexpected costs. For instance, you may need specific marketing tools, additional support specialists, new third-party extensions, etc. | ||

| Team and Business Maintenance | Nowadays, hiring or educating additional specialists is not always cost-effective. With a broad variety of third-party tools and services, some specialists become unnecessary. For instance, a PIM system can handle more operations daily than a corresponding team. At the same time, using this software may be associated with reduced costs and zero errors. Considering this example, you should always consider that new opportunities may impact your ongoing expenditures. |

According to some specialists, TCO should be calculated for a period of 5 years. Even if some of the numbers are estimated, this will broaden your planning horizon and provide visibility into future expenditures.

E-commerce TCO during a crisis

E-commerce Total Cost of Ownership is especially important during a crisis because it can help companies better manage their finances and ensure the sustainability of their business. During a recession, businesses face increased economic uncertainty and financial pressures, making it more critical than ever to understand and control their costs.

Companies can reduce costs by conducting a thorough analysis of their e-commerce TCO, such as selecting a more cost-effective platform, outsourcing certain functions, or optimizing their operations. This can assist them in lowering their overall e-commerce expenses and freeing up funds to invest in other business areas, ultimately improving their financial stability.

Moreover, understanding their e-commerce TCO can help businesses make informed decisions about their e-commerce strategy, such as choosing between in-house and outsourced models or switching to instruments that offer the right balance of cost and functionality. This can help companies optimize their e-commerce operations and ensure their long-term success, even during challenging economic times.

Let’s summarize reasons why e-commerce Total Cost of Ownership is important during a crisis:

- Helps control and reduce costs: A thorough analysis of e-commerce TCO can help identify areas where expenditures can be reduced, providing businesses with better control over their finances.

- Supports financial stability: Reducing overall e-commerce expenses helps businesses improve their financial stability and free up funds to invest in other areas.

- Informs e-commerce strategy: Understanding e-commerce TCO can help companies make informed decisions about their e-commerce strategy, such as choosing the right platform or model. As a result, it improves overall competitiveness.

- Optimizes operations: By choosing a platform or model that offers the right balance of cost and functionality, companies can optimize their e-commerce operations, ensuring their long-term success.

- Supports long-term success: By reducing costs and optimizing operations, businesses can improve their financial stability and health, achieving better results in a long run even during challenging economic times.

Bottom Line

As you can see, the e-commerce Total Cost of Ownership is an important metric for e-commerce businesses of all sizes and forms since it offers a thorough understanding of the costs related to their activities. Understanding e-commerce TCO assists companies in cost control, e-commerce strategy development, operational optimization, financial stability improvement, and long-term success.

Along with that, e-commerce TCO is especially crucial during a crisis because it gives firms the knowledge and resources they need to manage difficult economic times and come out stronger. Companies can make decisions that will help them succeed even in difficult situations by carefully examining their e-commerce TCO.

E-commerce TCO FAQ

What TCO means?

TCO or Total Cost of Ownership is an estimation of the expenses associated with purchasing, installing, maintaining, and retiring a product or piece of equipment.

What is an example of TCO?

Since TCO is the sum of the purchase price of an asset and its operating costs for a specific period, creating and running an e-commerce website is a simple example. Even if you purchase an operating website, it is still necessary to spend money on its maintenance.

How is TCO calculated?

You can use this formula to calculate the Total Cost of Ownership: TCO = I + O – R

Where I stands for initial cost, O stands for ongoing costs over 5 years, and R stands for the remaining value after 5 years of depreciation.

Alternatively, you can use its reduced version that ignores the remaining values: TCO = I + O

How much does it cost to start an ecommerce store?

The cost of creating an e-commerce website is determined by your particular business needs associated with initial and ongoing expenditures. While some e-commerce stores cost a few hundred bucks to set up, others can be extremely expensive with hundreds of thousands of dollars in budgets.

Does it cost money to maintain an ecommerce store?

Unless you can pay for several years in advance, your domain name will be an annual expense. A domain name usually costs between $2 and $20 per year. The cost is determined by where you buy it and the extension you choose.

Whether you choose a self-hosted, cloud-hosted, or SaaS solution, you’ll have to pay for hosting on a regular basis. Depending on the needs of your online store, these costs can range from $80 to more than $150,000 per year.

Another annual fee is an SSL certificate, which can range between $20 and $70.

And don’t forget about payment processing fees that are ongoing as long as you continue to sell online.