The Ultimate Guide To Stripe Integration

Stripe is one of the most prominent payment processing platforms used by merchants all over the globe. Although it offers several native integration options, they are not usually enough. Therefore, you can find dozens of solutions that claim to connect your business to Stripe. In the article below, we explain what Stripe is and describe its key features, advantages, and disadvantages. After that, you will learn what types of Stripe integrations are available. We compare native and third-party connectors, iPaaS integrations, and custom solutions, highlighting their benefits and downsides. You will also discover the most popular Stripe integrations: Quickbooks, Pipedrive, Salesforce, HubSpot, and Xero. Although we focus on the iPaaS approach, you will find links to the corresponding native and third-party connectors too. So, what is Stripe?

If you want to integrate any system with Stripe in the most effective way – write to us!

Table of contents

What is Stripe?

Stripe is a technology company that offers an online and mobile payment processing platform. It enables businesses to take online payments as well as manage subscriptions and recurring invoicing. Stripe accepts a variety of payment methods, including credit and debit cards, ACH payments, and other local payment methods, and is available in a number of countries worldwide. It is utilized by companies of various sorts, from small startups to major corporations.

There are several ways to establish a Stripe integration, including native and third-party connectors, iPaaS platforms, and custom integrations. The platform incorporates a collection of APIs, enabling developers to integrate payment processing into their websites and mobile apps.

Here are some key features of Stripe:

- Payment processing: Stripe enables businesses to take payments both online and through mobile apps. It accepts a variety of payment methods, including credit and debit cards, ACH payments, and a number of local payment options.

- Subscription and recurring billing: Stripe makes it easy to manage subscriptions and recurring billing for businesses that offer subscription-based products or services.

- Fraud protection: The platform includes built-in fraud protection tools to help businesses prevent fraudulent transactions.

- Global payments: Stripe is available in many countries all over the globe, making it easy for businesses to accept payments from international customers.

- Customizable checkout: Stripe provides customizable checkout pages that businesses can use to create a seamless payment experience for their clients.

- Mobile compatibility: Stripe is designed to work seamlessly on mobile screens of any size, making it easy for businesses to accept payments on the go.

- Scalability: The platform can handle high transaction volumes, making it suitable for businesses of all sizes, from small startups to large enterprises.

- Developer-friendly: Stripe provides a comprehensive set of APIs that enable developers to integrate payment processing into their websites and mobile apps with minimum effort.

- Customer support: Stripe offers customer support through its online documentation and knowledge base, as well as through emails and phone calls.

Here are some pros of using Stripe:

- Wide range of payment methods: Stripe supports a wide range of payment methods.

- Customizable checkout: The platform provides customizable checkout pages that merchants can seamlessly integrate into their businesses.

- Mobile compatibility: Stripe supports all mobile devices.

- Scalability: High volumes of transactions are supported.

- Developer-friendly: With a comprehensive set of APIs, developers can easily integrate Stripe with any existing business.

And these are the cons of integrating your business with Stripe::

- Fees: Stripe charges fees for its services, including a transaction fee and a fee for processing certain types of payments.

- Regional limitations: Although Stripe supports a wide range of payment methods, they may not be available in all countries. It also lacks support for some local payment methods.

- Complexity: Despite the flexible API and a relatively simple interface, the platform can be complex to use, especially for businesses that are new to online payments or are not technically savvy.

- Limited customer support: While Stripe does offer customer support, it may not be as comprehensive as the support provided by some other payment processors.

If you think that Stripe’s advantages fully prevail over its disadvantages (that’s what most merchants think), you need to think about integrating Stripe with your business. Let’s see what options are at your disposal.

Stripe Integrations

When it comes to Stripe integrations, the following four types can help you enhance your business:

- Native Stripe integrations;

- Third-party Stripe integrations;

- iPaaS Stripe integrations;

- Custom stripe integrations.

Below, we explore each one independently.

Native Stripe integrations

Stripe Checkout

Stripe native integrations are payment integration solutions supplied by the payment provider itself. These integrations enable businesses to take payments through Stripe without writing any code or developing their own integration solution.

There are several native Stripe integrations available, including:

- Checkout: Checkout is a pre-built payment form that businesses can use to accept payments from their customers. It is designed to be easy to use and can be easily added to a website or mobile app with just a few lines of code.

- Stripe.js: It is a more advanced Stripe integration solution aimed at developers. Stripe.js is a JavaScript library that enables businesses to build custom payment forms and integrations with Stripe. It allows businesses to have more control over the look and feel of their payment forms and to build more advanced payment flows.

- Stripe Elements: Stripe Elements is a more merchant-friendly solution that delivers a set of pre-built UI components that businesses can use to build custom payment forms. It includes a variety of form elements, such as text inputs, dropdowns, and checkboxes, as well as styling options.

- Stripe Connect: Stripe Connect is a payment integration solution designed for businesses that use Stripe to process payments for other businesses. It enables companies to onboard and manage their sellers or partners, as well as to track and reconcile transactions.

- Stripe Terminal: Stripe Terminal is a payment integration solution for businesses that need to accept in-person payments in a variety of different environments. It includes a range of hardware and software options, such as card readers and mobile POS systems.

The advantage of native Stripe integrations is obvious: they are already available and can be leveraged with the minimum effort. Some of them require neither technical skills nor development efforts. What are the disadvantages, you will ask?

Native integrations are usually limited and cannot be customized. However, you always get what your provider offers.

Third-party Stripe integrations

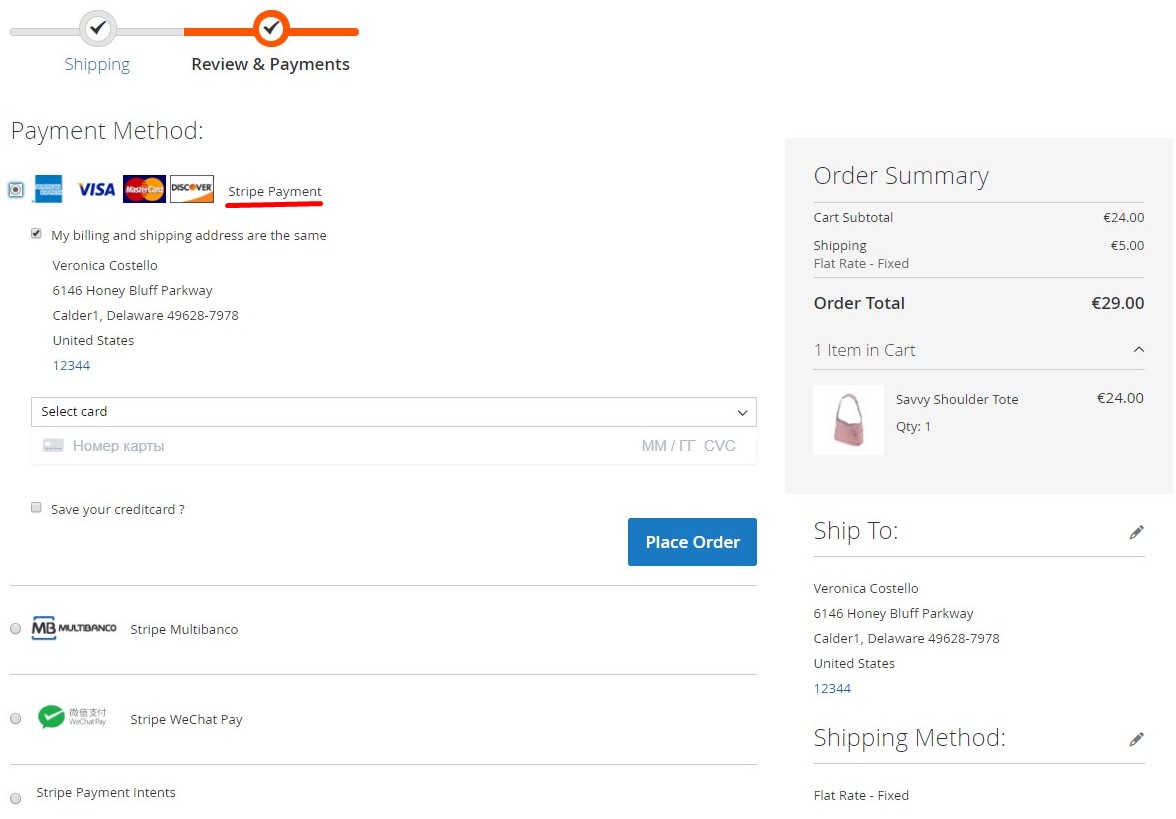

Stripe Payment & Subscription Magento 2 extension by Magenest

In addition to native Stripe integrations, there is a plethora of third-party solutions developed to connect Stripe to a variety of platforms. Third-party Stripe integrations are payment integration solutions developed by companies other than Stripe. These integrations allow businesses to accept payments through Stripe by using software or services provided by third-party companies.

Let’s divide third-party Stripe integrations into several groups::

- eCommerce platforms: Many eCommerce platforms, such as Magento or Shopify offer integration with Stripe. This allows businesses to easily accept payments through Stripe when using these e-commerce systems. For instance, Stripe Payment & Subscription by Magenest or Stripe Payment by Amasty.

- Invoicing and billing software: There are a number of invoicing and billing software solutions that offer integration with Stripe. This allows businesses to easily accept payments for invoices and recurring billing through Stripe. For instance, .

- CRM software: Some CRM software solutions, such as Salesforce, offer integration with Stripe. This allows businesses to easily accept payments through Stripe when using these platforms. For instance, or .

- Project management software: Some project management software solutions, such as Asana, offer integration with Stripe. This allows businesses to easily accept payments through Stripe when using these platforms. However, such integrations are more common on the basis of iPaaS platforms.

- Payment gateways: There are a number of payment gateway solutions that offer integration with Stripe. This allows businesses to easily accept payments through Stripe when using these platforms. Although you cannot integrate Stripe and PayPal directly, it is possible to use both systems on your e-commerce website. Thus, two data flows are synced.

Overall, third-party Stripe integrations can be a convenient way for businesses to easily accept payments through Stripe while using a wide range of different software and services. However, they don’t cover all business needs. As stated above, some integrations are more successfully covered with iPaaS systems. So, what are iPaaS stripe integrations?

iPaaS Stripe integrations

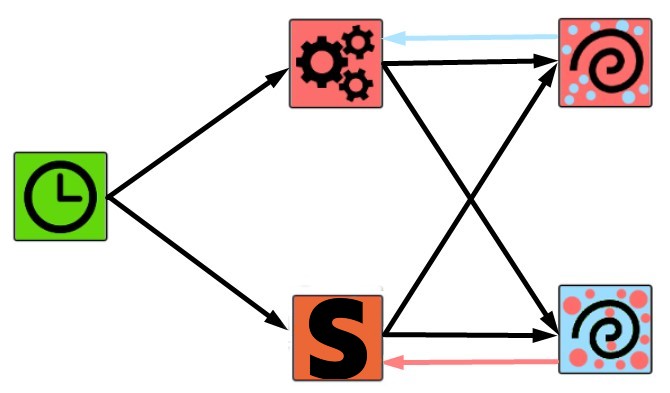

iPaaS Stripe integrations are interconnections based on third-party platforms able to connect hundreds of systems together. iPaaS providers allow businesses to connect Stripe with other software and systems, providing an intermediary platform for building, deploying, and managing integrations between Stripe and different systems. Usually, such platforms are intuitive and require no coding. Instead, they introduce a drag-and-drop interface with a system of triggers and actions. When certain conditions are met, a trigger launches a chain of actions synchronizing data between Stripe and the connected systems.

There are many iPaaS solutions that offer integration with Stripe, including:

- Zapier: Zapier is a popular iPaaS solution that enables businesses to automate workflows and connect different software applications. It offers a wide range of pre-built integrations with Stripe, as well as the ability to build custom integrations.

- MuleSoft: MuleSoft is an enterprise-grade iPaaS solution that enables businesses to connect their systems and data across on-premises and cloud environments. It offers integration with Stripe through its Anypoint platform.

- Boomi: Boomi is an iPaaS solution that enables businesses to easily connect their systems and data across on-premises and cloud environments. It offers integration with Stripe through its AtomSphere platform.

- Jitterbit: Jitterbit is an iPaaS solution that enables businesses to easily connect their systems and automate workflows. It offers integration with Stripe through its Harmony platform.

iPaaS Stripe integrations are a convenient and powerful way for businesses to connect Stripe with other software and systems. Here are some of the advantages of using iPaaS Stripe integrations:

- Ease of use: iPaaS solutions are designed to be simple to use, especially for enterprises with less technical experience. This makes it possible for organizations to be up and running with an iPaaS Stripe integration quickly and without a lot of hassle.

- Wide range of pre-built integrations: Many iPaaS providers, such as Zapier and MuleSoft, include a diverse set of pre-built integrations with well-known software applications. This makes it simple for businesses to integrate Stripe with other instruments they already use.

- Customization options: While many iPaaS systems have pre-built integrations, they also frequently include the ability to create custom integrations. This enables organizations to tailor their integration to match their unique demands and expectations.

- Scalability: Scalability is built into iPaaS systems, which means they can manage large amounts of transactions and data. This makes them an excellent choice for companies wishing to grow and extend their operations.

- Cost-effective: iPaaS solutions are frequently less expensive than developing a custom integration from start. They offer a simple and cost-effective way for organizations to integrate Stripe with other platforms.

iPaaS Stripe integrations are a convenient and powerful way for businesses to connect Stripe with other systems and automate workflows. They are easy to use, offer a wide range of pre-built integrations, and are scalable and cost-effective. If you choose the iPaaS path for your business, the following Stripe objects and actions are at your service:

| Object | Definition | Action example |

| Balance | This is an object that represents your Stripe balance. You can retrieve it to see the current balance on your Stripe account. |

|

| Charge | You create a Charge object (identified by a unique, random ID) to charge a credit or debit card in Stripe. It is possible to retrieve and refund individual charges as well as list all charges. |

|

| Coupon | A coupon informs about a percent-off or amount-off discount applied to a customer. Coupons may be applied to subscriptions, invoices, checkout sessions, quotes, and more. |

|

| Customer | This object is used to represent a customer of your business. It lets you create recurring charges and track payments that belong to the same person. |

|

| Customer Card | You can store numerous cards on a customer to charge the customer later. Also, it is possible to store multiple debit cards on a recipient to transfer to those cards later. |

|

| Source | This object allows you to accept a variety of payment methods. It represents a customer’s payment instrument and can be used with the Stripe API just like a Card object. |

|

| Token | Tokenization is the process of collecting sensitive card or bank account details, or personally identifiable information (PII), from your customers. A token representing this information is returned to your server to use so that no sensitive card data touches your server. Thus, your Stripe integration operates in a PCI-compliant way. |

|

Custom Stripe integrations

Custom Stripe integrations are payment integration solutions designed especially for the needs and requirements of a business. Such connectors enable organizations to customize their payment processing to their individual company objectives and needs.

One of the primary benefits of custom Stripe integrations is flexibility associated with fully-fledged adaptation to a company’s specific needs and requirements. Instead of choosing a pre-built solution that may not match the specific demands of a business, a custom integration can be developed to fulfill those needs exactly. This can help to improve the entire client experience by streamlining the payment process.

Another advantage of custom Stripe integrations is that they can be connected with all the systems and workflows a business incorporates. This can help to automate and streamline the payment process, saving time and resources.

Custom Stripe integrations can also be more flexible and scalable than other types of integrations. Because they are built specifically for a business’s needs, they can be designed to handle high volumes of transactions and to easily adapt to changing workflows, being a powerful tool for businesses that need a tailored, flexible, and scalable payment processing solution. Drop us a message if you need a custom system integration solution.

Most Popular Stripe Integrations

Below, we shed light on the most popular Stripe integrations:

- Stripe Quickbooks integration;

- Pipedrive Stripe integration;

- Stripe Salesforce integration;

- HubSpot Stripe integration;

- Stripe Xero Integration.

Stripe Quickbooks Integration

QuickBooks is accounting software that helps businesses manage their finances by invoicing, billing, and reporting. The Stripe QuickBooks integration connects a business’s Stripe account to QuickBooks, allowing them to effortlessly import and reconcile Stripe transactions in QuickBooks.

The Stripe QuickBooks integration is intended to simplify the management of financial data and the streamlining of accounting operations for businesses. It allows companies to import Stripe transactions into QuickBooks automatically, removing the need to manually enter data. This can save time and limit the possibility of mistakes.

Additionally, the QuickBooks Stripe integration enables businesses to effortlessly track and reconcile Stripe transactions within QuickBooks. This can help to enhance financial reporting accuracy and make it easier for firms to manage their money.

The Stripe Quickbooks integration provides the ability to add the following elements to your automated workflow:

- Bill – A bill is an invoice that your vendors send to you in order to collect payment from you.

- Invoice – An invoice is a document that is used to record consumer sales transactions.

- Transaction – A transaction type indicates the type of transaction that took place, such as a client transaction, a bill payment, or a bank transfer.

- Item – An item is a product or service that a company buys and sells.

- Payment – In QuickBooks, a payment object is used to record a payment. It can be used on several invoices and credit memos for the same customer.

- Customer – A customer is someone who pays for your goods and services.

- Vendor – A vendor is a person or company that provides you with goods and services.

- Employee – An employee is a person working for the company.

- Estimate – An estimate is a quote for goods or services provided to a customer that can be converted into a sales order or invoice.

- Purchase – A purchase object reflects an expense you incur, such as a vendor purchase.

Your Stripe Quickbooks integration may look as follows. Assume you need to update payments in Quickbooks every time they are changed in Stripe. Create the following workflow in your iPaaS system:

- A cron node initiates a search process that looks for new Stripe charges.

- The search node provides newly discovered information to another node that analyzes it and filters out charges that are not yet registered on the Quickbooks side.

- The next node receives the information necessary for updating transactions on the Quickbooks side.

Drop us a message to get more examples of the iPaas-based Shopify integration with Quickbooks

Alternatively, you can streamline the . It automates the transfer of Stripe sales activity into QuickBooks. Watch the video below for more information:

If you need a more complex tool, pay attention to the . In addition to Stripe, it lets you sync Quickbooks with Amazon, WooCommerce, PayPal, Square, Clover, Authorize.Net, etc.

, in turn, links QuickBooks and your payment gateway. With its help, you can send online invoice payment links in your QuickBooks invoice emails. The app works with with Moneris, Bambora, Global Payments, and Stripe.

is also designed to sync Quickbooks with other platforms, including Stripe. Other supported systems are Shopify, PayPal, Square, eBay, Walmart, Amazon, etc. It automatically synchronizes your eCommerce and payment platforms with QuickBooks in the background with zero manual adjustments.

is another tool perfectly integrated with QuickBooks. It is designed to help you spend less time to reconcile your Stripe transfers on your bank account in QuickBooks. The match is done automatically, you only have to approve it!

lets you sync your Stripe transactions with QuickBooks Online in an affordable and easy manner.

Altogether, the Stripe QuickBooks connection is a useful and effective solution for companies that use both Stripe and QuickBooks. It enables businesses to seamlessly import and reconcile Stripe transactions within QuickBooks, saving time and enhancing financial data accuracy.

Pipedrive Stripe Integration

Pipedrive is a sales management software that assists companies in tracking, managing, and prioritizing sales leads and deals. The Stripe Pipedrive integration connects organizations’ Stripe accounts to Pipedrive, allowing them to conveniently track and manage Stripe transactions within Pipedrive.

Companies can quickly access their Stripe transactions within their Pipedrive account thanks to the Stripe Pipedrive integration, making it easier to track and manage their sales activities. Organizations can also use the interface to automatically create new Pipedrive deals when they receive payment via Stripe, making it easier to track and follow up on new sales leads.

Pipedrive can assist you in keeping your sales drivers and procedures in order and governing sales from beginning to end. When it comes to extended opportunities, Pipedrive integrations with external systems are always a good bet. You can manage and transfer the following objects:

- Deal – A deal is an ongoing transaction with a person or organization that moves through your pipeline phases until it is won or lost.

- Activity – An activity is a scheduled action that must be completed in order to close a deal: a phone call, a lunch meeting, an email, and so on.

- Product – This object is associated with a product or service that you sell. Pipedrive allows you to add products straight to deals.

- File – A file is any type of document (spreadsheet, image, text file, etc.) related to a certain deal, person, organization, product, note, activity, and so on.

- Lead – A lead is a stage when a prospect is not yet a deal.

- Note – A note is a text attached to a deal, person, organization, etc.

- Organization – An organization is a company you make deals with.

- Person – A person is a customer you have deals with.

What are we going to do with all of these entities and actions? Let’s look at a simple example. Assume you need to add a new person to Pipedrive whenever a new customer is added to Stripe. You may edit or add contacts in Pipedrive from Stripe using the Stripe Pipedrive integration as follows:

- A cron node launches a search process that locates new customers in Stripe.

- A filter node inspects whether these customers are unique to Pipedrive.

- The filter node pools newly discovered information to a generation node that adds a new person to Pipedrive.

With iPaaS Stripe Pipedrive integration, you can configure this process as bi-directional. Contact us to learn more about it.

If you are looking for a more common tool, pay attention to the . It is a third-party connector that syncs and lets you view Stripe invoices and customers in Pipedrive.

For firms using both Stripe and Pipedrive, the Pipedrive Stripe integration can be a significant tool. It enables companies to track and handle their Stripe transactions within Pipedrive, making it easier to manage and organize their sales process.

Stripe Salesforce Integration

Salesforce offers a CRM) technology that assists organizations in managing and growing their customer relationships. The Stripe Salesforce integration connects a business’s Stripe account to Salesforce, allowing users to conveniently track and manage Stripe transactions within Salesforce.

Companies can quickly access their Stripe transactions within their Salesforce account thanks to the Stripe Salesforce integration, making it easier to track and manage their customer activity. Organizations may also use the integration to automatically create new Salesforce leads or opportunities when they accept payment via Stripe, making it easier to track and follow up on new sales leads.

Along with that, the Salesforce Stripe integration offers a significant advantage in automation. You can harness it to do a variety of chores automatically, manipulating the following objects:

- Lead – A lead is your potential customer who is going to pay for your goods and services.

- Contact – A contact marks the next stage in your interaction with leads. It is a lead that has been identified as a possible customer.

- Account – An account is a business that is your potential or current customer.

- Opportunity – An opportunity is a deal that you are currently working on. It indicates whose accounts it is for, who the player is, and how much potential revenue there is.

- Case – A case is a question, comment, or issue that a support agent gets from a customer.

- Attachment – An attachment is a file added to the record.

- Document – A document is a user-uploaded file. Unlike attachment, it is not attached to a Parent Object.

You can automate your Stripe Salesforce integration by streamlining these entities. Assume you need to create new Salesforce opportunities when accepting payment via Stripe. The workflow below illustrates this process:

- A cron node launches a search process that discovers new payments in Stripe.

- A filter node inspects whether these payments were not used previously to create opportunities in Salesforce.

- The filter node transfers the newly discovered information to a generation node that creates new opportunities in Salesforce.

You can also use or other similar third-party apps to integrate Stripe and Salesforce. As for ChargeOn, it is a ready-to-use Stripe payment gateway integration solution that updates transactions immediately in Salesforce.

The Salesforce Stripe integration can be a powerful tool for businesses that use both Stripe and Salesforce. It allows companies to easily track and manage their Stripe transactions within Salesforce, making it easier to manage their customer relationships and grow their business. Contact us to learn more about this integration.

HubSpot Stripe Integration

HubSpot is another marketing, sales, and customer service platform that assists companies in growing and managing their client connections. The HubSpot Stripe integration connects organizations’ Stripe accounts to HubSpot, allowing them to conveniently track and manage Stripe transactions within HubSpot – just like in the integrations above.

Businesses can quickly access their Stripe transactions within their HubSpot account thanks to the HubSpot Stripe integration, making it easier to track and manage their customer activity. When businesses receive payment through Stripe, the integration instantly creates new HubSpot contacts or deals, making it easy to track and follow up on new sales leads.

If you choose the iPaaS approach to the Stripe HubSpot integration, the following entities are at your disposal:

- Company – It is a source of information about companies and organizations you work with.

- Contact – It is anyone who engages with your business, e.g., various website visitors.

- Contact List – It lists contacts and companies in your HubSpot.

- Deal – It is an ongoing transaction with a person or business that might be either successful or failed.

- Engagement – It is a task, email, phone call, meeting, or note.

- Form – It is a tool used to collect data from your visitors.

- Ticket – It is a request from a client that your support team gets.

These entities can be used to automate your Stripe HubSpot integration. For example, every time a new payment is detected in Stripe, you can create a new deal in Hubspot. Use the corresponding workflow to automate this process:

- A cron node launches a search process to find new payment transactions on the Stripe side.

- A filter node analyzes whether the discovered information hasn’t yet been used in Hubspot.

- The filter node passes the transaction data to a generation node that creates a deal in HubSpot.

This simple example illustrates how the automated Stripe and Hubspot integration automates your routine. You can create hundreds of similar workflows to simplify your daily duties. Contact us to discover more opportunities associated with the Stripe HubSpot integration.

You can also visit the Stripe marketplace to find alternative solutions. For instance, will help you synchronize your HubSpot customers and products with Stripe, making manual data entry a thing of the past. is the same app available on the HubSpot marketplace. However, it doesn’t provide a fully immersive experience. Watch the following video to see why.

Stripe Xero Integration

Xero is an online accounting software that helps businesses to manage their finances, including invoicing, billing, and financial reporting. With the Stripe Xero integration, merchants can connect their Stripe account with Xero, enabling the reconciliation of Stripe transactions in Xero. This can save time and reduce the risk of errors, improving the accuracy of financial reporting and making it easier for businesses to manage their finances.

The iPaaS-based XeroStripe integration lets you manipulate the following Xero objects:

- Contact – It is a person that pays for your goods and services;

- Invoice – It is a document that includes order details.

These entities can be used to automate your Stripe Xero integration. For example, every time a new payment is accepted in Stripe, you can create a new invoice in Xero. Use the corresponding workflow for that:

- A cron node launches a search process to find payment transactions in Xero.

- A filter node analyzes whether the discovered transactions are unique to Xero.

- The filter node passes newly discovered information to a generation node that creates invoices on the Xero side.

This simple example illustrates how the Stripe Xero integration can enhance your daily routine by automating repetitive tasks. You can create hundreds of workflows like this. Contact us to discover more opportunities.

Alternatively, you can use the native . It lets you view relevant Xero customer and transaction data within the Stripe Dashboard. is another tool that can automate your integration. This app lets you receive payments via Stripe, a Xero invoice, or an eCommerce store, automatically see the transaction data flow into Xero, and reconcile each payment with one click.

Watch how to reconcile the Stripe feed for online payments for Xero invoices in the video below:

Conclusion

Integrating Stripe with other systems may become a complex process that requires additional assistance. At the same time, multiple one-click solutions are at your service. For instance, you can create a unique payment page hosted on Stripe, like Stripe Checkout, using native connectors. With this low-code option, you can easily collect payments on desktop and mobile devices.

As an alternative, you can utilize third-party connectors to link Stripe to certain programs, like Quickbooks, Pipedrive, Salesforce, HubSpot, and Xero. The good news is that you usually need a single iPaaS system to integrate Stripe with these and other platforms. If you don’t need a solution with greater scalability and flexibility, pay attention to native and third-party solutions because they may be enough to satisfy your business requirements.

If you want to integrate any system with Stripe in the most effective way – write to us!

Stripe Integration FAQ

What is Stripe integration?

Stripe integration is a process of connecting Stripe to other systems. For instance, you may use native integrations to build a customized payment page, hosted on Stripe, such as Stripe Checkout. It is a low-code payment integration that creates a customizable payment page so you can quickly collect payments on desktop and mobile devices.

Alternatively, you may use third-party connectors that integrate Stripe with particular systems, such as Salesforce. Note that such connectors usually sync data between Stripe and only one external system. If you need a solution associated with higher scalability and flexibility, pay attention to iPaaS platforms that also enable Stripe integrations.

Also, you may need to create a custom Stripe connector to satisfy specific business needs.

How can I integrate with Stripe?

You can integrate with Stripe within a few clicks due to iPaaS systems. They usually offer a drag-and-drop interface where you can establish connections between Stripe and your existing business instruments. Also, native, third-party, and custom connectors are at your service. You can leverage Stripe’s payment APIs to build a payment form or use a prebuilt checkout page to accept online payments.

Is Stripe easy to integrate?

The complexity of Stripe integration depends on the selected method and your business needs. You can find on-click integration solutions or spend months on custom connectors. Alternatively, iPaaS systems are at your service.

Does Stripe have PayPal integration?

Although Stripe doesn’t have direct PayPal integration, you can use your e-commerce website as a hub where data from both payment systems is synced and stored.

Is Stripe free to integrate?

By default, Stripe is free to integrate. The platform incorporates a per-transaction pricing model. It means that no setup fees or monthly fees are charged. At the same time, various third-party connectors may require additional fees.