Magento Accounting Integration: How to Connect Magento 2 to Any Accounting Software in 2026

Managing a Magento 2 store isn’t only about products and customers — it’s also about keeping finances accurate, taxes compliant, and books balanced. That’s where Magento accounting integration comes in. By connecting your online store with powerful accounting software such as QuickBooks, Xero, FreshBooks, or Sage, you can automate bookkeeping, streamline invoicing, and eliminate error-prone manual entries. Instead of exporting spreadsheets and reconciling numbers by hand, automated accounting for Magento ensures every order, invoice, refund, and tax calculation flows directly into your accounting system in real time. This approach not only saves hours of repetitive work but also gives your finance team instant access to accurate data for reporting and compliance.

In this guide, we’ll explain what Magento store accounting integration is, why it matters for both small retailers and enterprise merchants, and how to connect Magento 2 with leading accounting platforms. You’ll also learn about different integration methods — from ready-made connectors to custom API solutions — and how Firebear’s Improved Import & Export extension simplifies the entire process.

Table of contents

- What is Magento Accounting Integration?

- Benefits of Integrating Magento 2 with Accounting Software

- Methods of Magento 2 Accounting Integration

- Improved Import & Export — The All-in-One Solution for Magento Integration with Accounting Platforms

- Step-by-Step: How Magento 2 Accounting Integration Works With Improved Import & Export

- Popular Accounting Platforms to Integrate With Magento 2

- Common Challenges in Magento 2 Accounting Integration & How to Solve Them

- Final Words — Streamline Your Magento 2 Accounting Integration

- Magento Accounting Integration FAQ

What is Magento Accounting Integration?

Magento accounting integration is the process of connecting your Magento 2 store with accounting software to create a unified, automated financial workflow. Instead of juggling spreadsheets or entering transactions manually, the integration ensures that critical financial data — such as orders, invoices, refunds, credit memos, and tax calculations — flows seamlessly between Magento and your accounting system.

From an e-commerce perspective, this means every purchase made in your store automatically appears in your accounting software, every tax amount is recorded in the right place, and every refund or credit note is synced without delay. With automated accounting for Magento, merchants gain accurate, real-time visibility into revenue, expenses, and cash flow — without the risk of human error.

Typical workflows include syncing sales data with platforms like QuickBooks, Xero, or Sage; importing invoices and payments directly from Magento; and reconciling tax records across multiple jurisdictions. By enabling Magento store accounting integration, you transform your online shop into a fully connected financial system. Let’s take a closer look at the benefits of this process.

Benefits of Integrating Magento 2 with Accounting Software

Investing in Magento accounting integration is a strategic step toward financial accuracy, compliance, and efficiency. By connecting your Magento 2 store with an accounting platform, you eliminate manual data entry, reduce costly errors, and give your finance team the tools they need to operate with confidence. Here are the key advantages:

- Automated bookkeeping for Magento stores — Every order, invoice, refund, and tax entry is synced in real time, replacing manual spreadsheet updates with fully automated workflows.

- Error-free financial data — Integration ensures consistency between Magento and your accounting software, reducing mismatched transactions, duplicate records, or missing invoices.

- Tax compliance made simple — With tax data automatically pushed from Magento to accounting software, your store stays compliant with local, regional, and international tax regulations.

- Faster reporting & audits — Consolidated financial records give your team accurate insights for monthly reports, year-end closing, and audit preparation.

- Real-time revenue visibility — Track sales, expenses, and profits instantly as your Magento store accounting data is updated live in your accounting system.

- Scalability for growth — As your store grows, automated accounting for Magento keeps up with higher order volumes, multiple storefronts, and cross-border sales without creating bottlenecks.

- Better decision-making — Financial data from Magento combined with your accounting system’s analytics provides actionable insights to optimize pricing, cash flow, and profitability.

With these benefits, automated accounting for Magento turns financial management into a streamlined, error-free process — freeing your team from repetitive admin work and allowing you to focus on growth.

Methods of Magento 2 Accounting Integration

When planning a Magento accounting integration, the connection method you choose is just as important as selecting the accounting software itself. The approach defines how much customization you’ll have, how complex the setup will be, and how easily your integration can scale as your store grows. Below are the three most common ways to connect Magento 2 with accounting platforms:

1. Using Magento Accounting Integration Extensions

The simplest option is to install a ready-made Magento 2 accounting extension. These connectors link your store directly to popular systems like QuickBooks, Xero, or FreshBooks and synchronize entities such as invoices, credit memos, orders, and tax data.

Pros:

- Quick to deploy with minimal technical skills required.

- Centralized control within the Magento Admin.

- Often includes attribute mapping, scheduling, and multi-store support.

Cons:

- Typically supports only specific accounting platforms.

- Customization is limited to the extension’s feature set.

2. Custom API Integration

For businesses with in-house developers or a trusted agency, custom API integration offers maximum flexibility. Magento’s REST and GraphQL APIs can be connected directly to accounting platforms’ APIs, ensuring a tailored and scalable setup.

Pros:

- Works with virtually any accounting system that provides an API.

- Complete control over field mapping, business logic, and automation.

- Easily adaptable to evolving workflows and compliance requirements.

Cons:

- Requires development resources and ongoing maintenance.

- Higher upfront cost and longer implementation timeline.

- Responsibility for updates when APIs change.

3. Middleware & iPaaS Platforms

Integration hubs such as Celigo, MuleSoft, or Zapier act as middle layers between Magento and accounting platforms. Instead of building direct connections, Magento links to the middleware, which manages data transformation and synchronization with the accounting system.

Pros:

- One connection point for multiple systems beyond accounting.

- Advanced filtering, transformation, and automation features.

- Simplifies integration management across a larger tech stack.

Cons:

- Additional subscription costs for middleware usage.

- Adds another layer that can delay real-time sync.

- Steeper learning curve for configuration and monitoring.

Choosing the right method depends on your store size, accounting requirements, and available resources. Smaller merchants often benefit from an extension, while enterprises prefer APIs or middleware for flexibility and control. However, there is also an all-in-one solution that combines the strengths of each approach while reducing their limitations.

Improved Import & Export — The All-in-One Solution for Magento Integration with Accounting Platforms

While each method of Magento accounting integration — extensions, APIs, and middleware — has its advantages, merchants often face trade-offs. Extensions are quick to set up but limited in scope, APIs are highly customizable but require heavy development resources, and middleware provides scalability but adds extra costs and complexity. Firebear’s Improved Import & Export extension bridges these gaps by combining the best of all three approaches into one powerful tool.

As Easy as a Magento Accounting Extension

- No-code setup — Installs directly in Magento 2 and can be managed entirely from the Admin panel.

- Prebuilt accounting connectors — Ready-to-use integrations with QuickBooks, Xero, FreshBooks, and more.

- User-friendly mapping — Align Magento entities (orders, invoices, tax rates) with accounting fields without writing code.

As Flexible as Custom API Integration

- Native API support — Works with Magento REST and GraphQL APIs as well as accounting software APIs for secure, real-time synchronization.

- Custom workflows — Build advanced import/export rules tailored to your bookkeeping and compliance needs.

- Developer-friendly — Supports conditional logic, transformations, and complex multi-entity accounting processes.

As Scalable as Middleware Platforms

- Multi-system integration — Connect not only to accounting tools but also ERP, CRM, or PIM systems from a single backend.

- Automated scheduling — Keep invoices, orders, credit memos, and tax data synced at intervals you choose.

- Bulk operations — Handle thousands of transactions without performance bottlenecks.

How It Overcomes the Disadvantages of Other Methods

- Not limited to one accounting platform — Works with multiple tools simultaneously, future-proofing your setup.

- No advanced coding required — API-level flexibility through a visual, intuitive interface.

- No extra middleware fees — Runs entirely inside Magento, avoiding third-party subscription costs.

- Always accounting-ready — Regular updates keep the extension compatible with Magento 2 and the latest accounting software APIs.

Additional Enhancements for Magento Store Accounting

Beyond replacing other integration methods, Improved Import & Export adds extra value for merchants who want automated accounting for Magento:

- Advanced data mapping — Match Magento entities like invoices, taxes, and refunds with accounting fields in a few clicks.

- On-the-fly data transformation — Normalize values, adjust tax formats, or convert currencies before export.

- Multiple formats & sources — CSV, XML, JSON, Google Sheets, FTP/SFTP, Dropbox, API connections, and more.

- Two-way synchronization — Not only export orders and invoices from Magento but also import payments, reconciliations, and tax updates from your accounting system.

Bottom line: The Improved Import & Export extension isn’t just another connector — it’s a true all-in-one solution for Magento accounting integration. By merging the simplicity of extensions, the flexibility of APIs, and the scalability of middleware, it enables merchants to automate financial workflows, maintain compliance, and keep the Magento store accounting accurate at every stage.

Step-by-Step: How Magento 2 Accounting Integration Works With Improved Import & Export

Connecting Magento 2 with accounting software requires more than just moving data — it’s about ensuring every financial transaction is captured, categorized, and reconciled correctly. With Firebear’s Improved Import & Export extension, merchants can automate this entire workflow, keeping their Magento store accounting accurate and audit-ready without manual spreadsheets.

Here’s how a typical integration works:

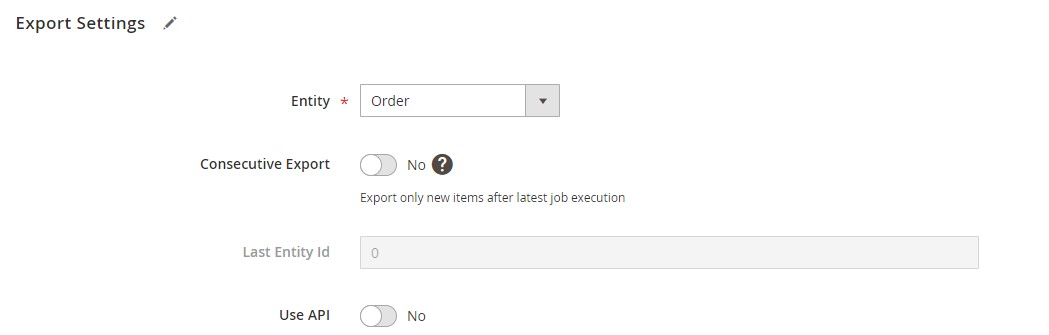

Step 1: Export Financial Data From Magento

Your first task is to push Magento transactions into your accounting system.

- Go to System → Improved Import / Export → Export Jobs.

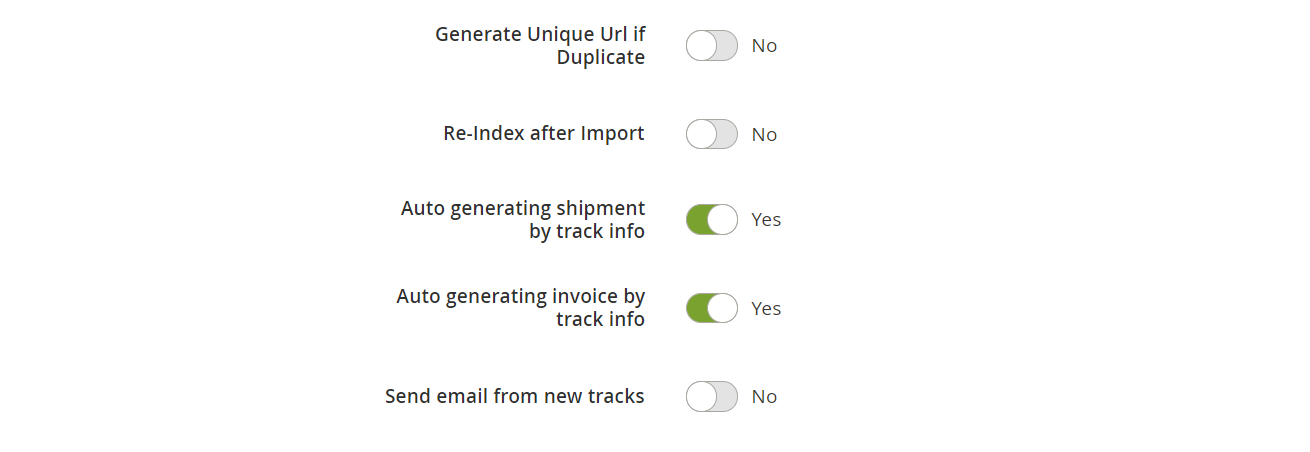

- Select entities such as Orders, Invoices, Credit Memos, or Taxes. Note that you can enable consecutive export to transfer only the latest created or updated records.

- Configure export settings:

- Scheduling — hourly, daily, or custom intervals for real-time or batched reporting.

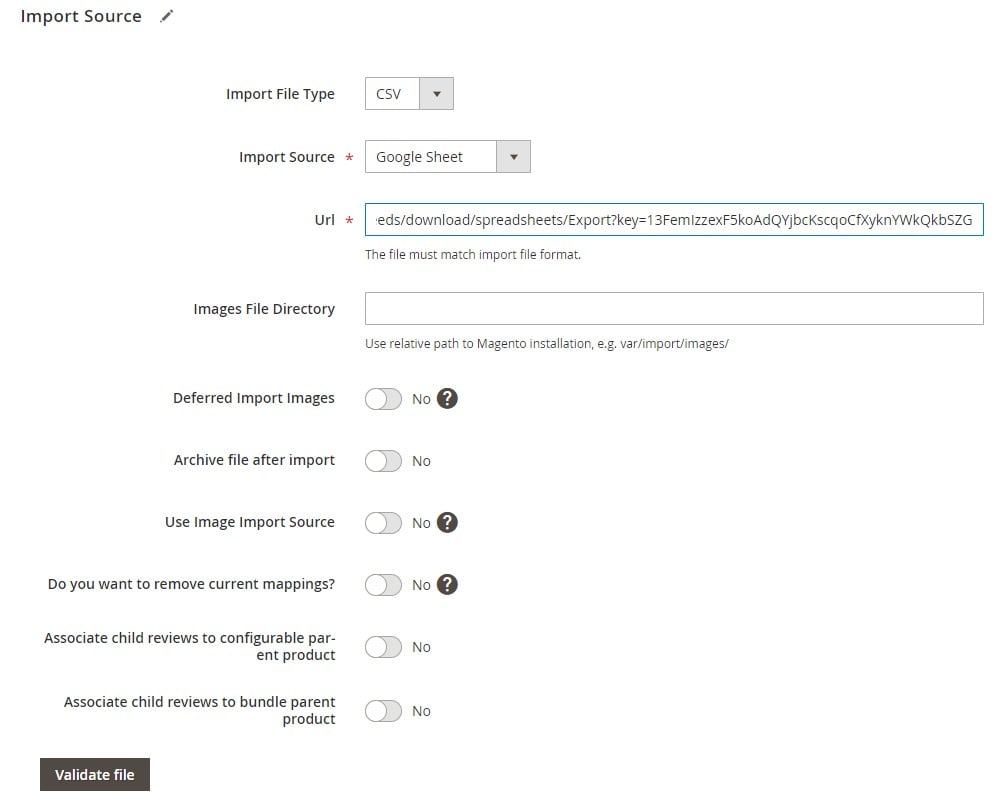

- File format — CSV, XML, JSON, or direct API output (depending on your accounting platform).

- Source — Local file, FTP/SFTP, Google Drive, Dropbox, or direct API endpoint.

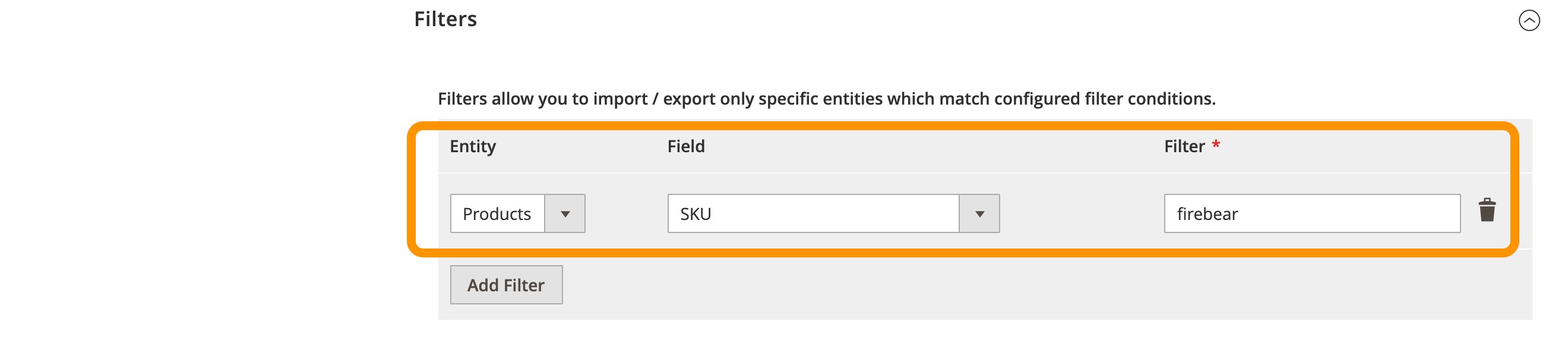

- Apply filters (e.g., export only completed orders, invoices from a specific store view, or tax records by region).

This ensures every sale, refund, and tax entry flows directly from Magento into your accounting software.

Step 2: Configure Attribute Mapping & Data Formatting

Accounting systems often require strict field names and formats.

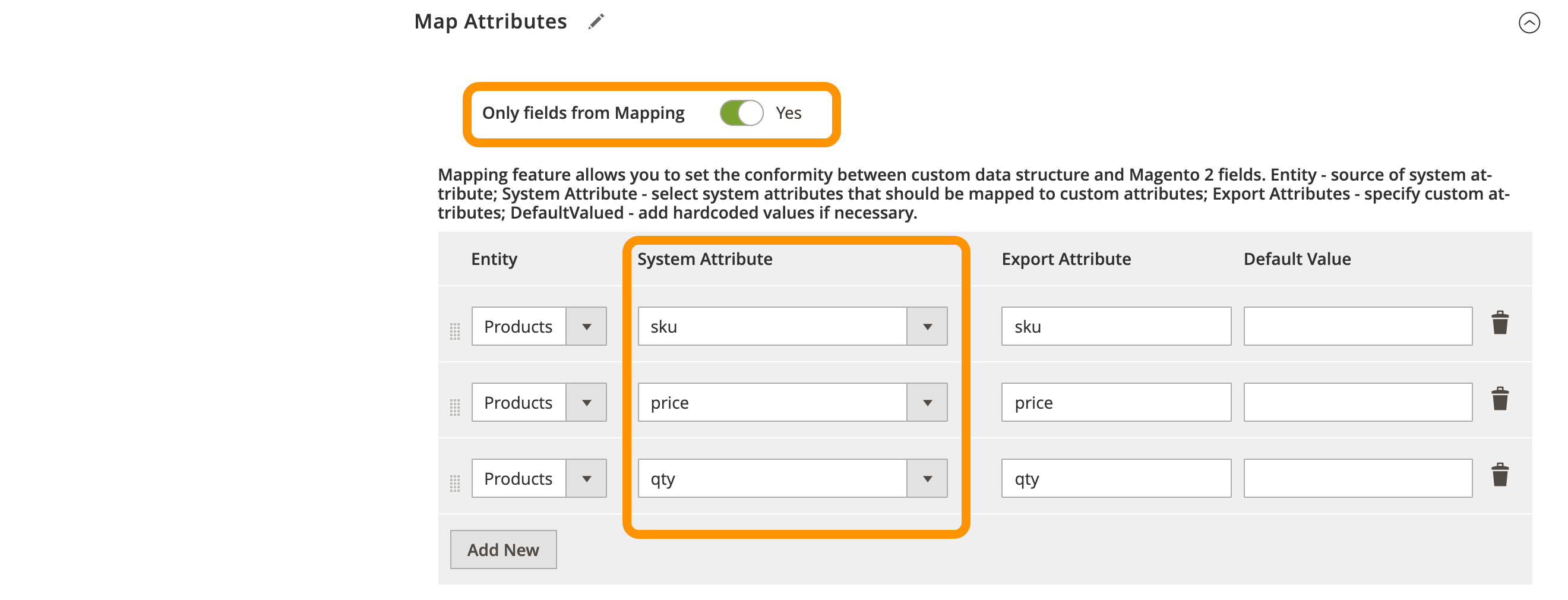

- Attribute mapping — Align Magento fields (order ID, invoice number, customer email, tax code) with accounting fields.

- Data transformation — Adjust formats in real time:

- Convert currency codes (USD → $).

- Reformat tax values to match accounting standards.

- Normalize customer names or payment methods for reconciliation.

Step 3: Import Data From Accounting Into Magento

Financial flows are two-way. For full automation, pull key accounting updates back into Magento.

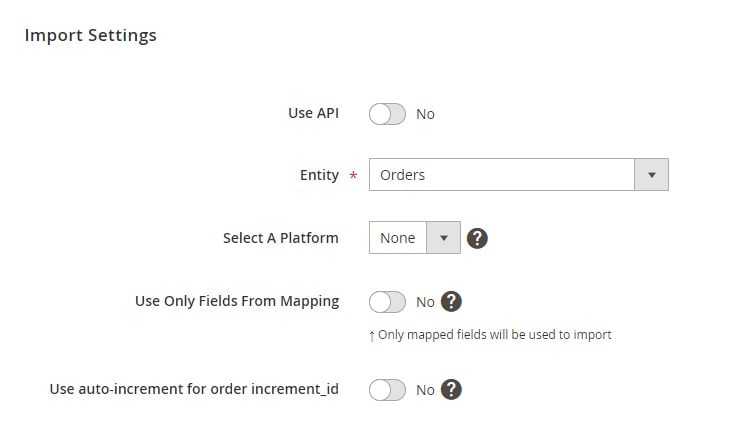

- Go to System → Improved Import / Export → Import Jobs.

- Select entity types like Orders, Invoices, Credit Memos, or Taxes.

- Connect the data source — API, FTP, or cloud storage.

- Map accounting fields (payment status, invoice reference, and refund approval) to Magento attributes.

- Enable scheduling to keep Magento updated with the latest financial records.

Example: If a payment is marked “cleared” in QuickBooks, that status can automatically update the related order in Magento.

Step 4: Enable Two-Way Synchronization

To prevent mismatches and ensure compliance, two-way sync is essential.

- Invoices & Orders — Orders created in Magento are sent to accounting software; payments and invoice status sync back.

- Taxes — Magento pushes calculated tax amounts into the accounting system, while accounting adjustments sync back for accurate reporting.

- Refunds & Credit Memos — Refund requests in Magento automatically generate matching entries in the accounting system.

This creates a closed loop between sales, payments, and bookkeeping.

Step 5: Test Your Magento Accounting Integration

Before going live, test carefully:

- Export a sample batch of orders and invoices.

- Import trial reconciliations from the accounting sandbox environment.

- Confirm tax amounts, totals, and payment statuses match across both systems.

Step 6: Go Live & Monitor Performance

Once validated, activate your scheduled jobs:

- Continuous sync keeps Magento and your accounting platform aligned.

- Logs inside the extension dashboard help track and troubleshoot data mismatches.

- Fine-tune schedules for peak sales seasons (e.g., daily sync during regular months, hourly during holiday promotions).

With this workflow, automated accounting for Magento becomes seamless. Instead of chasing invoices or reconciling payments manually, every financial transaction moves between Magento and your accounting platform in real time — ensuring compliance, accuracy, and peace of mind.

Popular Accounting Platforms to Integrate With Magento 2

Choosing the right accounting software is critical for building a reliable Magento store accounting workflow. Below are some of the most popular accounting platforms that Magento merchants integrate with, along with their key strengths and dedicated Magento 2 integration guides.

| Accounting Software | Description | Integration Guide |

| Designed for small businesses but scalable for larger teams, FreshBooks simplifies invoicing, expense tracking, and project-based accounting. With profit & loss reports, balance sheets, and time-tracking tools, it offers an intuitive way to automate daily bookkeeping. Ideal for merchants who want automated accounting for Magento combined with collaboration features for clients and partners. | Magento 2 FreshBooks Integration | |

| One of the most widely used accounting tools, QuickBooks enables merchants to generate invoices, manage taxes, and track payments across multiple devices. Its dashboard offers instant reports and role-based permissions, making it a strong fit for Magento accounting automation in both small and mid-sized businesses. | Magento 2 QuickBooks Integration | |

| Xero combines simplicity with enterprise-level features. It supports customizable invoices, payroll management, bank reconciliation, and multi-currency reporting — perfect for international stores. By integrating with Magento, merchants can streamline store accounting tasks and maintain accurate, real-time financial data. | Magento 2 Xero Integration | |

| Zoho Books centralizes accounting, invoicing, and expense management in one dashboard. With built-in automation and seamless ties to Zoho CRM, it helps businesses connect marketing and Magento accounting into one ecosystem. Best for growing merchants who want a balance of affordability and advanced features. | Magento 2 Zoho Books Integration | |

| Aimed at businesses needing advanced financial tools, Sage Intacct offers fixed asset tracking, multi-tax management, and automated journal entries. Magento merchants can use it for complex workflows, such as multi-entity accounting and compliance-driven reporting. | Magento 2 Sage Intacct Integration | |

| Cloud-based and built for freelancers and small businesses, Crunched covers bookkeeping, invoicing, and payment tracking. With Magento accounting integration, it becomes a lightweight yet effective solution for stores that don’t need enterprise-level features. | Magento 2 Crunched Integration | |

| Kashoo offers affordable accounting for small businesses, covering essentials like invoices, payments, and expense management. Though simpler than larger platforms, it’s a good entry point for merchants who need automated accounting for Magento without heavy costs. | Magento 2 Kashoo Integration | |

| While not a traditional accounting system, Avalara specializes in automated tax compliance. For Magento merchants operating across multiple jurisdictions, it ensures accurate tax calculations and keeps pace with changing regulations. | Magento 2 Avalara Integration | |

| UK-based KashFlow provides a complete set of accounting tools tailored to local tax and compliance rules. Magento merchants in the UK benefit from its simplicity, add-on ecosystem, and VAT-ready workflows. | Magento 2 KashFlow Integration | |

| Popular in Australia and New Zealand, MYOB combines accounting with ERP, payroll, and inventory modules. For Magento stores in the APAC region, MYOB offers a strong foundation for both store accounting and broader business management. | Magento 2 MYOB Integration | |

| Another Australian solution, Saasu provides real-time reporting, multi-currency support, and automation for recurring transactions. Its Magento integration is suitable for merchants needing affordable yet flexible accounting automation across regions. | Magento 2 Saasu Integration | |

| Built on Salesforce, FinancialForce combines CRM and accounting in one platform. It’s ideal for mid-to-large businesses that need advanced financial reporting tied to customer and sales data. Perfect for complex Magento accounting ecosystems. | Magento 2 FinancialForce Integration | |

| A trusted solution for small and midsize businesses, Sage 50cloud delivers all essential accounting features — from invoicing to tax compliance — with the scalability of cloud deployment. | Magento 2 Sage 50cloud Integration | |

| myBooks targets small businesses with budget-friendly accounting. It supports invoicing, expenses, and multi-currency transactions, making it a cost-effective choice for startups running on Magento. | Magento 2 myBooks Integration | |

| Focused on payroll and HR tasks, Gusto complements accounting platforms by managing employee salaries, pay stubs, and compliance. For Magento stores with staff, it ensures payroll integrates smoothly into broader store accounting workflows. | Magento 2 Gusto Integration |

Common Challenges in Magento 2 Accounting Integration & How to Solve Them

Even with the right tools, Magento accounting integration can present hurdles that affect accuracy, compliance, and efficiency. Left unresolved, these issues may lead to tax discrepancies, reconciliation delays, or even compliance risks. Below are the most frequent problems merchants encounter and practical solutions to overcome them.

1. Data Mapping & Format Inconsistencies

The challenge: Magento and accounting platforms often use different field names or formats for invoices, taxes, or payment methods. Without proper mapping, entries may fail or show incorrect totals.

The solution: Use attribute mapping to align Magento fields (order ID, tax class, invoice number) with accounting fields. Test with small batches before enabling full automation.

2. Duplicate or Missing Transactions

The challenge: Without careful sync rules, orders or invoices can be duplicated, while some transactions may be skipped — leading to inaccurate books.

The solution: Enable deduplication based on unique identifiers (order ID, invoice number). Set incremental sync (delta updates) to capture only new or updated records. Run reconciliation reports periodically.

3. Tax Calculation Mismatches

The challenge: Magento tax settings don’t always match accounting software rules, especially with multi-state or multi-country compliance. This can result in wrong VAT/GST postings or missing entries.

The solution: Map tax codes carefully and test cross-border orders. For global compliance, consider pairing automated accounting for Magento with tax-focused tools like Avalara.

4. Currency & Multi-Store Complexities

The challenge: Stores selling internationally face mismatched currencies and reporting issues when syncing sales to accounting platforms.

The solution: Use data transformation to normalize currency formats before export. Enable multi-currency and multi-entity support in your accounting software.

5. Payment & Refund Sync Issues

The challenge: Orders may sync, but payment statuses, chargebacks, or credit memos don’t always update properly, causing reconciliation gaps.

The solution: Ensure two-way synchronization for payments and refunds. Set up import jobs to bring reconciled transactions from accounting back into Magento.

6. API Rate Limits & Performance Bottlenecks

The challenge: Accounting APIs (like QuickBooks or Xero) often restrict the number of requests per minute. High order volumes can hit these limits, delaying syncs.

The solution: Schedule exports during off-peak hours, use delta updates instead of full exports, and group smaller transactions into batch calls where possible.

7. Integration Breaks After Platform Updates

The challenge: When Magento or your accounting software updates their API, integrations may fail if not updated quickly.

The solution: Monitor release notes and test in staging before production updates. Use tools like Improved Import & Export that receive regular compatibility updates.

By addressing these challenges proactively, merchants ensure their Magento store accounting remains accurate, tax-compliant, and ready for audits. Automation reduces errors, while proper sync rules guarantee every invoice, refund, and payment is correctly recorded.

Final Words — Streamline Your Magento 2 Accounting Integration

A well-executed Magento accounting integration does more than automate bookkeeping — it transforms the way your store handles finances. By syncing orders, invoices, refunds, and tax records directly between Magento 2 and your accounting software, you eliminate repetitive manual work, reduce errors, and ensure compliance across all markets you sell in.

Whether you run a small boutique, a high-volume B2C operation, or a complex B2B store, automated accounting for Magento helps you maintain accurate records, speed up reconciliations, and provide finance teams with the real-time data they need for smarter decisions. From simplifying audits to handling multi-currency transactions, Magento store accounting integration becomes a cornerstone of sustainable growth.

The Firebear Improved Import & Export extension makes this process easier than ever. With flexible mapping, automated scheduling, two-way synchronization, and compatibility with leading platforms like QuickBooks, Xero, FreshBooks, and Sage, it eliminates the complexity of manual bookkeeping. You can configure exports for orders and invoices, import reconciled payments and tax updates, and keep your store’s financial data in sync — all from the Magento admin.

📦 Explore the Improved Import & Export Extension to see how it powers Magento accounting integration.

📩 Contact the Firebear Team for tailored guidance on building a reliable, automated accounting workflow for your Magento store.

Not sure how to import specific data types into Magento 2? Our guide covers everything — from products and customers to CMS pages and B2B entities.

👉 Browse all Magento 2 import topics

Magento Accounting Integration FAQ

What is Magento accounting integration?

Magento accounting integration connects your Magento 2 store with accounting software like QuickBooks, Xero, or Sage to automatically sync orders, invoices, refunds, payments, and tax records.

Does Magento 2 have built-in accounting features?

No, Magento 2 does not include a native accounting system. You need an integration tool or extension to connect Magento with accounting software.

Which accounting software works best with Magento 2?

Popular options include QuickBooks, Xero, FreshBooks, Sage Intacct, and Zoho Books. The best choice depends on your business size, complexity, and tax compliance requirements.

Can I automate bookkeeping for my Magento store?

Yes. With automated accounting for Magento, every order, invoice, refund, and tax entry is pushed directly into your accounting system without manual input.

How does Magento handle tax compliance when integrated with accounting?

Accounting software automatically receives tax data from Magento and applies local or international tax rules, helping merchants stay compliant with VAT, GST, or sales tax.

Can I sync Magento payments and refunds with my accounting platform?

Yes. Most integrations allow two-way synchronization, meaning that cleared payments, refunds, and credit memos in your accounting system update Magento records automatically.

Is Magento accounting integration secure?

Yes, when implemented correctly. Secure integrations use encrypted API connections, role-based access, and regular updates to protect financial data.

Can Magento accounting integration handle multi-currency transactions?

Yes. Platforms like Xero and QuickBooks support multi-currency accounting. With proper mapping, Magento orders in different currencies sync accurately into your accounting system.

What are the biggest challenges in Magento store accounting integration?

Common issues include mismatched tax codes, duplicate invoices, API rate limits, and multi-currency reconciliation. These can be solved with proper mapping, delta updates, and compliance tools.

Where can I get help setting up Magento accounting integration?

You can contact the Firebear team for expert assistance in configuring and optimizing Magento store accounting with the Improved Import & Export extension.