Magedelight GST Magento 2 Extension

In July 2017 the law on collecting the Goods and Service Tax (GST) came into force in India. GST is levied on goods and services on each stage of the supply chain from the manufacturer to the direct consumer. If you run your ecommerce business for the Indian market, it is compulsory for Magento 2 stores to comply with the GST regulations. GST tax rules are very complex, so it takes much time and effort to implement the GST system on an online store.

Luckily, there is an appropriate third-party tool designed to simplify the management of taxes related to GST – the Magedelight GST extension for Magento 2. The module automates the calculation of GST taxes and applies them to the products and services you offer on your website based on the configured rules. This way, the Magedelight extension helps merchants to quickly set applicable GST tax rates and other options and improves the customer checkout experience on their stores.

In this post, we explore the functionality of the Magento 2 Indian Goods & Services Tax module and look at how it works in the backend and frontend.

Table of contents

Features

- GST calculation based on product origin location;

- Global and product-specific GST rules;

- Product price display with or without GST included;

- Bifurcation of GST in the order summary and order-related documents;

- GSTIN, CIN, and PAN displayed in the order documents;

- Possibility to use GST in orders generated by admin;

- No limitations on the number of created GST rates.

The GST extension by Magedelight allows users to leverage automated calculation of GST taxes based on the product origin location. If necessary, Magento admins can change the default location in the backend and use it as a basis for GST calculations. The sub-parts of GST such as SGST, CGST, and IGST are also calculated automatically based on the specified tax classes.

With the Magento 2 Indian GST module, you decide whether to apply configured GST options globally to all of your products or particular items. Product-specific settings are available on the product view page where you can set the required tax rate individually. After configuring all options in the backend, the extension calculates GST automatically and applies it to the products in a customer’s cart depending on selected billing and shipping address. Note that the module works well with multiple shipping addresses.

Furthermore, you choose how to display product prices to your store visitors: whether with GST included or not. Also, you can set the GST rate to be applied before or after discounts. The Magento 2 Goods & Services Tax module shows the GST calculation in the order summary block in the cart and checkout pages. This way, your customers will always be aware of how the final order sum is calculated, which increases trust to your store.

Another feature provided by the Magedelight extension is GST bifurcation. With this function, you can show the clear division of GST calculation into SGST, CGST or IGST in the order summary and order confirmation emails as well as on various documents, including invoices, shipments, and credit memos. Besides, you can include a buyer GSTIN (Goods & Services Tax Identification Number), CIN (Corporate Identity Number), and PAN (Permanent Account Number) in the Magento order documents.

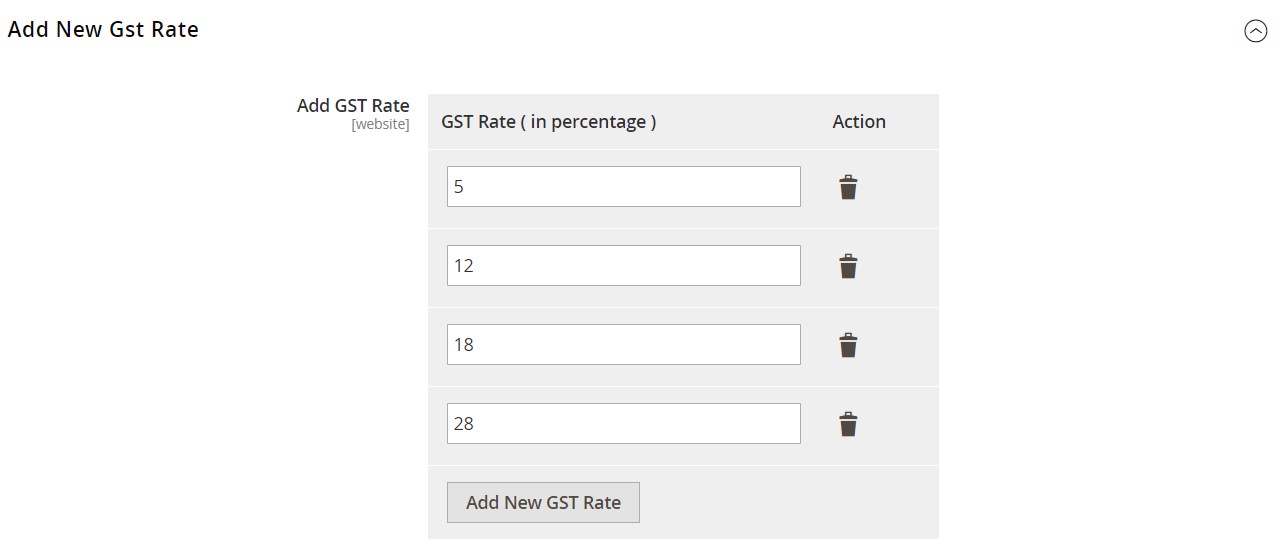

As for some other admin features, users can apply GST to the orders created in the backend as well as utilize the tax rate calculation when modifying existing orders. Also, note that store admins can add an unlimited number of GST rates as per specific requirements.

Backend

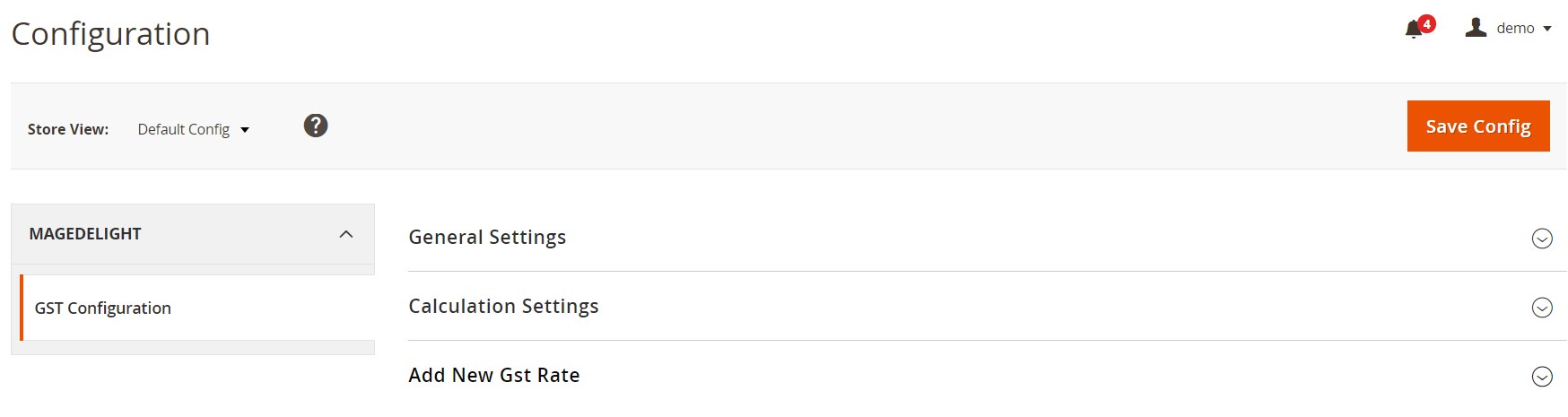

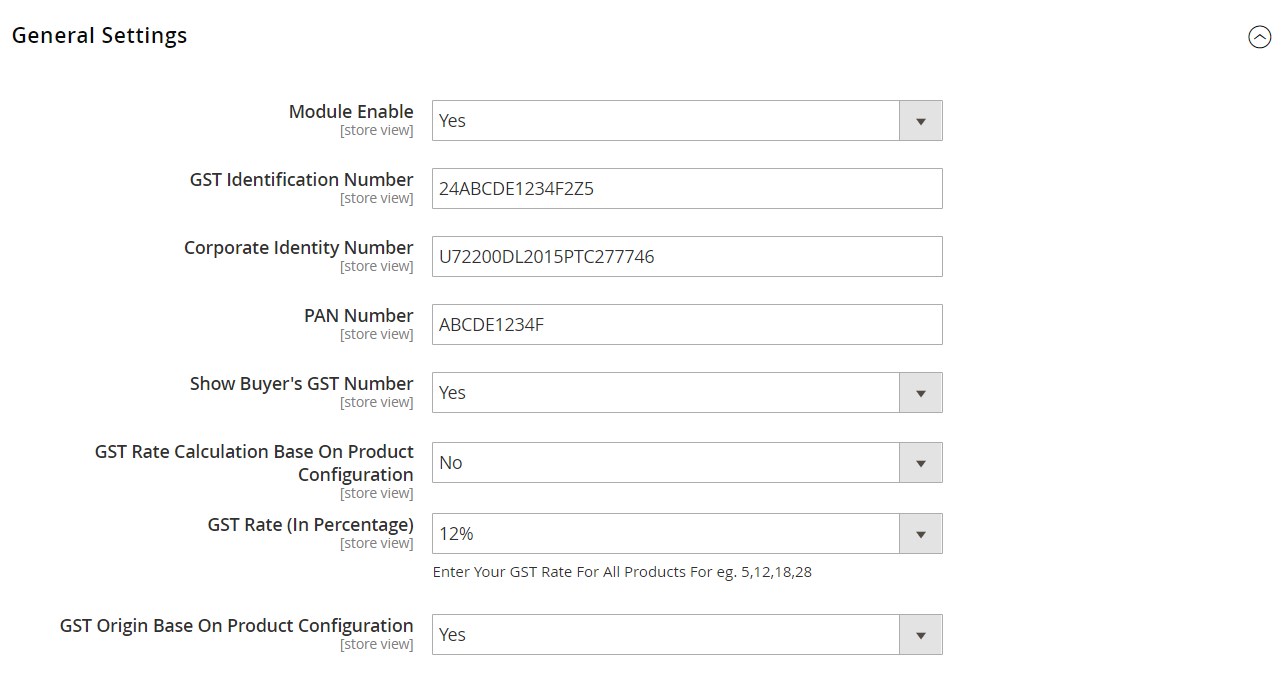

The general settings of the GST extension are available under Stores -> Settings -> Configuration -> Magedelight -> GST Configuration. The configuration page is divided into three sections: General Settings, Calculation Settings, and Add New Gst Rate.

In the first section, you enable/disable the module and enter the GST identification, corporate identity, and PAN card numbers for admin usage. Next, you decide whether to include a GST number in the customer address and display it in the customer account area as well as order details and invoice in the backend. Here, you also set the method of the GST rate calculation: based on global or individual product configuration. The GST rate that you select in the next field will be applied to all your store products. Besides, you can choose the basis for the GST origin: whether global or product configuration. In case you want to apply global configuration, select an origin state from the drop-down list.

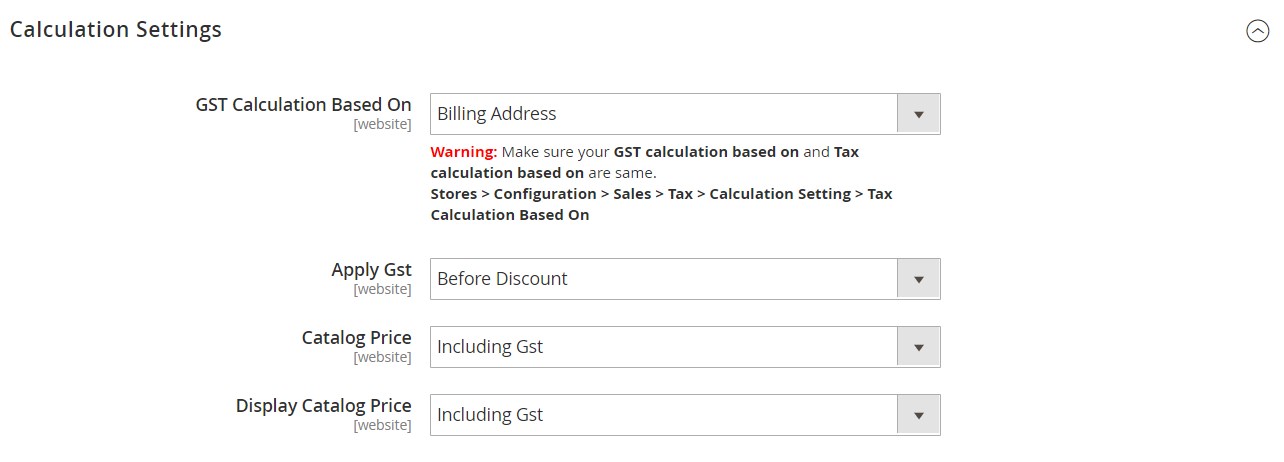

In the next settings tab, you can set shipping or billing address as a basis for the GST rate calculation. Here, you also decide whether to apply the tax before or after discount and include it or not in the catalog price. You can also select how the price should be displayed on the frontend: including or excluding the GST amount.

In the last section of the module’s configuration, you can add any number of the GST rates and specify their values in percent. Note that GST rate values are based on the government tax slabs. It is also possible to delete existing GST rates from here.

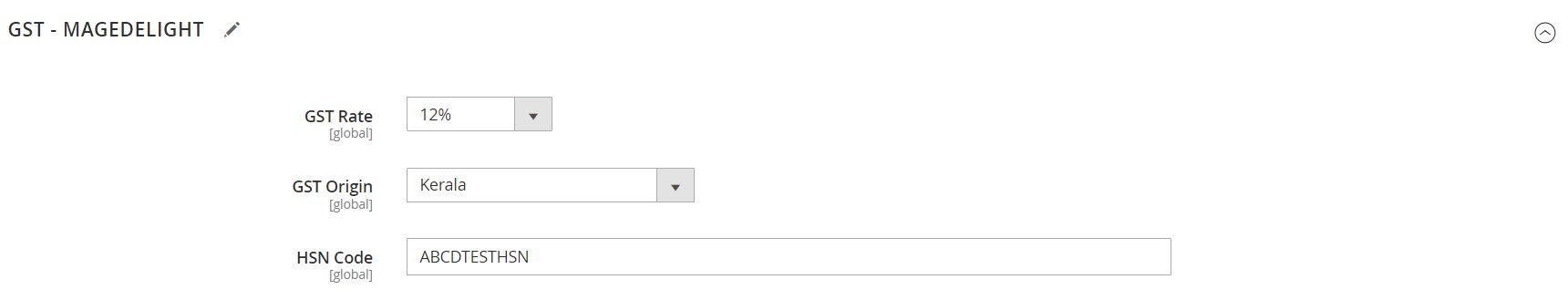

If you want to set the GST rate for an individual product, navigate to the Products grid, select the required product, and scroll down to the GST – MAGEDELIGHT tab on the product view page.

Then, select a GST rate and origin and specify the HSN code.

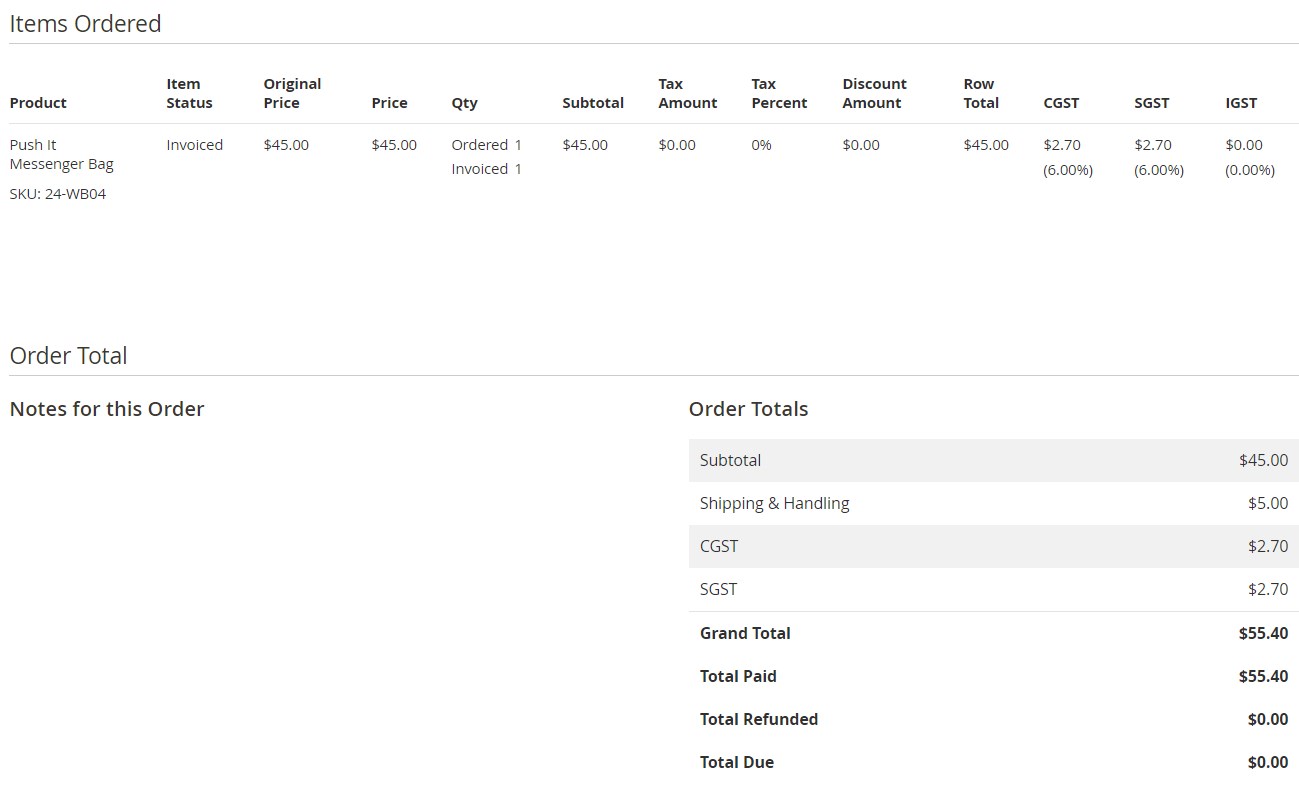

As we’ve mentioned above, the GST calculation is displayed for each order in the Magento Admin. On the order view page, admins can see a buyer GST number in the Address Information block of the Information tab. Besides, they can check the amounts of CGST, SGST and IGST in percent and as a lump sum applied to the product price in the Items Ordered section. The Magento 2 module also adds the GST bifurcation to the Order Totals section.

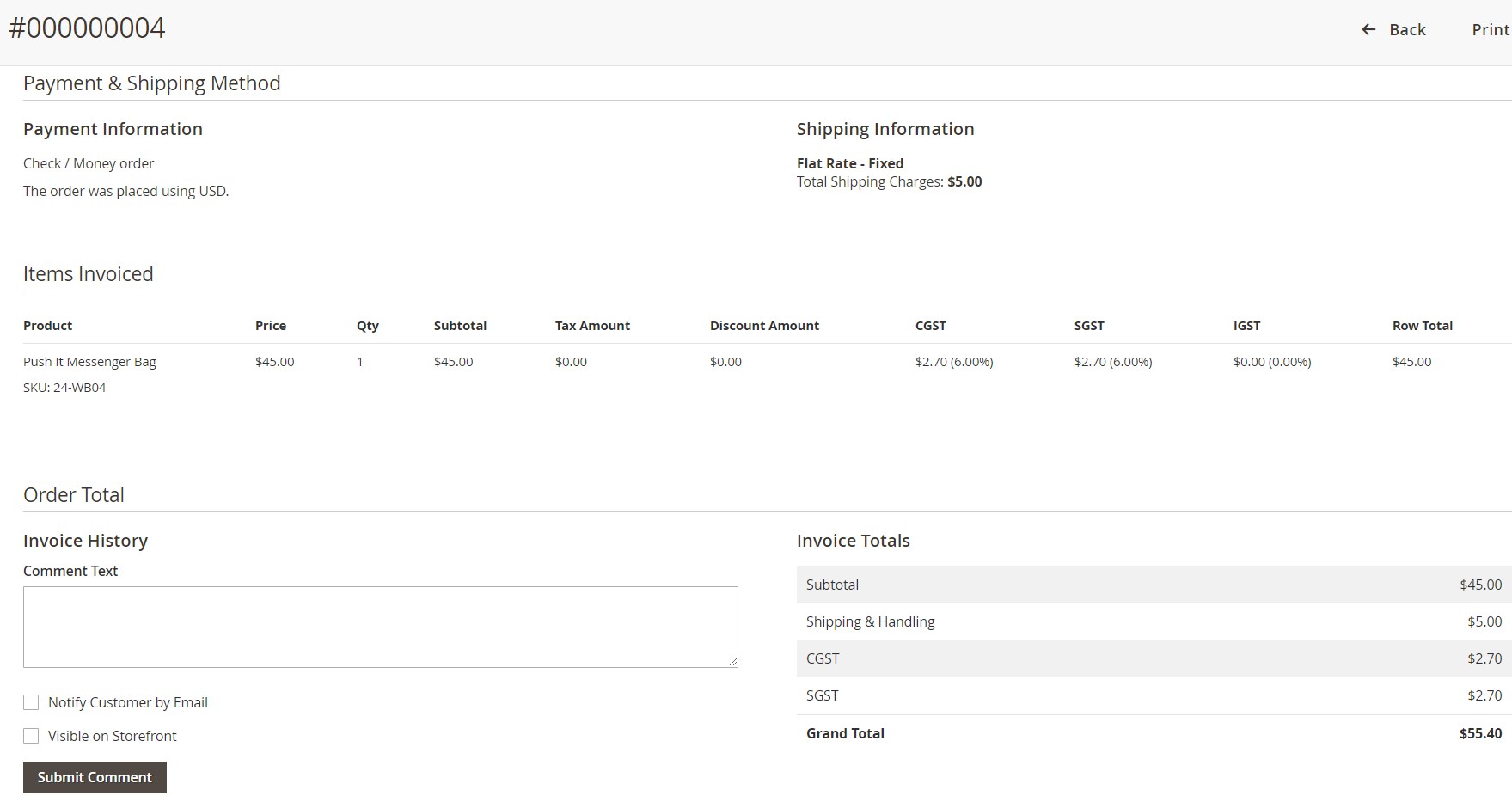

Under the Invoices tab of the order view page, you can see the GST calculation divided into CGST, SGST, and IGST amounts on the invoice page. GST-related tax calculations are displayed in the Items Invoiced and Invoice Totals sections.

Frontend

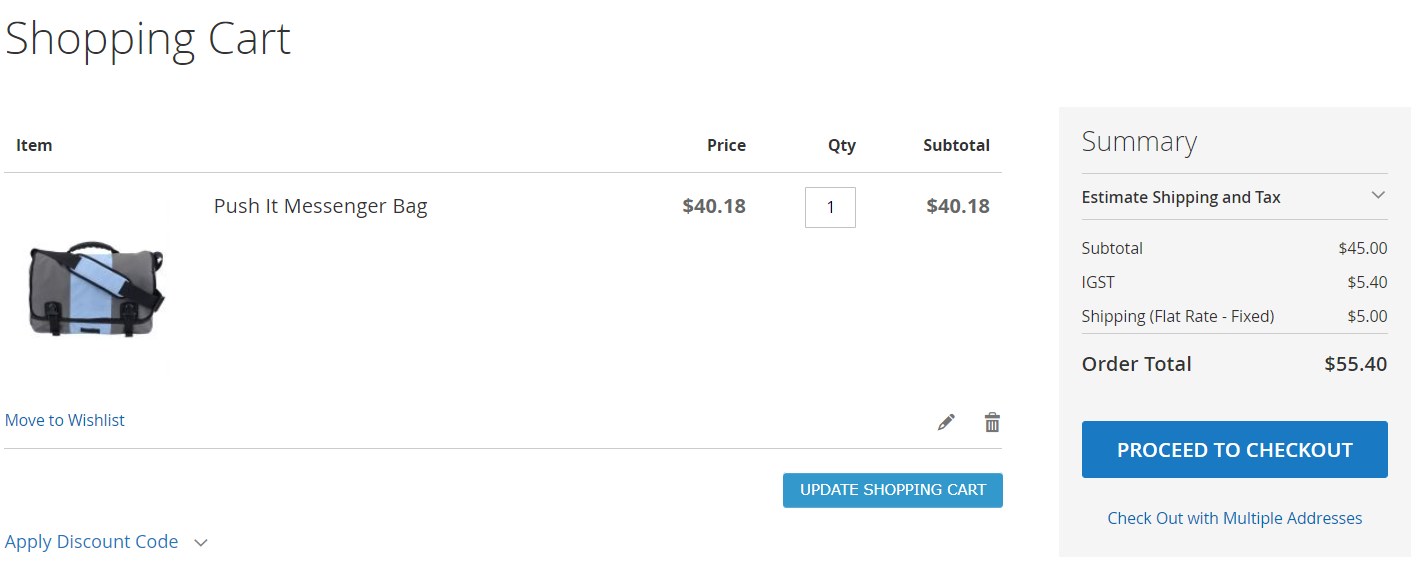

The Magento 2 Indian GST module adds GST rate to the order totals on the cart page.

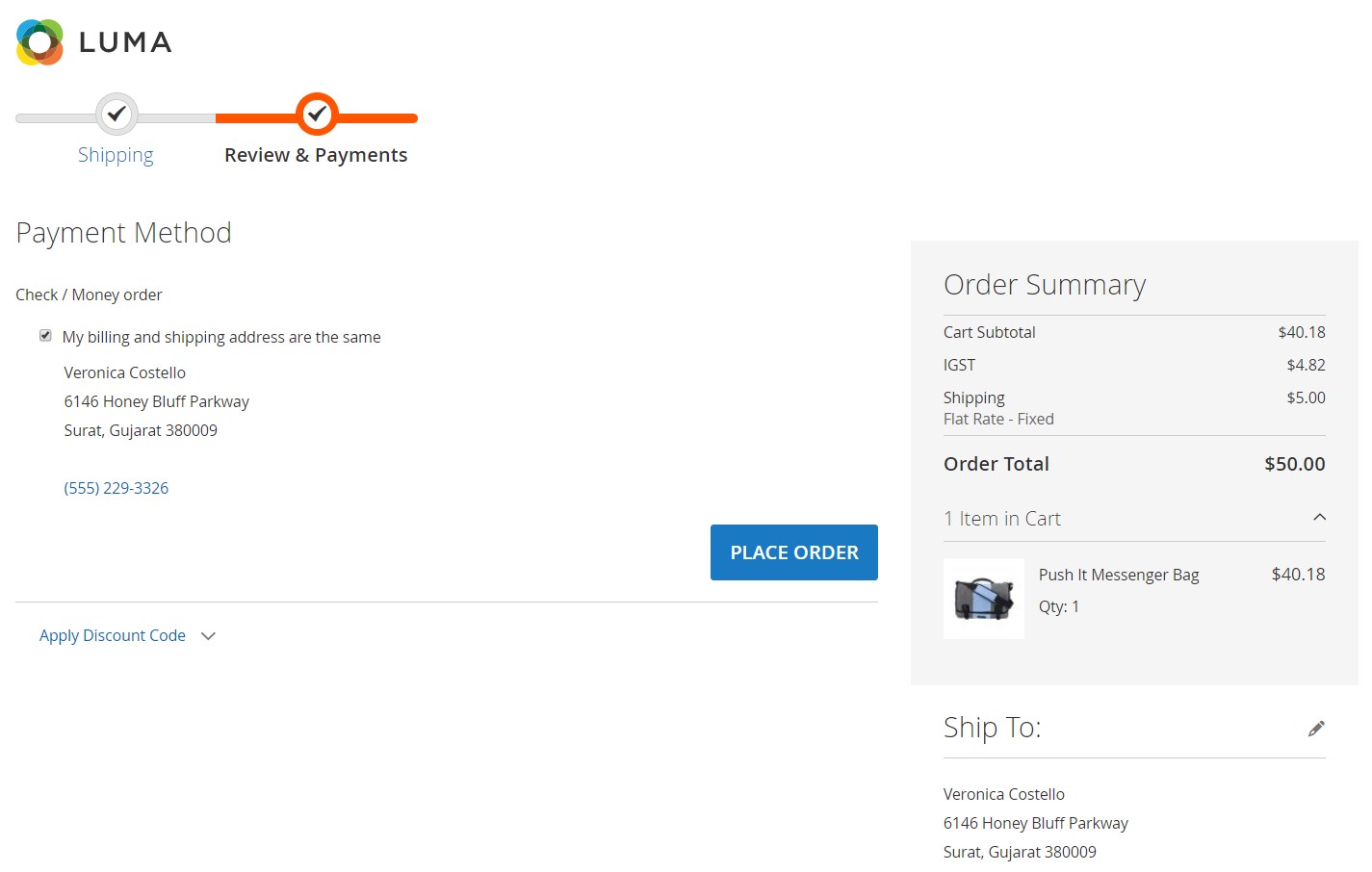

Taxes related to GST are also displayed in the Order Summary block at the checkout relevant to the shipping and billing address selected by a customer.

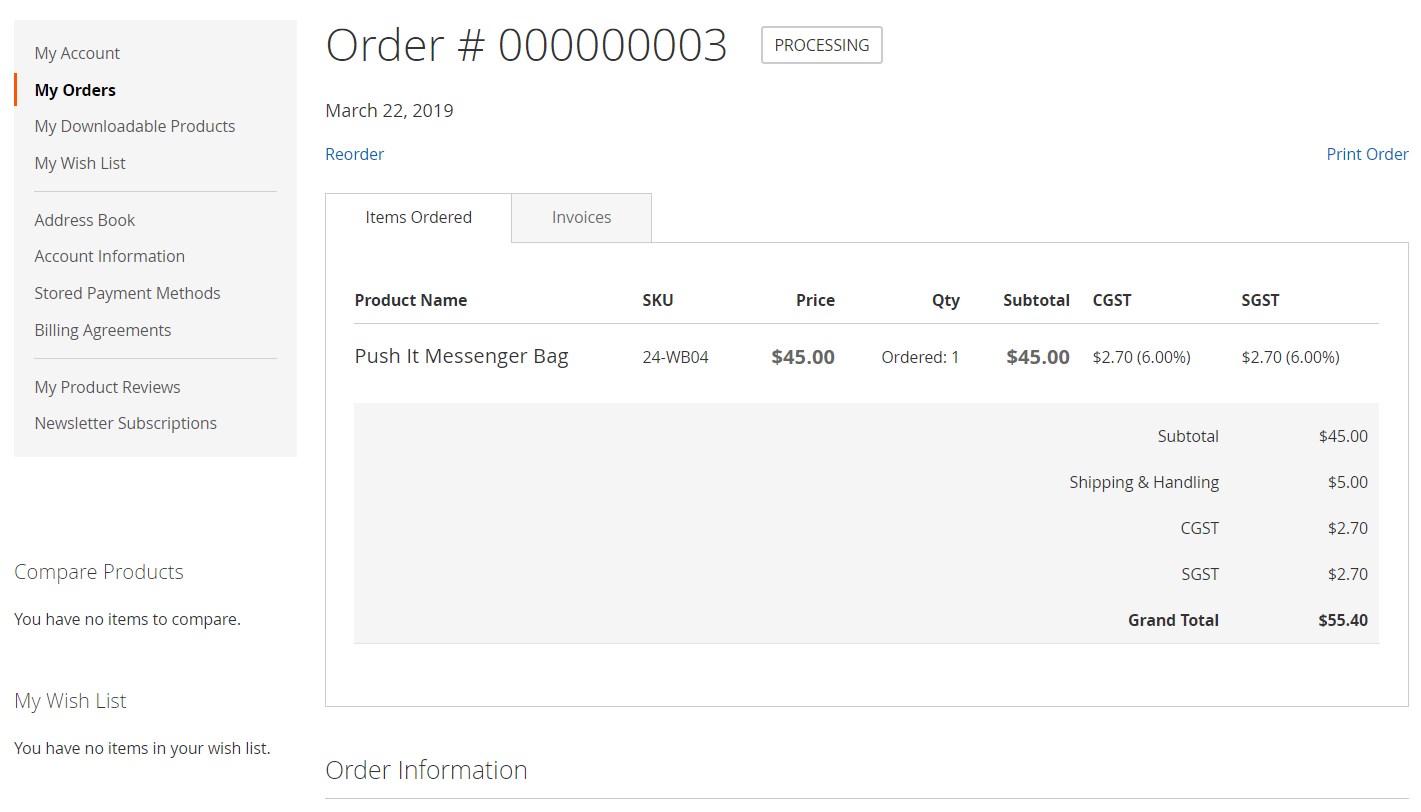

Below, you can see how the bifurcation of the GST taxes looks in the Items Ordered tab of the order details page in the customer account area.

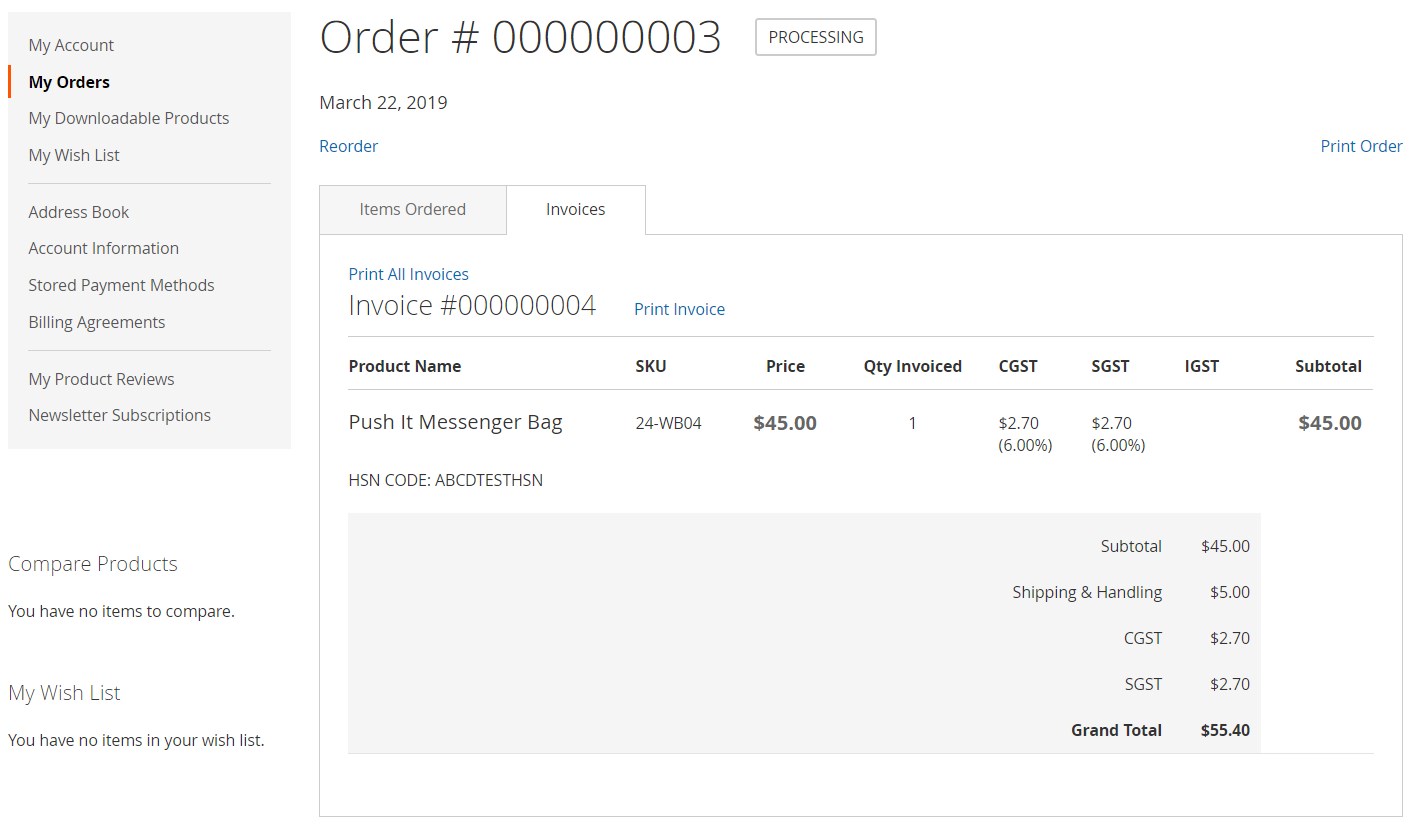

GST calculation can also be viewed in the Invoices tab on the same page.

Final Words

The Magedelight GST extension is a robust add-on to your online store that offers all necessary features for smooth implementation of GST rates calculation. The Magento 2 module enables store owners to quickly configure all settings related to levying GST taxes and automatically apply them to ordered items. The extension also improves the customer experience at the checkout, increasing conversions and building trust to your store. As for the price, you can buy the M2 module for just $99.