Ultimate Guide to Fixed Product Tax in Magento 2: Manual Setup & Bulk Import

What is Fixed Product Tax in Magento 2? Let’s see! If you’re selling products across regions with specific environmental or regulatory tax requirements — like WEEE, recycling fees, or eco taxes — Magento 2’s Fixed Product Tax (FPT) feature is essential. Unlike standard VAT or sales tax, FPT is a flat fee added to a product regardless of its price, and it can vary based on country or state.

In this guide, you’ll learn what Fixed Product Tax in Magento 2 is, how it works, and why it’s crucial for cross-border compliance. We’ll also show you how to add and import FPT values using CSV files, automate the process with advanced tools, and avoid common mistakes during setup. Whether you’re dealing with regional regulations or just looking for a flexible way to apply fixed surcharges, this article has you covered.

Table of contents

What Is Fixed Product Tax in Magento 2?

What is fixed product tax, and how does it differ from standard Magento 2 tax rules?

In Magento 2, Fixed Product Tax is a flat tax amount applied directly to a product. Unlike regular sales tax or VAT, which are percentage-based and calculated on the cart subtotal, FPT is a fixed amount that stays the same regardless of the product price or order value.

🔍 Fixed Product Tax Meaning and Use Cases

The meaning of fixed product tax becomes clear when dealing with specific regional tax obligations. For example, merchants who sell electronics in the EU must often comply with WEEE (Waste Electrical and Electronic Equipment) directives, which require a flat recycling fee per item. Other use cases include:

- Environmental taxes (eco tax) on batteries, appliances, and electronics

- Recycling or disposal fees for certain products

- Government-imposed product surcharges that must be displayed separately

Magento 2 allows merchants to configure FPT per product and assign it based on the shipping destination, making it easier to stay compliant with region-specific regulations.

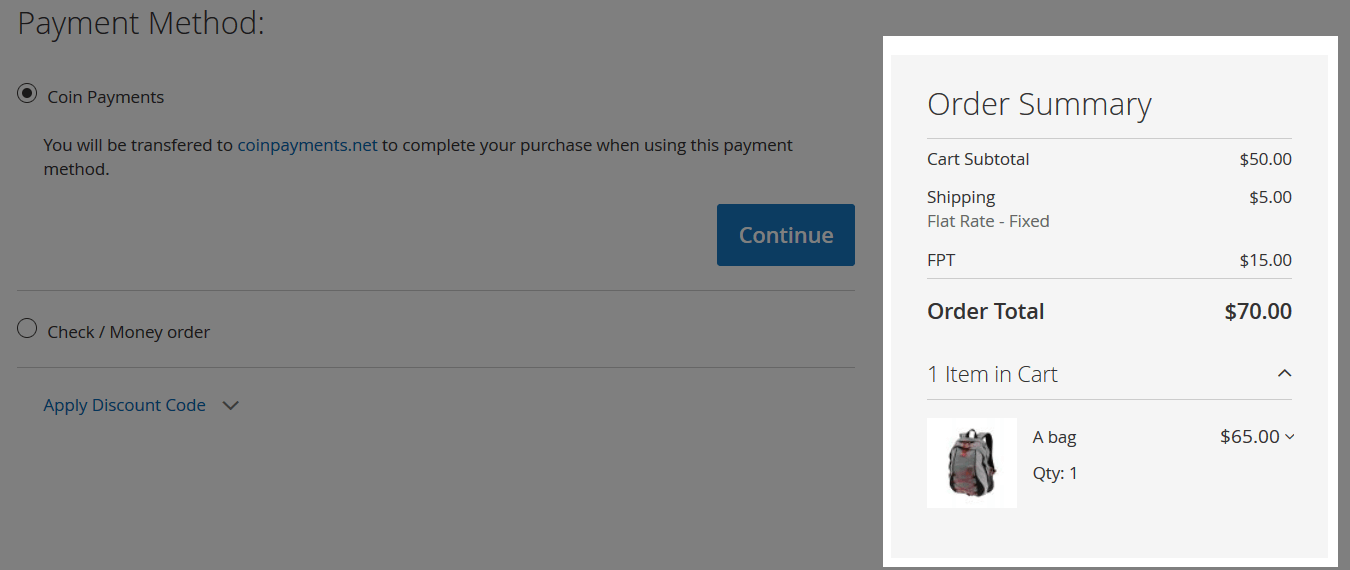

Customers, in turn, can see FPT in the Order Summary section:

🧾 FPT in Action

Let’s say you’re selling a bag that carries an FPT of $15. This amount is shown separately on the product page and checkout. Additionally, Magento 2 can apply regular taxes (like VAT or sales tax) on top of the FPT, if configured that way, creating a tax-on-tax situation often required by local laws.

✅ FPT is not meant to replace standard taxes — it’s used in addition to them, serving specific legal and environmental needs. Let’s be more specific here.

📊 Magento 2 Fixed Product Tax vs Other Tax Types

Magento 2 offers several tax options, each designed to support different pricing models and compliance needs. Understanding the difference between fixed product tax and other Magento 2 tax types like VAT is essential for configuring the right strategy for your store.

The core difference between FPT and VAT lies in how they are calculated and displayed:

| Feature | Fixed Product Tax (FPT) | VAT / Sales Tax |

| Type | Fixed amount per item | Percentage of product price |

| Applied On | Per product, flat fee | Cart subtotal or product price |

| Purpose | WEEE, recycling, eco taxes | Government-mandated sales tax |

| Displayed | As a separate surcharge | Included or added to product price |

| Taxable | Can be taxed again (configurable) | Tax itself, not taxed |

✅ Use Case Example: If you’re selling electronics in the EU, you may apply a $10 FPT for WEEE compliance in addition to standard VAT.

By knowing how FPT compares to other Magento 2 tax types, you can create a tax setup that’s both compliant and customer-friendly. Whether you’re dealing with WEEE vs fixed product tax or deciding between FPT and VAT, Magento 2 offers the flexibility to handle complex tax scenarios globally. Follow this link to lern more about the complete Magento 2 Tax Configuration.

How to Create Magento 2 Fixed Product Tax

Once you understand what Fixed Product Tax is and when it applies, the next step is to configure it in your Magento 2 admin panel. Below is a complete walkthrough — from enabling the feature to assigning fixed tax values per product.

📌 This setup is ideal if you’re handling eco tax, WEEE tax, or any flat-fee regulation across specific countries or states.

✅ Step 1: Enable Fixed Product Tax in Magento 2 Configuration

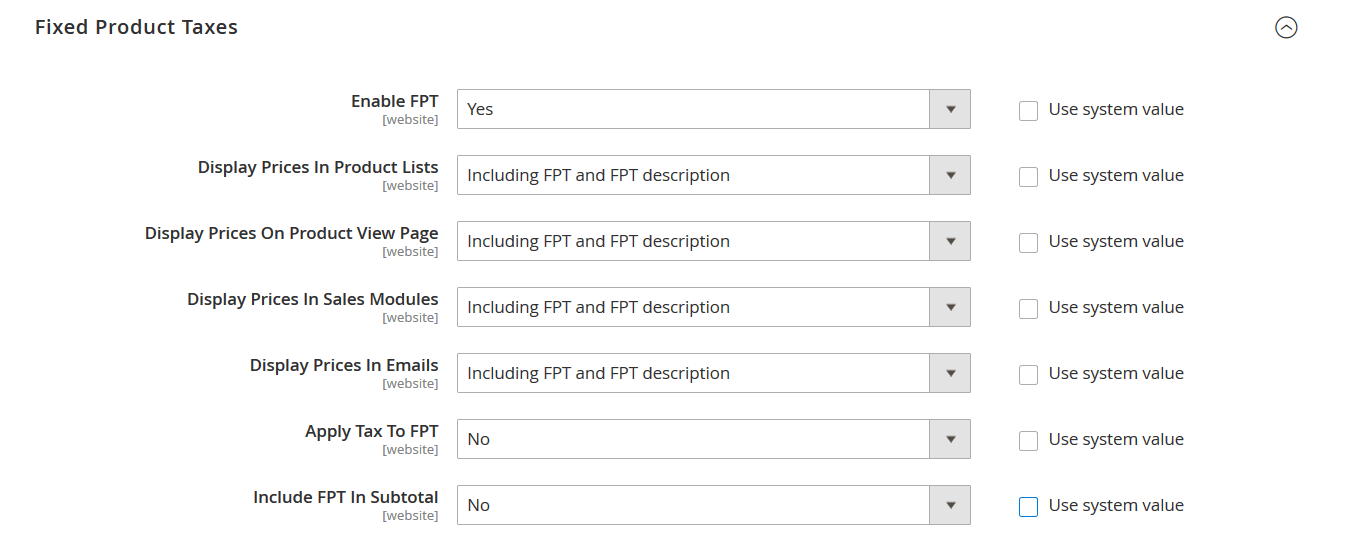

To begin, go to: Stores → Configuration → Sales → Tax → Fixed Product Taxes

Here, you’ll find several options, most of which default to “Use system value.” Uncheck the boxes to manually configure them. Pay special attention to:

- Enable FPT – Activates the fixed product tax feature.

- Apply Tax to FPT – If enabled, your store’s existing tax rules (like VAT) will apply on top of the FPT.

- Include FPT in Subtotal – If checked, the fixed tax is included in the order subtotal, which can affect discounts and shipping rules.

⚠️ Tip: Adjust these settings based on your local tax regulations and how your storefront should display pricing and totals.

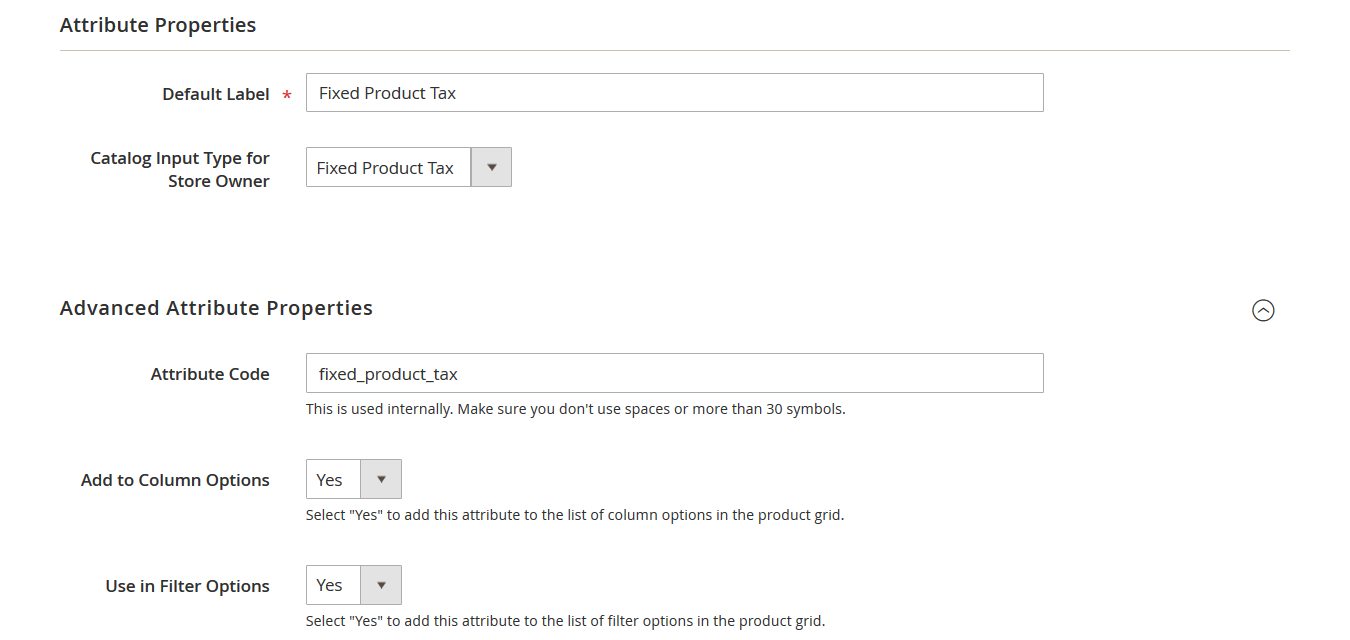

🏷️ Step 2: Create the Magento 2 FPT Product Attribute

Enabling FPT in settings isn’t enough — you also need to create a product attribute that holds the fixed tax value.

- Go to Stores → Attributes → Product

- Click Add New Attribute

Fill in the following:

- Default Label – Name for the attribute (e.g., “Eco Fee” or “FPT Tax”)

- Catalog Input Type for Store Owner – Select Fixed Product Tax

- Attribute Code – Used internally and for CSV imports (e.g., fpt_tax)

- Enable options like Use in Filter Options if you’d like to show it on layered navigation or search filters.

💡 If you don’t see “Fixed Product Tax” as a catalog input option, make sure Step 1 was completed and saved properly.

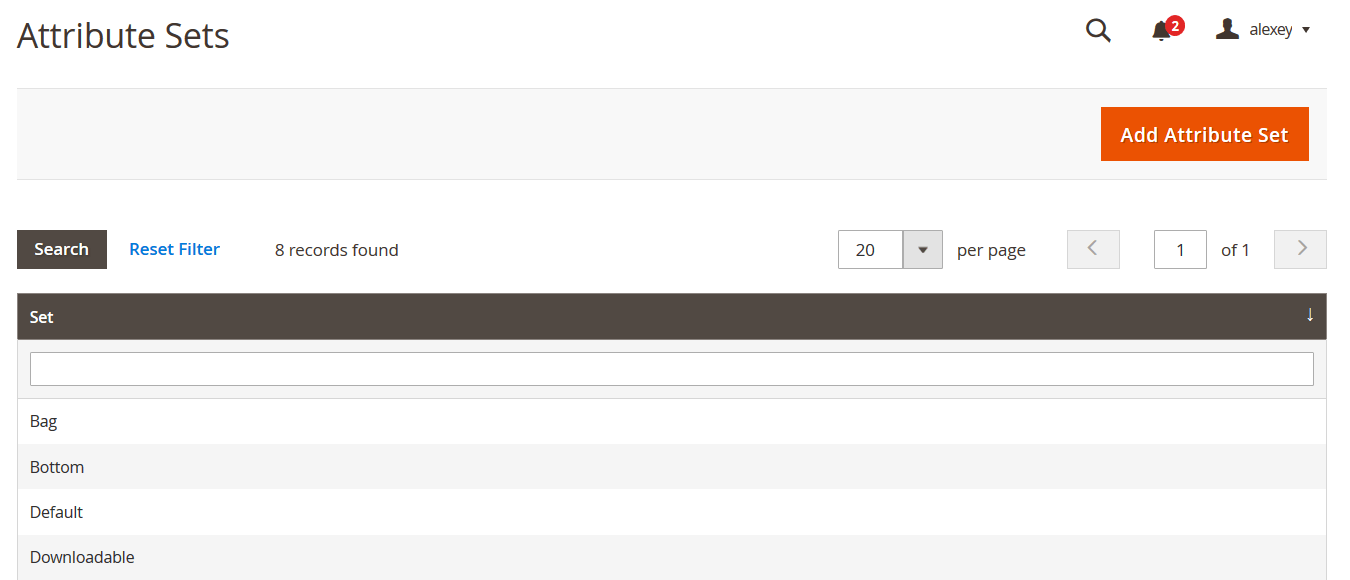

📦 Step 3: Add the FPT Attribute to an Attribute Set

Magento 2 requires all product attributes to be part of an attribute set to appear in product settings.

- Navigate to Stores → Attributes → Attribute Sets

- Open the set you want to use (e.g., Default)

- Find your FPT attribute in Unassigned Attributes

- Drag it into an existing group (e.g., Product Details)

- Click Save

🧩 This step ensures the FPT field is available for all products using this attribute set.

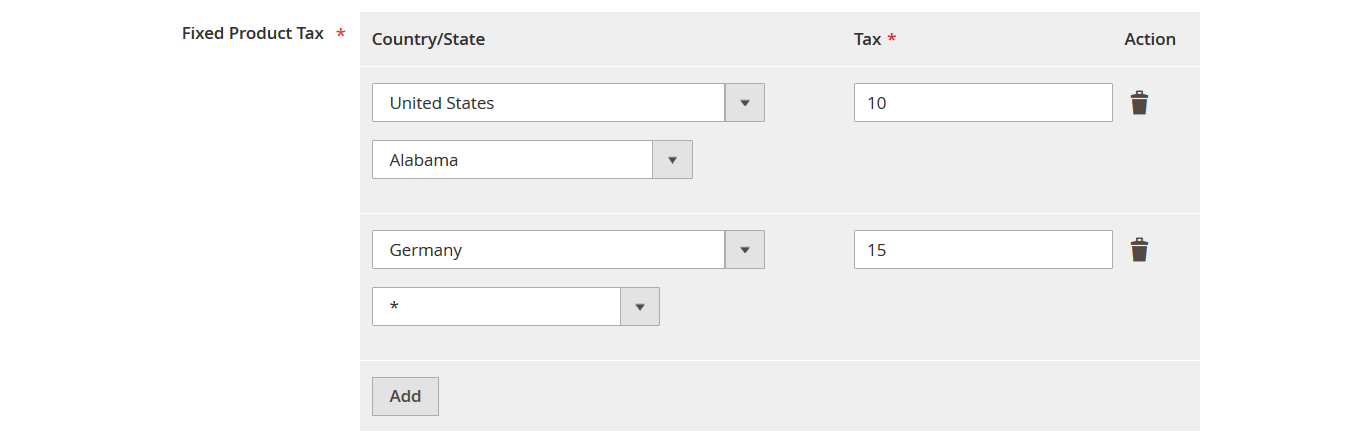

✍️ Step 4: Assign and Configure FPT Per Product

- Go to your product catalog

- Open a product that uses the attribute set you edited

- Scroll to the Fixed Product Tax field

Here’s where you can:

- Select country and state where the tax applies

- Enter the fixed tax amount (e.g., “10” = $10 flat fee)

🔎 Magento 2 FPT Example: If you assign a $15 FPT to a product for shipping to Germany, this amount will be added as a surcharge — and optionally taxed — at checkout.

🎯 Fixed Product Tax Calculation and Display

- FPT is shown on the product page, cart, and checkout — either as a separate surcharge or included in the price, depending on your configuration.

- You can calculate FPT manually based on local tax laws, then enter the values for each product and destination.

✅ With this setup complete, Magento 2 will automatically handle fixed product tax display and calculation for your entire catalog — ensuring transparency and compliance.

How to Import Fixed Product Tax to Magento 2 via CSV

Manually adding Fixed Product Tax to hundreds of products can be time-consuming. Fortunately, Magento 2 allows you to import FPT using a CSV file, just like any other product attribute.

This section explains how to structure your file correctly, which attribute to use, and how to avoid common import issues.

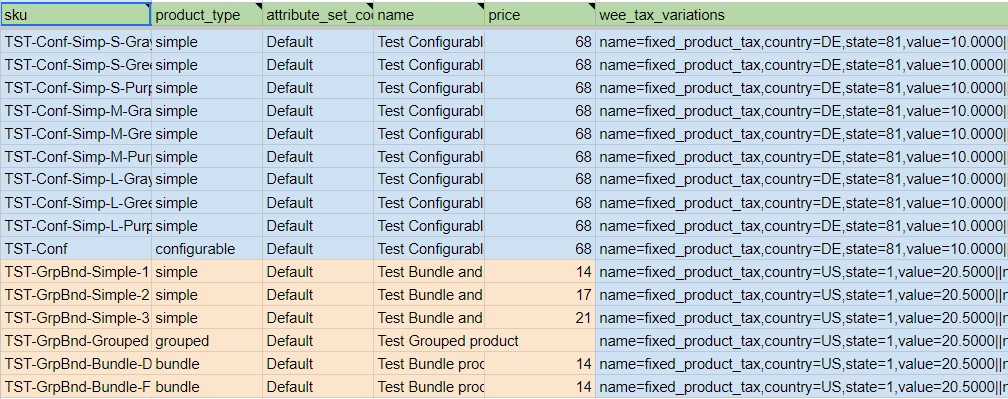

🧾 Fixed Product Tax CSV Attribute in Magento 2

To import fixed product taxes, Magento 2 uses a specific attribute called:

wee_tax_variations

You can add this attribute column to any product import table you’re working with. This column defines FPT per region (country and state) and assigns a flat fee to each product accordingly.

📊 CSV Sample Explained

If you don’t have a product import template prepared, here are a few ways to get started:

- Export your current catalog: Go to System → Export → Entity Type: Products

- Download a pre-built sample:

- Master Google Sheet with Examples:

Structure of wee_tax_variations:

name=attribute_code,country=country_code,state=state_code,value=fpt_value

If you want to assign multiple FPT values, separate each variation using a pipe symbol (|). Here is an example value:

name=fixed_product_tax,country=US,state=1,value=20.5000||name=fixed_product_tax,country=ES,state=139,value=5.0000

- US, state=1 applies $20.50 FPT for Alabama

- ES, state=139 applies €5.00 FPT for Barcelona

You can find all valid Magento 2 country and state codes in the Master Table linked above.

⚙️ Steps to Import FPT to Magento 2

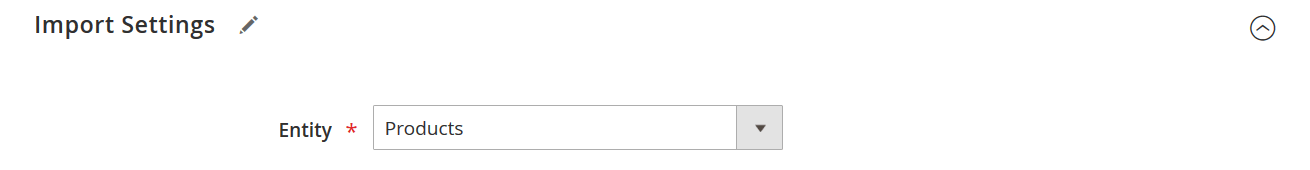

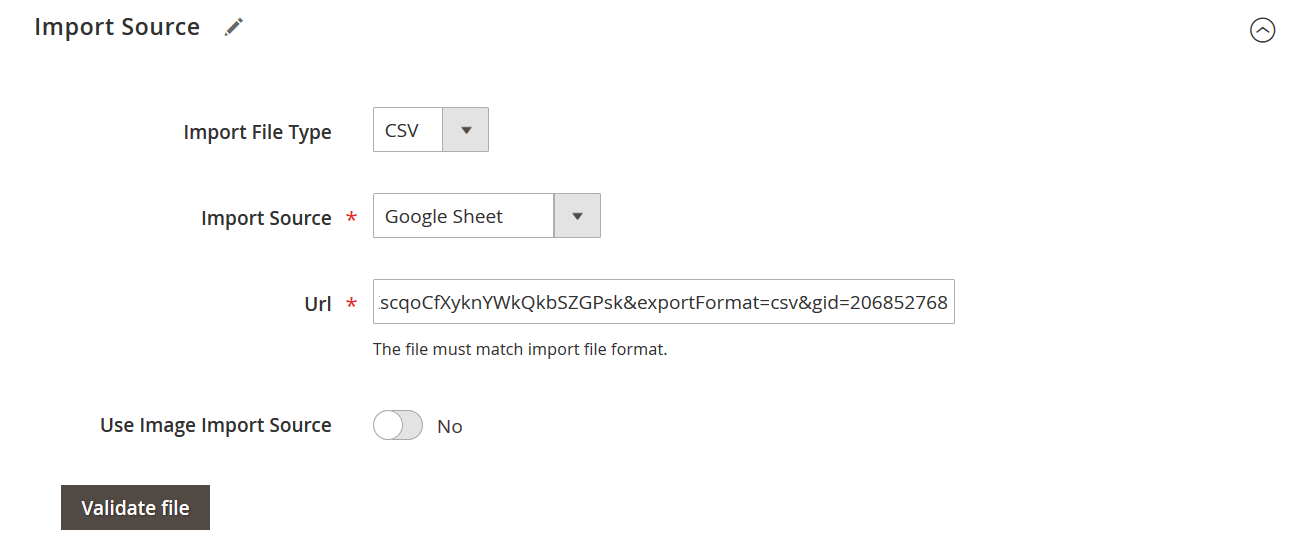

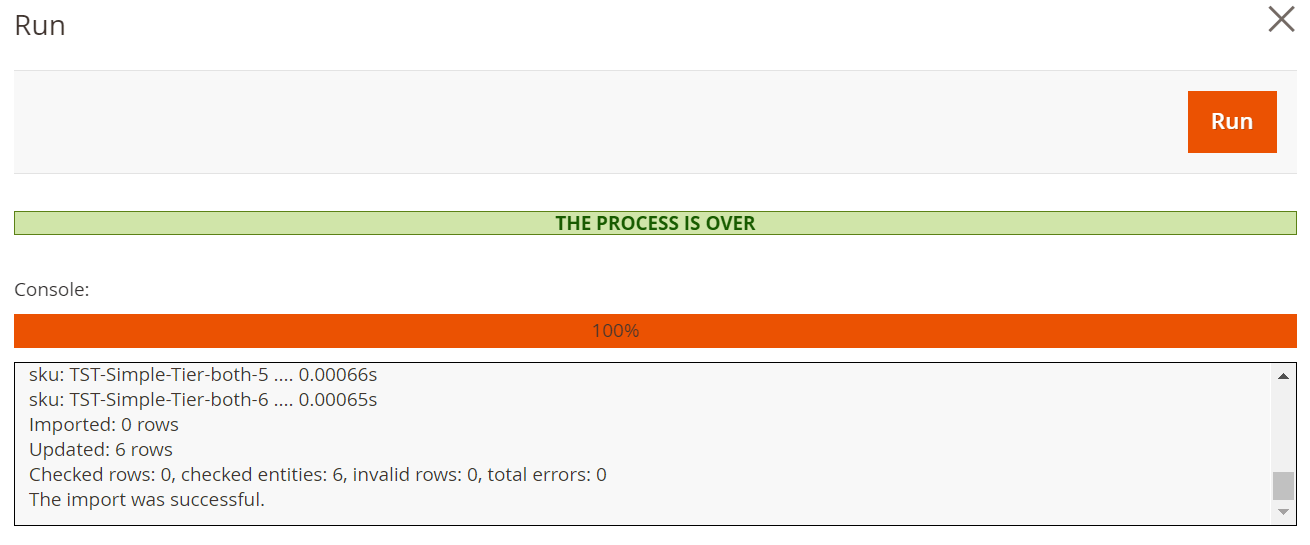

- Go to System → Improved Import Jobs of Firebear’s Improved Import & Export extension.

- Choose Entity Type: Products

- Upload your CSV file, or paste the Google Sheets URL.

- Configure other parameters.

- Click Check Data → then Import

💡 Done! Your products now have region-specific fixed product taxes applied automatically during checkout.

🚫 Common Fixed Product Tax Magento 2 Import Errors and How to Fix Them

Even a small format issue can cause the FPT import to fail or the values to not display correctly. Here are the most common issues:

| ❌ Error | 💡 Cause | ✅ Solution |

| FPT not showing on product page | Attribute not added to the product’s attribute set | Revisit your attribute set and assign wee_tax_variations |

| Invalid column error | Column header is misspelled | Ensure it’s exactly wee_tax_variations |

| No tax applied at checkout | Country/state codes are incorrect or missing | Use valid ISO 3166 country codes and Magento 2-specific state IDs |

| CSV format error | Incorrect separators | Double-check the separators |

| Import fails validation | Missing required fields (SKU, attribute_set_code) | Check the full structure of your product CSV |

🔍 Tip: If you’re unsure what caused the error, try importing just one product row with FPT for testing.

Support for importing fixed product tax via CSV allows you to quickly scale tax configuration across thousands of products, especially when using advanced import tools like the Improved Import & Export extension from Firebear Studio.

Best Practices for Managing Magento 2 FPT

Successfully implementing Fixed Product Tax goes beyond simply enabling it in the backend. To ensure fixed product tax compliance, minimize customer confusion, and meet regional tax requirements, it’s essential to follow a few key practices.

Below are some of the most important tips for managing fixed product tax in Magento 2:

🧾 1. Keep FPT Separate from Base Product Price

While Magento allows you to include FPT in the product price, it’s best to display it separately, especially if your business operates in regions with strict tax transparency laws.

✅ Magento 2 tax configuration tip: In Stores → Configuration → Sales → Tax, set “Display FPT Separately” to ensure clarity in cart and checkout.

🧪 2. Test FPT Display on Product Page, Cart, and Checkout

Before deploying FPT across your entire catalog, test how the fixed product tax displays:

- Is it visible on the product page?

- Does it show up correctly in the shopping cart and order totals?

- Is it taxed properly when “Apply Tax to FPT” is enabled?

Testing a few SKUs across different regions will help catch errors before they affect real customers.

📋 3. Follow Regional Legal Requirements

FPT is often used to comply with environmental or regulatory laws like WEEE (in the EU) or eco taxes on electronics and batteries. These fees:

- Must sometimes be shown as a separate line item

- May or may not be taxable

- Can differ based on state, country, or product type

⚠️ Always consult your local tax advisor to ensure fixed product tax compliance in every market you serve.

🔄 4. Use CSV Imports for Efficient Bulk Updates

Managing FPT manually for hundreds of products is not scalable. Use Magento’s CSV import functionality (or Firebear’s Improved Import & Export extension) to:

- Assign or update FPT values by country/state

- Add FPT attributes to multiple SKUs in one go

- Automate updates based on legal changes

🔁 5. Keep FPT Values Synced with Suppliers or ERP Systems

If you’re working with suppliers or using an ERP system that calculates eco fees, make sure those values are regularly synced with Magento.

🔄 With tools like Improved Import & Export, you can automate updates via Google Sheets, FTP, or API, avoiding manual errors and keeping your catalog compliant.

🔒 6. Document Your Magento 2 Tax Configuration

Maintain internal documentation that clearly outlines:

- Which attribute is used for FPT (wee_tax_variations)

- How FPT is calculated and displayed

- Any country/state-specific rules you’re applying

- Who is responsible for tax updates (developer, tax advisor, merchant)

This helps new team members onboard faster and makes future audits easier.

By following these best practices, you ensure your store remains compliant, your customers stay informed, and your Magento 2 tax setup is scalable and reliable. Managing fixed product tax doesn’t have to be complex — with the right structure, it becomes just another part of a healthy tax strategy.

Final Words: Why Proper Magento 2 FPT Setup Matters

Configuring Fixed Product Tax (FPT) in Magento 2 isn’t just a checkbox in your admin panel — it’s a vital part of building a store that respects international tax laws, improves pricing transparency, and meets customer expectations. Whether you’re adding environmental fees, complying with WEEE directives, or addressing state-level surcharges, the ability to set fixed fees per region ensures your store can operate smoothly across multiple jurisdictions.

Magento 2 offers a built-in FPT system that lets you assign fixed tax values to products based on country or state. With the right setup, those fees appear exactly where they should — on the product page, in the cart, and at checkout. You have full control over whether these fees are taxed, included in the subtotal, or displayed separately to meet specific legal or UX requirements.

While the native functionality is flexible, managing fixed product tax manually — especially across a large catalog — can quickly become overwhelming. Creating attributes, configuring them for each product, and updating tax values for every region is time-consuming and prone to errors. That’s why automation is more than a convenience — it’s a necessity for modern e-commerce.

With the Improved Import & Export extension for Magento 2, the entire process becomes seamless. You can import FPT values from CSV files or connect your tax data directly from Google Sheets or external systems. Updates can be scheduled, synced, and adjusted without touching a single product manually. The extension supports not only FPT but all aspects of product, attribute, and tax class management, giving you one place to control your catalog at scale.

If you’re unsure where to begin or need help configuring your store for FPT compliance, reach out to our team. We’ll help you implement the optimal strategy, whether you’re working with eco taxes, recycling fees, or custom regional rules.

With the right tools and expertise, fixed product tax no longer needs to be a headache — it can be a streamlined, automated part of your Magento 2 operations.

Want to master Magento 2 import from A to Z? Explore our complete guide and unlock step-by-step tutorials, tips, and expert tools.

👉 Go to the Full Magento 2 Import & Export Guide

Magento 2 Fixed Product Tax FAQ

What is Fixed Product Tax in Magento 2?

Fixed Product Tax (FPT) in Magento 2 is a flat fee applied to products, regardless of their price. It’s typically used for environmental or regulatory charges such as WEEE, recycling, or eco taxes, and can vary by region.

How does Fixed Product Tax differ from VAT in Magento 2?

Unlike VAT, which is a percentage of the product price, FPT is a fixed amount. FPT can be shown separately and optionally taxed, while VAT is usually calculated on the total cart or product subtotal.

Where is Fixed Product Tax displayed in Magento 2?

Magento 2 displays FPT on the product page, in the shopping cart, during checkout, and in order summaries. Depending on configuration, it can be included in or added to the product price.

Can I apply different Fixed Product Tax amounts based on customer location?

Yes, Magento 2 allows you to assign different FPT values based on country and state using the wee_tax_variations attribute. This supports location-based tax compliance.

How do I import Fixed Product Tax to Magento 2 via CSV?

You can import FPT using a CSV file with the wee_tax_variations column. This column defines tax values per region using a structured format and supports multi-country/state input with || separators.

Why is my Fixed Product Tax not showing on the frontend?

If FPT isn’t displaying, check whether the FPT attribute is assigned to the product’s attribute set and whether the product has the correct country/state codes. Also ensure that FPT display settings are enabled in the configuration.

Is Fixed Product Tax taxable in Magento 2?

Yes, you can configure Magento 2 to apply regular sales tax (like VAT) on top of the FPT. This option is available under Stores > Configuration > Sales > Tax > Fixed Product Taxes.

What is the correct CSV format for importing Fixed Product Tax?

The correct format for the wee_tax_variations column is: name=fixed_product_tax,country=US,state=1,value=15.0000||name=fixed_product_tax,country=CA,state=12,value=10.0000. Use valid ISO 3166 country codes and Magento’s internal state IDs.

Can I automate Fixed Product Tax updates in Magento 2?

Yes, using tools like Firebear’s Improved Import & Export extension, you can schedule automated FPT imports from Google Sheets, FTP, or API sources to keep your tax data up-to-date.

Do I need developer help to manage FPT in Magento 2?

Not necessarily. Magento’s built-in tools and extensions like Improved Import & Export make it possible for store admins to manage FPT without developer involvement, even across large catalogs.