How E-Commerce is Disrupting the Supermarket Industry

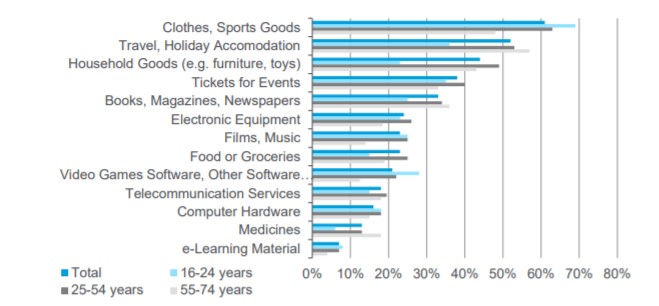

More and more goods nowadays are purchased online. It isn’t a result of our laziness, rather lack of time and the general question of expediency. Today, with the fast shipping and a wide range of products available online at attractive prices, a lot of us will think twice before going shopping, especially when we don’t have too much time or don’t want to go outside. As outlined by Eurostat, a European statistical agency, food, and groceries online purchase penetration rates are quite behind compared to other segments such as clothes, sports goods, travel and household goods.

The one industry currently awaiting a breakthrough by entering the e-commerce world is a grocery. The looks very exciting.

Today, online grocery shopping is at the start position with only 3% of the $1 trillion per year spend on this industry. This index can be significantly changed with Amazon entering this game. By analyzing and changing consumer behavior, developing the new purchasing technologies, and growing supplier support, this world-famous giant can become the trigger for the supermarket shift all over the globe.

Amazon is on the way of changing the whole model of grocery and package goods, aiming at placing the last major category of consumer spending online at the new modern level. Despite almost twenty years of ineffectual efforts, today is the time when it has an excellent opportunity to implement the new way of grocery shopping in life. Why today and not in ten or twenty years? There are some reasons for it:

- Changing in the consumer behavior. We become more comfortable buying online instead of going to the supermarkets;

- The appearance of the new purchasing models. Introduction of such models as subscription and penetration of such technologies as voice commerce into our everyday life;

- A unique opportunity for growth for brands. Looking for the new channels for growth, brands contribute growing supplier support;

- move into their prime spending years;

- A fine line between profitability and mass stores closures. Changes in the grocery industry significantly accelerate online share gains in packaged goods, grocery, and fresh food.

According to several research analysts, until 2027 the percentage of the online sales in the grocery space will reach the 20% mark from currently close to 5%. Although there are many players who contribute to the disruption of the industry, Amazon plays a particular dominant role. Some of Amazon’s strategies will be outlined in the following sections.

The Elephant in the Room Changing the World. Amazon’s Strategies for Online Grocery

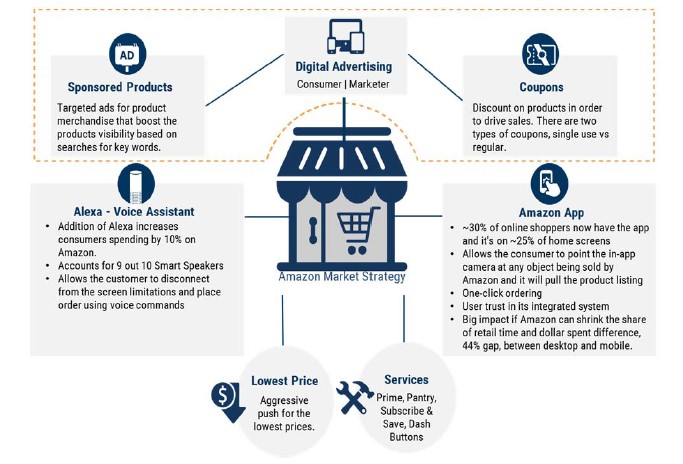

All of Amazon’s strategies are aimed at changing the grocery and CPG (consumer packaged goods)_manufacturers’ behavior and moving their retail online from the habitual Brick-And-Mortar scheme. The motto of such a shift is that times are changing and the direct-to-customer business scheme may bring much more improved customer experience and global efficiency. Amazon is going to act as the intermediary between the seller and buyer (between the manufacturer and consumer), changing not only the usual way of grocery shopping but the way of thinking also. For managing this process, Amazon can use its marketplace. A range of strategies has been developed to drive online sales and increase the profit. Among the major ones are:

- Sponsored products;

- Coupons;

- Digital Advertising.

Let’s consider the main peculiarities of each of them separately.

Sponsored products. The auction-based pricing model is a decisive factor. The more the sellers can pay for a click, the higher is the likelihood that the advertisement will be displayed to the buyer after searching for the keyword.

Coupons. There are two main reasons for using coupons for the seller. First of all, it will drive the positive review, as well as increase sales and drive the product ranking.

Digital Advertising. Giving sellers access to the customers’ purchasing habits, Amazon provides them with a chance of improving the ads placing and coupons usage. Based on such information, each seller will be able to evaluate what drives sales in its category and make necessary improvements.

There are lots of reasons for sellers to work with Amazon and take significant advantage of its marketing tools. With its help, vendors will be able to grow bigger e-commerce space and put their retail on the much higher level.

Another aspect of Amazon’s entering the market is managing the profit margins. Analytics state that a significant part of getting to the lowest price will come from the trade budget of CPG companies. The trade budgets can reach 20% of the gross sales and have a significant impact on grocery products. The major challenge for the CPG companies is that the trade budgets impact market share more than category growth. It means that it will be quite tricky for the CPG company to lower its trade budget unless its competitors do the same. Based on this, we can state that Amazon’s coming will be able to provide CPGs with insight into the efficacy of the trade budget and more efficient deployment of their resources.

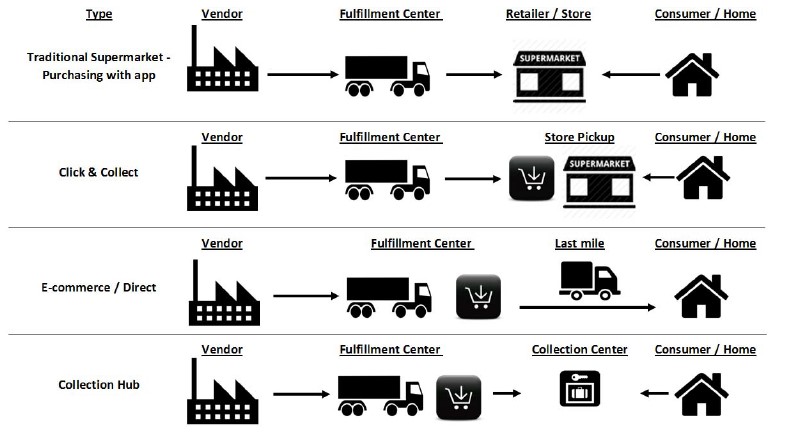

No E-commerce Without Delivery

Well established and fast delivery is one of the primary keys to e-commerce success. Focusing on customer convenience, Amazon has more than 200 fulfillment in the US, that are ranging in size from the small distribution centers to the large sortable fulfillment centers. Approximately 14 warehouses are built to service the Amazon’s Panty and fresh customers. The radius of each of the warehouses is from 50 to 100 miles that coincide with the Amazon’s willingness delivery for up to 100 miles. Each of the warehouses is highly automated and are at the leading age of industry due to the heavy investments in building, hiring professionals, and automating the process. According to the analytics’ forecasts, the Amazon’s EBIT margin in the grocery sector will increase until 2020 due to advantages of the automation processes.

The important part of the whole shipping process is the last mile or the final delivery of goods to the buyer. Currently, Amazon operates such carriers for the final delivery as UPS, USPS, and FedEx. In addition to this, recently it has introduced the new type of delivery vehicles created especially for the grocery sector – Fresh delivery trucks. But it is Amazon, and of course, it is not going to stop at this point. Several additional delivery methods are at the experimental stage now. Among them are:

- Amazon Flex. This method was launched in 2015 and is similar to ride-sharing services, but for packages;

- Drone delivery. Launching a drone delivery program, Amazon will be able to decrease delivery time significantly. In addition to this, it will have a highly positive impact on sales of the products with a higher cost;

- Mobile depots. Land, water or air based depots can contribute significant savings on logistics and increased sales.

What about the financial side of an issue? Amazon has all the chances to grab the large part of the online grocery sector because of its unique online marketing strategies, cost decreasing, private brands, and modern services. Adding to it the customer base (already existing), well-developed fulfillment infrastructure, technology, and access to the capital, we can conclude that Amazon can put the online grocery on the next level even faster than analysts expect it.

Among the central forecasts are:

- Amazon’s share of the online grocery will reach 55% until 2027;

- Operating income for the grocery business for Amazon will rise to $10.9-14.5 billion until 2027;

- 15-20% of Amazon’s sales will come from the online grocery sector until 2027.

Challenging Amazon. Who is Going to Rival With the Giant?

From the first view it may seem that Amazon is one and only candidate to put the online grocery on the next level and create the “shops of the future”, but actually the strong rivalry between VC companies aimed at the e-commerce and mobile commerce industries with the focus at Food and Grocery has remained strong since 2015. So, the question is if Amazon can disrupt the usual way of shopping, who can disrupt Amazon? There are several private and public companies tackling specific issues in the industry not addressed by Amazon. These companies contribute further to the new online shopping era.

- Grubhub, Deliveroo, Delivery Hero. These services offer delivery of the local restaurant food to the customer’s home. Focuses on high-quality food from the curated restaurants.

- Instacart. This online grocery service allows ordering grocery from the smartphone and gets them delivered within an hour. The food is delivered from the local stores.

- Peapod. This service operates under a centralized distribution model and relies on the purchasing power to keep costs low. Peapod services around 24 US markets. Is well aligned to grab a share of online sales from Amazon and incumbents as well.

- Freshdirect. The service is focused on organic food. Offers custom preparations of orders and sources items that customers buy on a daily basis in the brick-and-mortar grocery stores.

- Brandless. Among the main focuses are transparency and high quality of groceries and CPG products. It is aimed at cutting off the inefficiency of national brands and markups. Offer great products at a low cost.

- Boxed. The service allows buying orders in bulk. All the orders can be made via the app on the smartphone or using the computer. Any annual membership fee isn’t required.

- Helo Fresh and Blue Apron. Fresh food provider. Offers customers every-week changing menu and deliver the seasonal, pre-measured, locally-sourced ingredients needed for it. All the meals take up to an hour to prepare.

- Petnet. It is a pet feeding app that integrates with the pet food vendors. The service helps pet owners managing their pets’ health

- Fruit day. Is one of the largest shopping sites in China. Has the own well-established logistic system and cold storages to provide customers with the high-quality fresh fruits.

- Thrive market. Service offers natural and organic products at wholesale prices. The company is aimed at keeping the costs low and allows up to 50% savings on each item it carries.

- Hema fresh. The company is “between” the online and brick-and-mortar shopping. All the products are ordered via the mobile app and can be delivered either straight to the buyer’s home or the store.

- Soylent. The company offers drinks that can replace sit-down meals. The Soylent’s message is that packing nutrients into a drink can save time, money, and environmental costs.